对开积分

原文: https://www.backtrader.com/blog/posts/2016-07-17-pyfolio-integration/pyfolio-integration/

笔记

2017 年 2 月

pyfolioAPI 已更改,create_full_tear_sheet不再使用gross_lev作为命名参数。

因此,下面的示例不起作用

鉴于 zipline 和 pyfolio 之间的紧密集成,第一眼看到教程就觉得很难,但 pyfolio 提供的用于其他用途的样本测试数据实际上非常有用,可以解码幕后运行的内容,从而实现集成的奇迹。

票证 108中提出了组合工具pyfolio的整合。

大部分零件已在backtrader中就位:

-

分析器基础结构

-

儿童分析仪

-

时间返回分析器

只需要一台主PyFolio分析仪和 3 台简易儿童分析仪。加上一个依赖于pyfolio已经需要的依赖项之一的方法,即pandas。

最具挑战性的部分是“正确处理所有依赖项”。

-

更新

pandas -

更新

numpy -

更新

scikit-lean -

更新

seaborn

在使用C编译器的类 Unix 环境下,一切都与时间有关。在 Windows 下,即使安装了特定的Microsoft编译器(在本例中是Python 2.7的链),事情还是失败了。但是一个著名的网站为Windows提供了一系列最新的软件包。如果需要,请访问:

如果没有测试,集成就不完整,这就是为什么通常的示例总是存在的原因。

没有文件夹

样本使用random.randint来决定何时购买/何时出售,因此这只是检查事情是否正常:

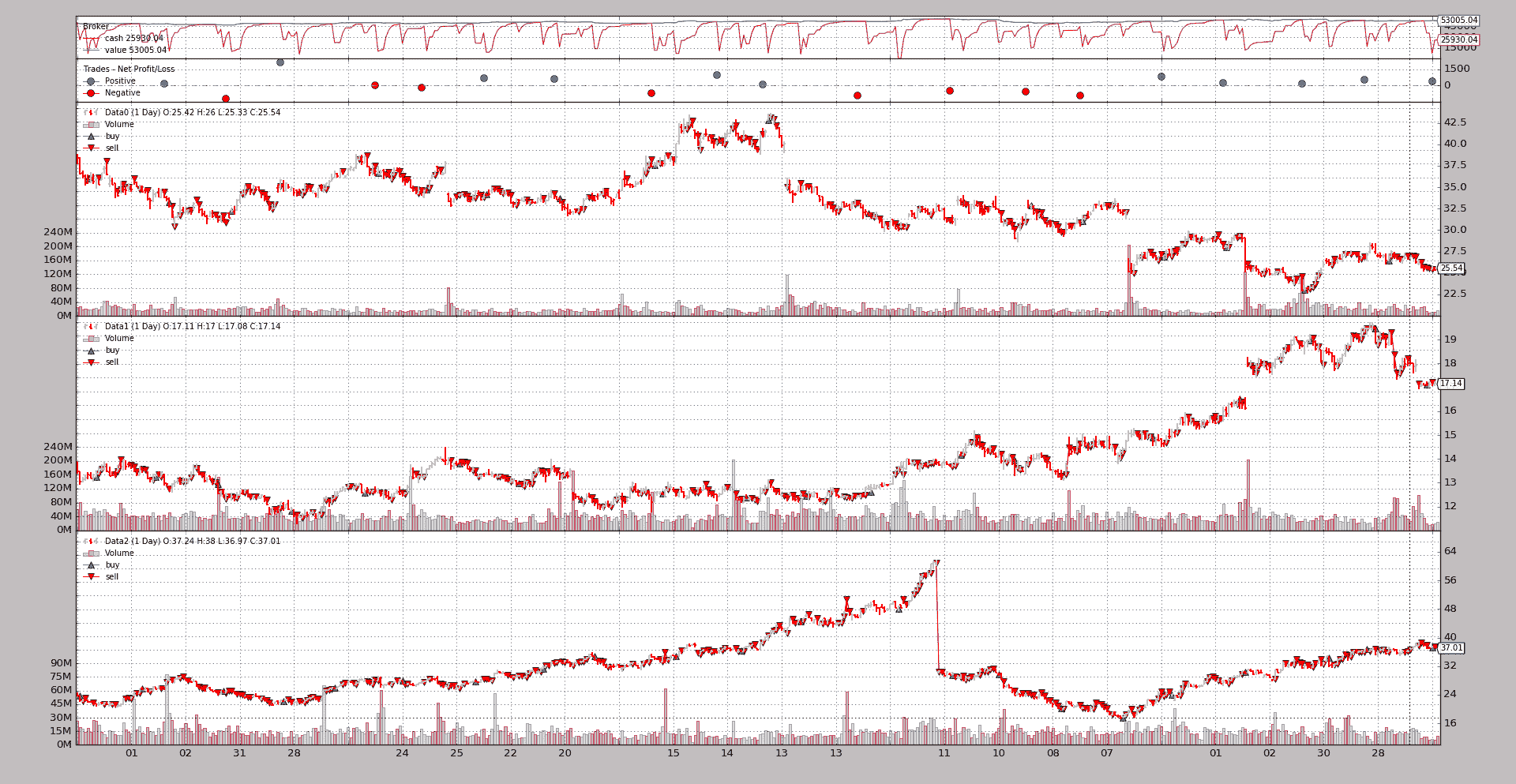

$ ./pyfoliotest.py --printout --no-pyfolio --plot

输出:

Len,Datetime,Open,High,Low,Close,Volume,OpenInterest

0001,2005-01-03T23:59:59,38.36,38.90,37.65,38.18,25482800.00,0.00

BUY 1000 @%23.58

0002,2005-01-04T23:59:59,38.45,38.54,36.46,36.58,26625300.00,0.00

BUY 1000 @%36.58

SELL 500 @%22.47

0003,2005-01-05T23:59:59,36.69,36.98,36.06,36.13,18469100.00,0.00

...

