奥运会组委会命令

原文: https://www.backtrader.com/docu/order-creation-execution/oco/oco/

发布版1.9.34.116将OCO(又名一个取消其他添加到回溯测试库中。

笔记

这只在回溯测试中实现,还没有针对实时代理的实现

笔记

更新版本为1.9.36.116。交互代理对StopTrail、StopTrailLimit和OCO的支持。

-

OCO始终指定组中的 1st顺序作为参数oco -

StopTrailLimit:经纪人模拟和IB经纪人具有 asme 行为。指定:price为初始停止触发价(同时指定trailamount),然后指定plimi为初始限价。两者之间的差异将决定limitoffset(限制价格与停止触发价格之间的距离)

使用模式试图保持用户友好。因此,如果策略中的逻辑已经决定是发布订单的时候,那么可以这样使用OCO:

def next(self):

...

o1 = self.buy(...)

...

o2 = self.buy(..., oco=o1)

...

o3 = self.buy(..., oco=o1) # or even oco=o2, o2 is already in o1 group

容易的第 1条命令o1将有点像组长。o2和o3通过使用oco命名参数指定o1而成为OCO 组的一部分。请注意,代码段中的注释表明,o3也可以通过指定o2(已经是组的一部分)成为组的一部分

组建团队后,将发生以下情况:

- 如果组中的任何订单被执行、取消或过期,其他订单将被取消

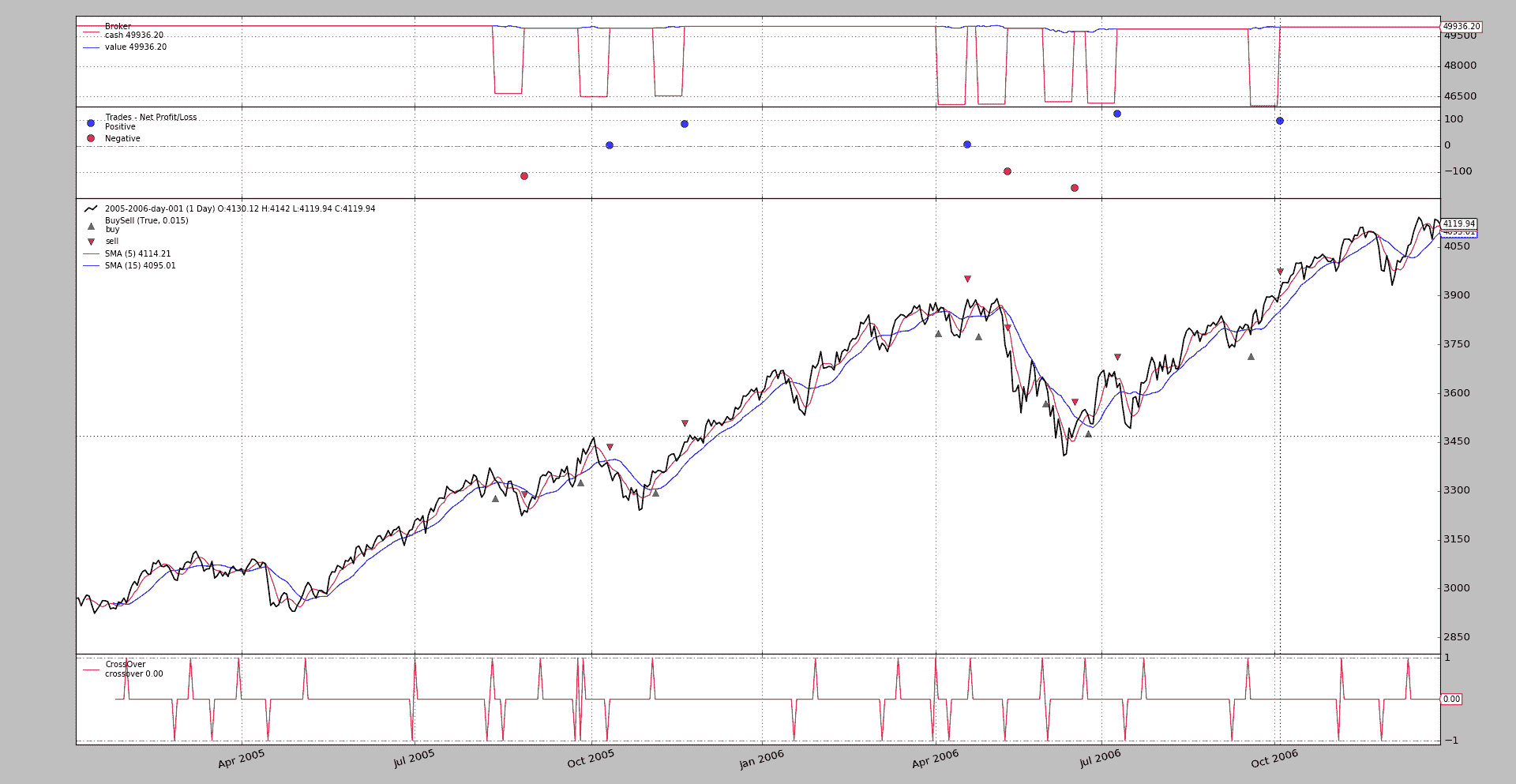

下面的示例说明了OCO的概念。带有绘图的标准执行:

$ ./oco.py --broker cash=50000 --plot

笔记

现金增加至50000,因为资产达到4000的价值,1项目的 3 个订单至少需要12000货币单位(经纪人默认为10000)

用下面的图表。

这实际上并没有提供太多的信息(这是一个标准的SMA Crossover策略)。该示例执行以下操作:

-

当快速SMA越过慢速SMA向上时,发出 3 个指令

-

order1为Limit订单,将在limdays天后到期(策略参数),以close价格降低一个百分比作为限价 -

order2是一个Limit订单,有效期更长,限价更低。 -

order3是进一步降低限价的Limit订单

因此,不会执行order2和order3,因为:

order1将首先执行,这将触发其他的取消

或

order1将到期,这将触发其他的取消

系统保留 3 张订单的ref标识,仅当notify_order中的三张ref标识为Completed、Cancelled、Margin或Expired时,系统才会发出新的buy订单

退出只需在保持某些杆的位置后进行。

为了尝试跟踪实际执行,将生成文本输出。其中一些:

2005-01-28: Oref 1 / Buy at 2941.11055

2005-01-28: Oref 2 / Buy at 2896.7722

2005-01-28: Oref 3 / Buy at 2822.87495

2005-01-31: Order ref: 1 / Type Buy / Status Submitted

2005-01-31: Order ref: 2 / Type Buy / Status Submitted

2005-01-31: Order ref: 3 / Type Buy / Status Submitted

2005-01-31: Order ref: 1 / Type Buy / Status Accepted

2005-01-31: Order ref: 2 / Type Buy / Status Accepted

2005-01-31: Order ref: 3 / Type Buy / Status Accepted

2005-02-01: Order ref: 1 / Type Buy / Status Expired

2005-02-01: Order ref: 3 / Type Buy / Status Canceled

2005-02-01: Order ref: 2 / Type Buy / Status Canceled

...

2006-06-23: Oref 49 / Buy at 3532.39925

2006-06-23: Oref 50 / Buy at 3479.147

2006-06-23: Oref 51 / Buy at 3390.39325

2006-06-26: Order ref: 49 / Type Buy / Status Submitted

2006-06-26: Order ref: 50 / Type Buy / Status Submitted

2006-06-26: Order ref: 51 / Type Buy / Status Submitted

2006-06-26: Order ref: 49 / Type Buy / Status Accepted

2006-06-26: Order ref: 50 / Type Buy / Status Accepted

2006-06-26: Order ref: 51 / Type Buy / Status Accepted

2006-06-26: Order ref: 49 / Type Buy / Status Completed

2006-06-26: Order ref: 51 / Type Buy / Status Canceled

2006-06-26: Order ref: 50 / Type Buy / Status Canceled

...

