多示例

原文: https://www.backtrader.com/blog/posts/2017-04-09-multi-example/multi-example/

社区中的两个主题似乎是关于如何跟踪订单的,特别是当多个数据源正在运行时,还包括多个订单一起工作时,如括号订单的情况

下面的脚本试图通过允许用户执行以下操作作为示例:

-

使用 3 个数据源

-

使用其中一个

usebracket=False时Market类型的单笔购买订单

或

- A括号订单集(

usebracket=True

在这种情况下,可以指定如何创建括号集

-

rawbracket=True时发出 3 个订单(1 个家长+2 个孩子) -

在

rawbracket=False时打电话给buy_bracket

主括号订单的有效期在

valid天后(默认为10) -

当

weekday与为默认为[1, 3, 4]的每个数据馈送定义的enter值匹配时,将输入(或至少尝试输入)一个位置 -

打开的位置将退出

- 在

holding周期后使用常规close。在一个带有参数hold的列表中为每个数据馈送单独定义时段,该参数默认为[7, 10, 15]

这将触发取消任何括号订单的

stop侧(如果存在)(将自动取消另一侧)- 或者如果使用了括号,当

stop(限额损失)或limit(获利回吐)一方执行时(系统将自动取消另一方) -

订单保存在仓库里

-

dict使用data作为键 -

每个

data条目包含一个list条目,每个data条目都有打开的订单

订单发出后,在

notify_order中进行管理 - 在

此外:

-

使用一个

TestSizer,它将返回buy和sell订单的不同值作为测试因为只启动了长操作,所以只返回

buy大小调整,并且输出日志将不包含sell大小调整的痕迹。

创建了大量的操作、位置和订单管理日志,以帮助了解发生了什么。

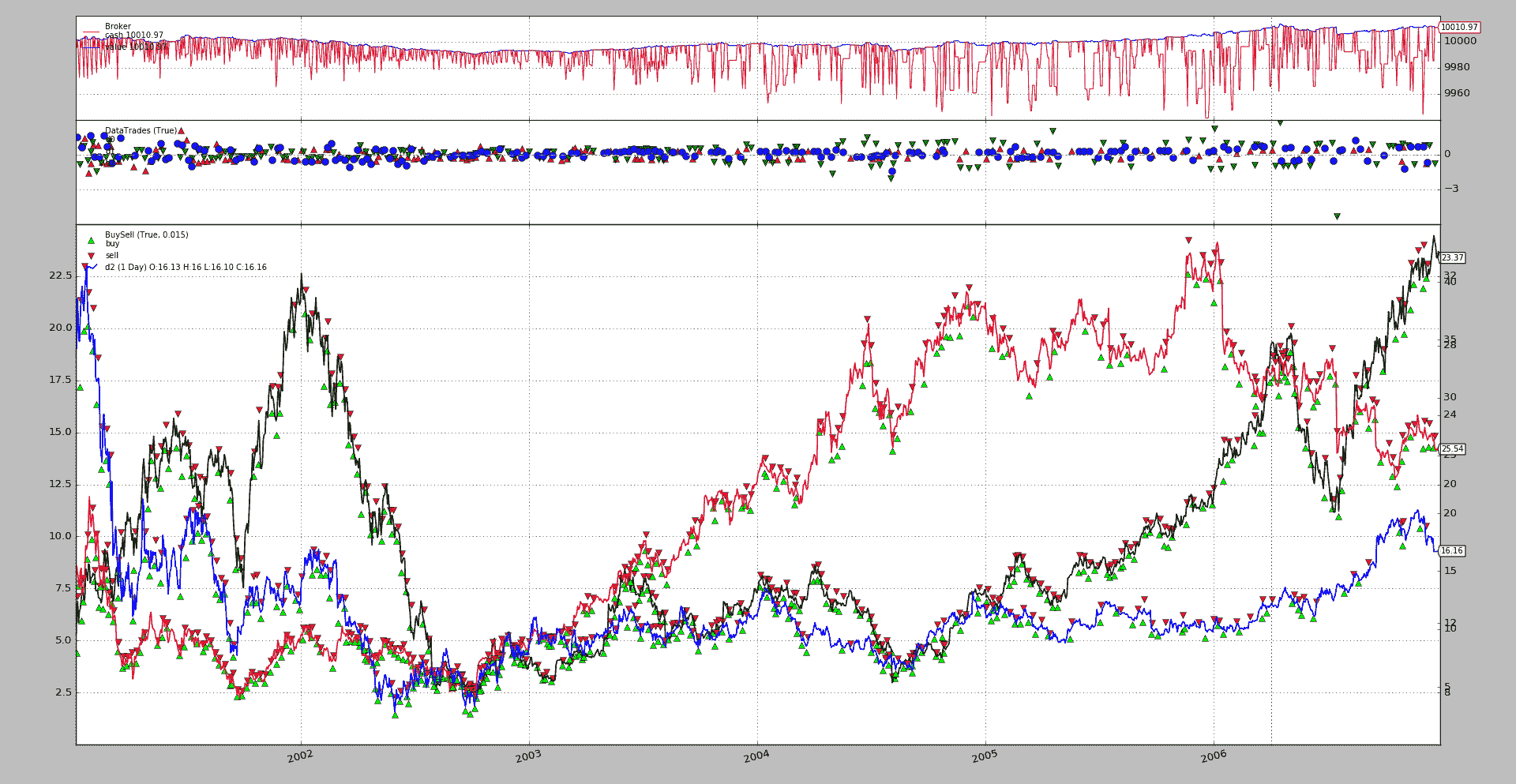

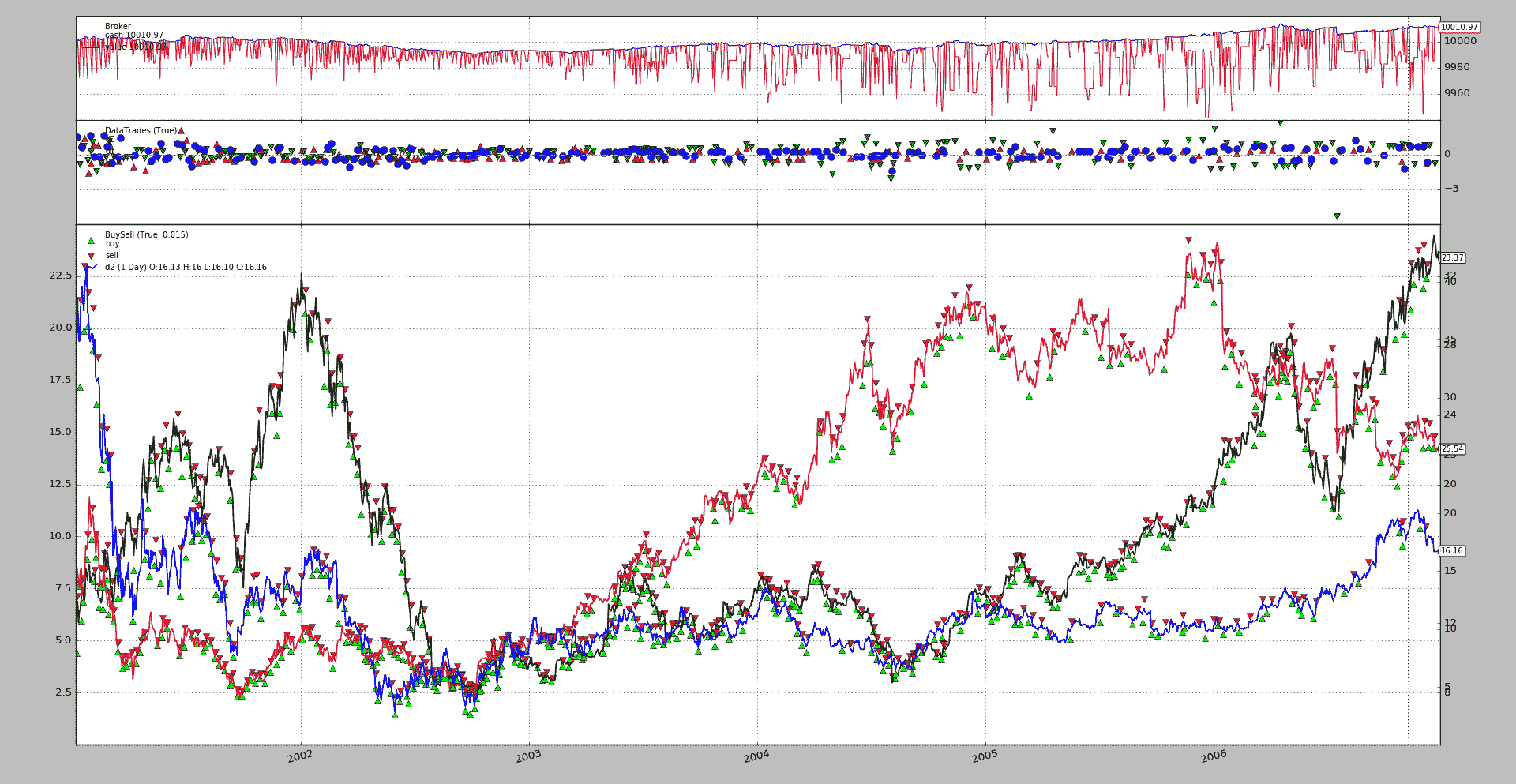

让我们看一个默认值为usebracket=True和rawbracket=True的示例执行(为了简化绘图,将删除体积):

