你好!

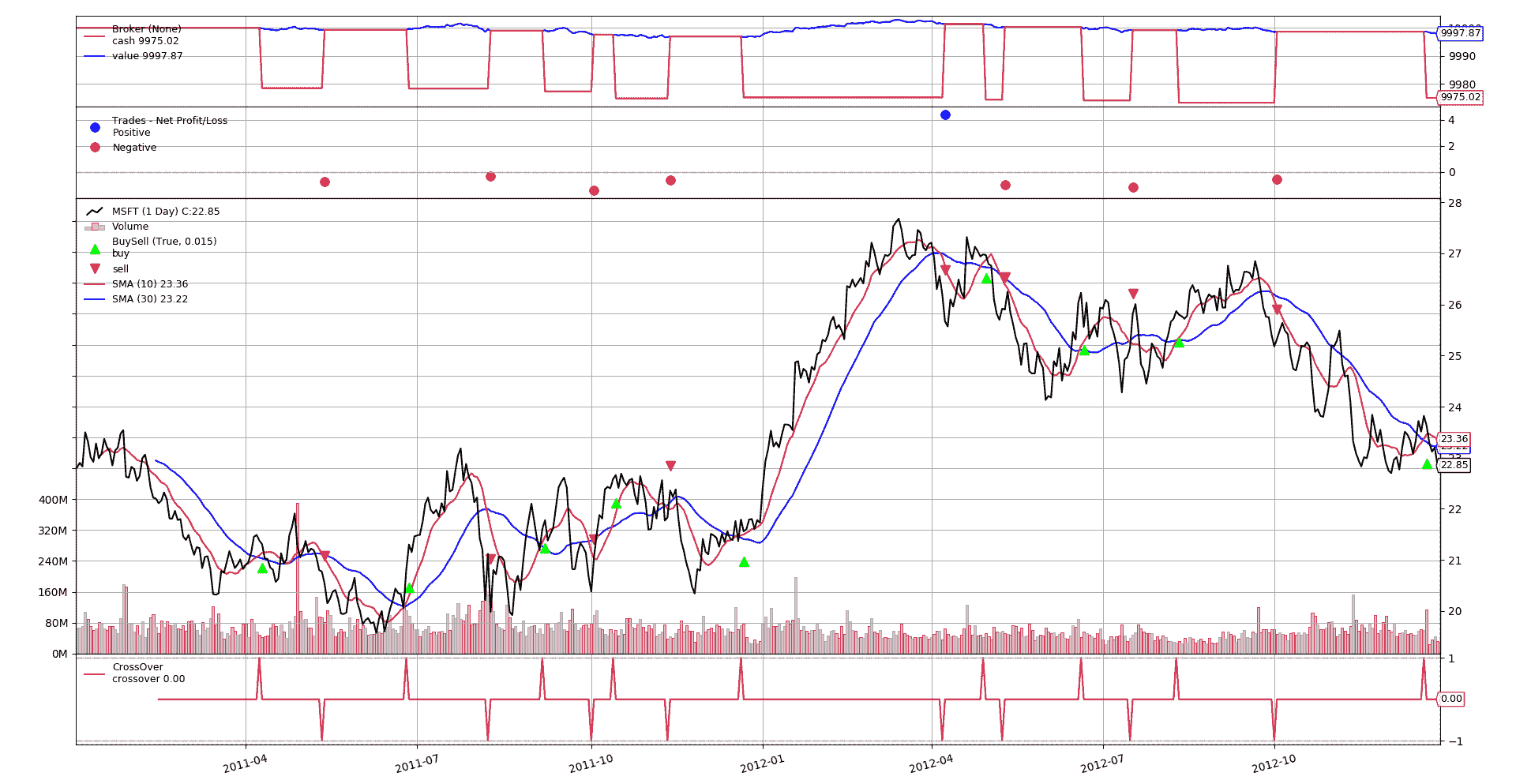

经典的简单移动平均交叉策略,可以以不同的方式轻松实现。以下三个片段的结果和图表相同。

from datetime import datetime

import backtrader as bt

# Create a subclass of Strategy to define the indicators and logic

class SmaCross(bt.Strategy):

# list of parameters which are configurable for the strategy

params = dict(

pfast=10, # period for the fast moving average

pslow=30 # period for the slow moving average

)

def __init__(self):

sma1 = bt.ind.SMA(period=self.p.pfast) # fast moving average

sma2 = bt.ind.SMA(period=self.p.pslow) # slow moving average

self.crossover = bt.ind.CrossOver(sma1, sma2) # crossover signal

def next(self):

if not self.position: # not in the market

if self.crossover > 0: # if fast crosses slow to the upside

self.buy() # enter long

elif self.crossover < 0: # in the market & cross to the downside

self.close() # close long position

cerebro = bt.Cerebro() # create a "Cerebro" engine instance

# Create a data feed

data = bt.feeds.YahooFinanceData(dataname='MSFT',

fromdate=datetime(2011, 1, 1),

todate=datetime(2012, 12, 31))

cerebro.adddata(data) # Add the data feed

cerebro.addstrategy(SmaCross) # Add the trading strategy

cerebro.run() # run it all

cerebro.plot() # and plot it with a single command

from datetime import datetime

import backtrader as bt

# Create a subclass of Strategy to define the indicators and logic

class SmaCross(bt.Strategy):

# list of parameters which are configurable for the strategy

params = dict(

pfast=10, # period for the fast moving average

pslow=30 # period for the slow moving average

)

def __init__(self):

sma1 = bt.ind.SMA(period=self.p.pfast) # fast moving average

sma2 = bt.ind.SMA(period=self.p.pslow) # slow moving average

self.crossover = bt.ind.CrossOver(sma1, sma2) # crossover signal

def next(self):

if not self.position: # not in the market

if self.crossover > 0: # if fast crosses slow to the upside

self.order_target_size(target=1) # enter long

elif self.crossover < 0: # in the market & cross to the downside

self.order_target_size(target=0) # close long position

cerebro = bt.Cerebro() # create a "Cerebro" engine instance

# Create a data feed

data = bt.feeds.YahooFinanceData(dataname='MSFT',

fromdate=datetime(2011, 1, 1),

todate=datetime(2012, 12, 31))

cerebro.adddata(data) # Add the data feed

cerebro.addstrategy(SmaCross) # Add the trading strategy

cerebro.run() # run it all

cerebro.plot() # and plot it with a single command

from datetime import datetime

import backtrader as bt

# Create a subclass of SignaStrategy to define the indicators and signals

class SmaCross(bt.SignalStrategy):

# list of parameters which are configurable for the strategy

params = dict(

pfast=10, # period for the fast moving average

pslow=30 # period for the slow moving average

)

def __init__(self):

sma1 = bt.ind.SMA(period=self.p.pfast) # fast moving average

sma2 = bt.ind.SMA(period=self.p.pslow) # slow moving average

crossover = bt.ind.CrossOver(sma1, sma2) # crossover signal

self.signal_add(bt.SIGNAL_LONG, crossover) # use it as LONG signal

cerebro = bt.Cerebro() # create a "Cerebro" engine instance

# Create a data feed

data = bt.feeds.YahooFinanceData(dataname='MSFT',

fromdate=datetime(2011, 1, 1),

todate=datetime(2012, 12, 31))

cerebro.adddata(data) # Add the data feed

cerebro.addstrategy(SmaCross) # Add the trading strategy

cerebro.run() # run it all

cerebro.plot() # and plot it with a single command