2006-11-10: Order ref: 61 / Type Buy / Status Canceled

2006-12-11: Oref 63 / Buy at 4032.62555

2006-12-11: Oref 64 / Buy at 3971.8322

2006-12-11: Oref 65 / Buy at 3870.50995

2006-12-12: Order ref: 63 / Type Buy / Status Submitted

2006-12-12: Order ref: 64 / Type Buy / Status Submitted

2006-12-12: Order ref: 65 / Type Buy / Status Submitted

2006-12-12: Order ref: 63 / Type Buy / Status Accepted

2006-12-12: Order ref: 64 / Type Buy / Status Accepted

2006-12-12: Order ref: 65 / Type Buy / Status Accepted

2006-12-15: Order ref: 63 / Type Buy / Status Expired

2006-12-15: Order ref: 65 / Type Buy / Status Canceled

2006-12-15: Order ref: 64 / Type Buy / Status Canceled

发生以下情况:

-

第 1st批订单发出。订单 1 过期,订单 2 和订单 3 被取消。正如所料。

-

几个月后,又发出了一批 3 份订单。在这种情况下,49 号订单得到

Completed,50 号和 51 号订单立即取消 -

最后一批就像 1st一样

现在让我们检查一下没有OCO的行为:

$ ./oco.py --strat do_oco=False --broker cash=50000

2005-01-28: Oref 1 / Buy at 2941.11055

2005-01-28: Oref 2 / Buy at 2896.7722

2005-01-28: Oref 3 / Buy at 2822.87495

2005-01-31: Order ref: 1 / Type Buy / Status Submitted

2005-01-31: Order ref: 2 / Type Buy / Status Submitted

2005-01-31: Order ref: 3 / Type Buy / Status Submitted

2005-01-31: Order ref: 1 / Type Buy / Status Accepted

2005-01-31: Order ref: 2 / Type Buy / Status Accepted

2005-01-31: Order ref: 3 / Type Buy / Status Accepted

2005-02-01: Order ref: 1 / Type Buy / Status Expired

就这样,这并不多(没有订单执行,也不太需要图表)

-

该批订单已发出

-

订单 1 过期,但由于策略已获得参数

do_oco=False,订单 2 和订单 3 不属于OCO组 -

因此,订单 2 和订单 3 不会被取消,因为默认的到期时间差为

1000天后,它们不会因样本的可用数据(2 年的数据)而到期 -

系统从不发出第 2和批订单。

样本使用

$ ./oco.py --help

usage: oco.py [-h] [--data0 DATA0] [--fromdate FROMDATE] [--todate TODATE]

[--cerebro kwargs] [--broker kwargs] [--sizer kwargs]

[--strat kwargs] [--plot [kwargs]]

Sample Skeleton

optional arguments:

-h, --help show this help message and exit

--data0 DATA0 Data to read in (default:

../../datas/2005-2006-day-001.txt)

--fromdate FROMDATE Date[time] in YYYY-MM-DD[THH:MM:SS] format (default: )

--todate TODATE Date[time] in YYYY-MM-DD[THH:MM:SS] format (default: )

--cerebro kwargs kwargs in key=value format (default: )

--broker kwargs kwargs in key=value format (default: )

--sizer kwargs kwargs in key=value format (default: )

--strat kwargs kwargs in key=value format (default: )

--plot [kwargs] kwargs in key=value format (default: )