$ ./mult-values.py --plot volume=False

2001-01-02 d0 Position 0

2001-01-02 Data d0 OType buy Sizing to 1

2001-01-02 d0 Main 1 Stp 2 Lmt 3

2001-01-02 d1 Position 0

2001-01-02 d2 Position 0

2001-01-03 d0 Order 1 Status Accepted

2001-01-03 d0 Order 2 Status Accepted

2001-01-03 d0 Order 3 Status Accepted

2001-01-03 d0 Order 1 Status Completed

-- No longer alive main Ref

2001-01-03 d0 Position 1

2001-01-03 d1 Position 0

2001-01-03 d2 Position 0

2001-01-04 d0 Order 3 Status Completed

-- No longer alive limit Ref

2001-01-04 d0 Order 2 Status Canceled

-- No longer alive stop Ref

...

...

...

2006-12-27 d0 Order 2036 Status Accepted

2006-12-27 d0 Order 2037 Status Accepted

2006-12-27 d0 Order 2038 Status Accepted

2006-12-27 d0 Position 0

2006-12-27 d1 Position 0

2006-12-27 d2 Position 0

2006-12-28 d0 Position 0

2006-12-28 d1 Position 0

2006-12-28 d2 Position 0

2006-12-29 d0 Position 0

2006-12-29 d1 Position 0

2006-12-29 d2 Position 0

A 2nd执行集rawbracket=False

$ ./mult-values.py --plot volume=False --strat rawbracket=False

输出完全相同的结果,这次使用了buy_bracket。

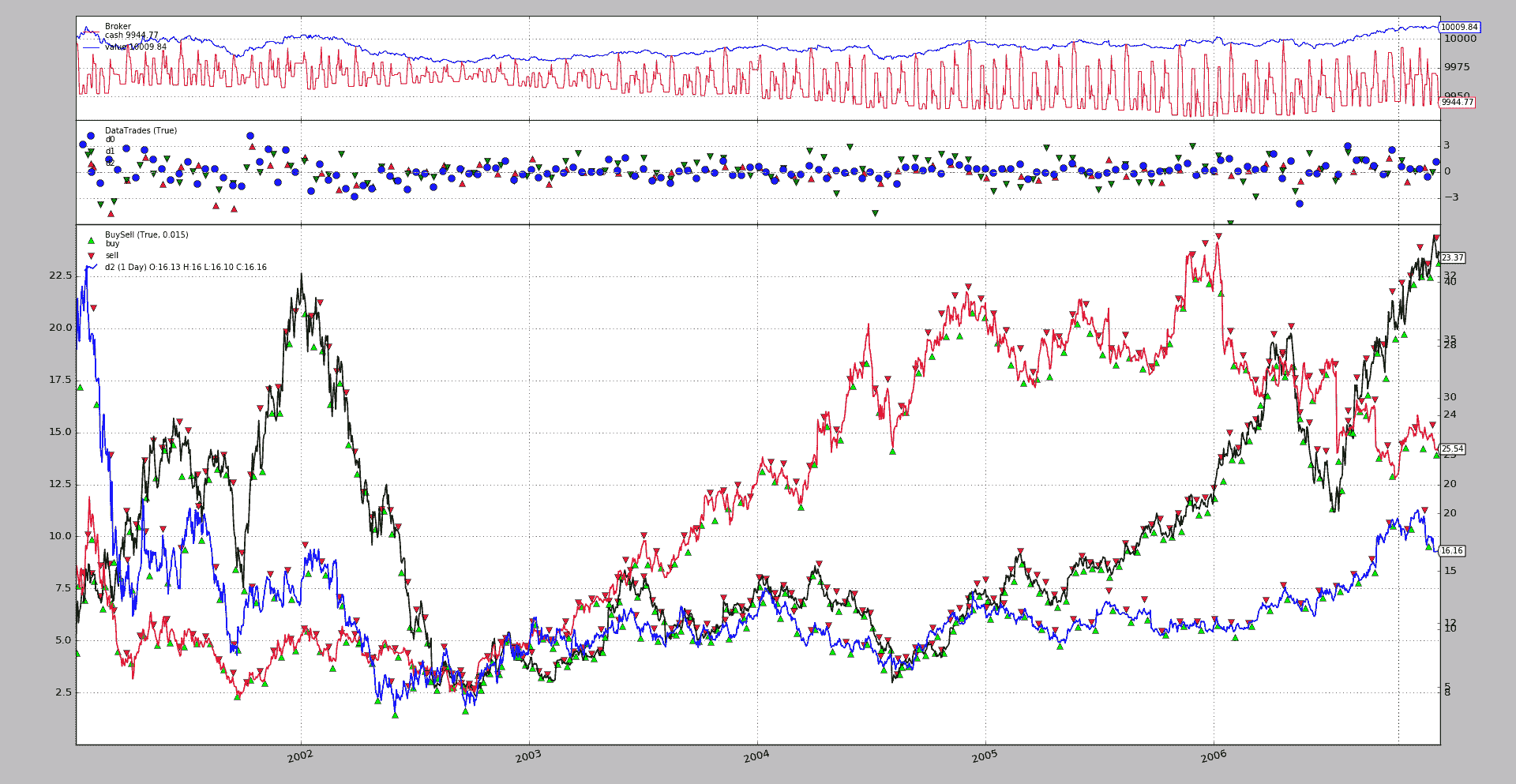

最后禁用括号使用:

./mult-values.py --strat usebracket=False --plot volume=False

结论

这应该是订单管理的一个很好的例子,具有多个数据源和订单集。

样本使用

$ ./mult-values.py --help

usage: mult-values.py [-h] [--data0 DATA0] [--data1 DATA1] [--data2 DATA2]

[--fromdate FROMDATE] [--todate TODATE]

[--cerebro kwargs] [--broker kwargs] [--sizer kwargs]

[--strat kwargs] [--plot [kwargs]]

Multiple Values and Brackets

optional arguments:

-h, --help show this help message and exit

--data0 DATA0 Data0 to read in (default:

../../datas/nvda-1999-2014.txt)

--data1 DATA1 Data1 to read in (default:

../../datas/yhoo-1996-2014.txt)

--data2 DATA2 Data1 to read in (default:

../../datas/orcl-1995-2014.txt)

--fromdate FROMDATE Date[time] in YYYY-MM-DD[THH:MM:SS] format (default:

2001-01-01)

--todate TODATE Date[time] in YYYY-MM-DD[THH:MM:SS] format (default:

2007-01-01)

--cerebro kwargs kwargs in key=value format (default: )

--broker kwargs kwargs in key=value format (default: )

--sizer kwargs kwargs in key=value format (default: )

--strat kwargs kwargs in key=value format (default: )

--plot [kwargs] kwargs in key=value format (default: )

示例代码

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import argparse

import datetime

import backtrader as bt

class TestSizer(bt.Sizer):

params = dict(stake=1)

def _getsizing(self, comminfo, cash, data, isbuy):

dt, i = self.strategy.datetime.date(), data._id

s = self.p.stake * (1 + (not isbuy))

print('{} Data {} OType {} Sizing to {}'.format(

dt, data._name, ('buy' * isbuy) or 'sell', s))

return s

class St(bt.Strategy):

params = dict(

enter=[1, 3, 4], # data ids are 1 based

hold=[7, 10, 15], # data ids are 1 based

usebracket=True,

rawbracket=True,

pentry=0.015,

plimits=0.03,

valid=10,

)

def notify_order(self, order):

if order.status == order.Submitted:

return

dt, dn = self.datetime.date(), order.data._name

print('{} {} Order {} Status {}'.format(

dt, dn, order.ref, order.getstatusname())

)

whichord = ['main', 'stop', 'limit', 'close']

if not order.alive(): # not alive - nullify

dorders = self.o[order.data]

idx = dorders.index(order)

dorders[idx] = None

print('-- No longer alive {} Ref'.format(whichord[idx]))

if all(x is None for x in dorders):

dorders[:] = [] # empty list - New orders allowed

def __init__(self):

self.o = dict() # orders per data (main, stop, limit, manual-close)

self.holding = dict() # holding periods per data

def next(self):

for i, d in enumerate(self.datas):

dt, dn = self.datetime.date(), d._name

pos = self.getposition(d).size

print('{} {} Position {}'.format(dt, dn, pos))