示例代码

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import argparse

import datetime

import backtrader as bt

class St(bt.Strategy):

params = dict(

ma=bt.ind.SMA,

p1=5,

p2=15,

limit=0.005,

limdays=3,

limdays2=1000,

hold=10,

switchp1p2=False, # switch prices of order1 and order2

oco1oco2=False, # False - use order1 as oco for order3, else order2

do_oco=True, # use oco or not

)

def notify_order(self, order):

print('{}: Order ref: {} / Type {} / Status {}'.format(

self.data.datetime.date(0),

order.ref, 'Buy' * order.isbuy() or 'Sell',

order.getstatusname()))

if order.status == order.Completed:

self.holdstart = len(self)

if not order.alive() and order.ref in self.orefs:

self.orefs.remove(order.ref)

def __init__(self):

ma1, ma2 = self.p.ma(period=self.p.p1), self.p.ma(period=self.p.p2)

self.cross = bt.ind.CrossOver(ma1, ma2)

self.orefs = list()

def next(self):

if self.orefs:

return # pending orders do nothing

if not self.position:

if self.cross > 0.0: # crossing up

p1 = self.data.close[0] * (1.0 - self.p.limit)

p2 = self.data.close[0] * (1.0 - 2 * 2 * self.p.limit)

p3 = self.data.close[0] * (1.0 - 3 * 3 * self.p.limit)

if self.p.switchp1p2:

p1, p2 = p2, p1

o1 = self.buy(exectype=bt.Order.Limit, price=p1,

valid=datetime.timedelta(self.p.limdays))

print('{}: Oref {} / Buy at {}'.format(

self.datetime.date(), o1.ref, p1))

oco2 = o1 if self.p.do_oco else None

o2 = self.buy(exectype=bt.Order.Limit, price=p2,

valid=datetime.timedelta(self.p.limdays2),

oco=oco2)

print('{}: Oref {} / Buy at {}'.format(

self.datetime.date(), o2.ref, p2))

if self.p.do_oco:

oco3 = o1 if not self.p.oco1oco2 else oco2

else:

oco3 = None

o3 = self.buy(exectype=bt.Order.Limit, price=p3,

valid=datetime.timedelta(self.p.limdays2),

oco=oco3)

print('{}: Oref {} / Buy at {}'.format(

self.datetime.date(), o3.ref, p3))

self.orefs = [o1.ref, o2.ref, o3.ref]

else: # in the market

if (len(self) - self.holdstart) >= self.p.hold:

self.close()

def runstrat(args=None):

args = parse_args(args)

cerebro = bt.Cerebro()

# Data feed kwargs

kwargs = dict()

# Parse from/to-date

dtfmt, tmfmt = '%Y-%m-%d', 'T%H:%M:%S'

for a, d in ((getattr(args, x), x) for x in ['fromdate', 'todate']):

if a:

strpfmt = dtfmt + tmfmt * ('T' in a)

kwargs[d] = datetime.datetime.strptime(a, strpfmt)

# Data feed

data0 = bt.feeds.BacktraderCSVData(dataname=args.data0, **kwargs)

cerebro.adddata(data0)

# Broker

cerebro.broker = bt.brokers.BackBroker(**eval('dict(' + args.broker + ')'))

# Sizer

cerebro.addsizer(bt.sizers.FixedSize, **eval('dict(' + args.sizer + ')'))

# Strategy

cerebro.addstrategy(St, **eval('dict(' + args.strat + ')'))

# Execute

cerebro.run(**eval('dict(' + args.cerebro + ')'))

if args.plot: # Plot if requested to

cerebro.plot(**eval('dict(' + args.plot + ')'))

def parse_args(pargs=None):

parser = argparse.ArgumentParser(

formatter_class=argparse.ArgumentDefaultsHelpFormatter,

description=(

'Sample Skeleton'

)

)

parser.add_argument('--data0', default='../../datas/2005-2006-day-001.txt',

required=False, help='Data to read in')

# Defaults for dates

parser.add_argument('--fromdate', required=False, default='',

help='Date[time] in YYYY-MM-DD[THH:MM:SS] format')

parser.add_argument('--todate', required=False, default='',

help='Date[time] in YYYY-MM-DD[THH:MM:SS] format')

parser.add_argument('--cerebro', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--broker', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--sizer', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--strat', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--plot', required=False, default='',

nargs='?', const='{}',

metavar='kwargs', help='kwargs in key=value format')

return parser.parse_args(pargs)

if __name__ == '__main__':

runstrat()