if not pos and not self.o.get(d, None): # no market / no orders

if dt.weekday() == self.p.enter[i]:

if not self.p.usebracket:

self.o[d] = [self.buy(data=d)]

print('{} {} Buy {}'.format(dt, dn, self.o[d][0].ref))

else:

p = d.close[0] * (1.0 - self.p.pentry)

pstp = p * (1.0 - self.p.plimits)

plmt = p * (1.0 + self.p.plimits)

valid = datetime.timedelta(self.p.valid)

if self.p.rawbracket:

o1 = self.buy(data=d, exectype=bt.Order.Limit,

price=p, valid=valid, transmit=False)

o2 = self.sell(data=d, exectype=bt.Order.Stop,

price=pstp, size=o1.size,

transmit=False, parent=o1)

o3 = self.sell(data=d, exectype=bt.Order.Limit,

price=plmt, size=o1.size,

transmit=True, parent=o1)

self.o[d] = [o1, o2, o3]

else:

self.o[d] = self.buy_bracket(

data=d, price=p, stopprice=pstp,

limitprice=plmt, oargs=dict(valid=valid))

print('{} {} Main {} Stp {} Lmt {}'.format(

dt, dn, *(x.ref for x in self.o[d])))

self.holding[d] = 0

elif pos: # exiting can also happen after a number of days

self.holding[d] += 1

if self.holding[d] >= self.p.hold[i]:

o = self.close(data=d)

self.o[d].append(o) # manual order to list of orders

print('{} {} Manual Close {}'.format(dt, dn, o.ref))

if self.p.usebracket:

self.cancel(self.o[d][1]) # cancel stop side

print('{} {} Cancel {}'.format(dt, dn, self.o[d][1]))

def runstrat(args=None):

args = parse_args(args)

cerebro = bt.Cerebro()

# Data feed kwargs

kwargs = dict()

# Parse from/to-date

dtfmt, tmfmt = '%Y-%m-%d', 'T%H:%M:%S'

for a, d in ((getattr(args, x), x) for x in ['fromdate', 'todate']):

if a:

strpfmt = dtfmt + tmfmt * ('T' in a)

kwargs[d] = datetime.datetime.strptime(a, strpfmt)

# Data feed

data0 = bt.feeds.YahooFinanceCSVData(dataname=args.data0, **kwargs)

cerebro.adddata(data0, name='d0')

data1 = bt.feeds.YahooFinanceCSVData(dataname=args.data1, **kwargs)

data1.plotinfo.plotmaster = data0

cerebro.adddata(data1, name='d1')

data2 = bt.feeds.YahooFinanceCSVData(dataname=args.data2, **kwargs)

data2.plotinfo.plotmaster = data0

cerebro.adddata(data2, name='d2')

# Broker

cerebro.broker = bt.brokers.BackBroker(**eval('dict(' + args.broker + ')'))

cerebro.broker.setcommission(commission=0.001)

# Sizer

# cerebro.addsizer(bt.sizers.FixedSize, **eval('dict(' + args.sizer + ')'))

cerebro.addsizer(TestSizer, **eval('dict(' + args.sizer + ')'))

# Strategy

cerebro.addstrategy(St, **eval('dict(' + args.strat + ')'))

# Execute

cerebro.run(**eval('dict(' + args.cerebro + ')'))

if args.plot: # Plot if requested to

cerebro.plot(**eval('dict(' + args.plot + ')'))

def parse_args(pargs=None):

parser = argparse.ArgumentParser(

formatter_class=argparse.ArgumentDefaultsHelpFormatter,

description=(

'Multiple Values and Brackets'

)

)

parser.add_argument('--data0', default='../../datas/nvda-1999-2014.txt',

required=False, help='Data0 to read in')

parser.add_argument('--data1', default='../../datas/yhoo-1996-2014.txt',

required=False, help='Data1 to read in')

parser.add_argument('--data2', default='../../datas/orcl-1995-2014.txt',

required=False, help='Data1 to read in')

# Defaults for dates

parser.add_argument('--fromdate', required=False, default='2001-01-01',

help='Date[time] in YYYY-MM-DD[THH:MM:SS] format')

parser.add_argument('--todate', required=False, default='2007-01-01',

help='Date[time] in YYYY-MM-DD[THH:MM:SS] format')

parser.add_argument('--cerebro', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--broker', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--sizer', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--strat', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--plot', required=False, default='',

nargs='?', const='{}',

metavar='kwargs', help='kwargs in key=value format')

return parser.parse_args(pargs)

if __name__ == '__main__':

runstrat()