SELL 500 @%37.51

0502,2006-12-28T23:59:59,25.62,25.72,25.30,25.36,11908400.00,0.00

0503,2006-12-29T23:59:59,25.42,25.82,25.33,25.54,16297800.00,0.00

SELL 250 @%17.14

SELL 250 @%37.01

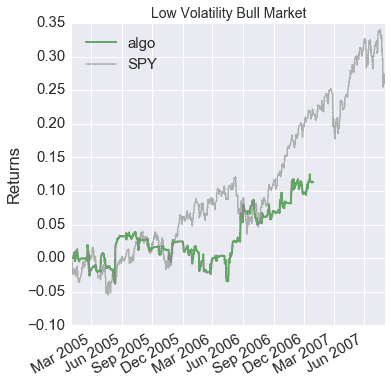

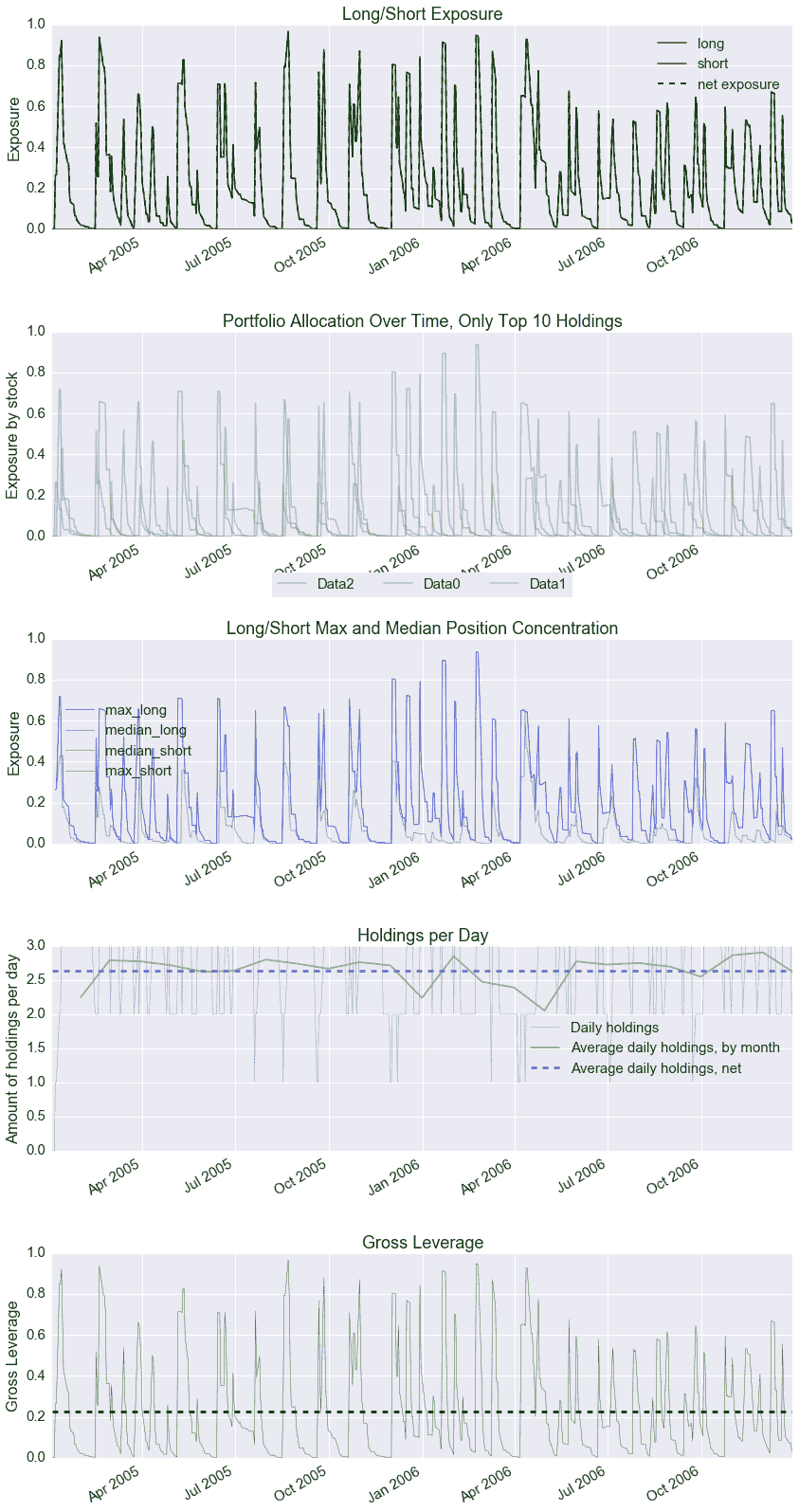

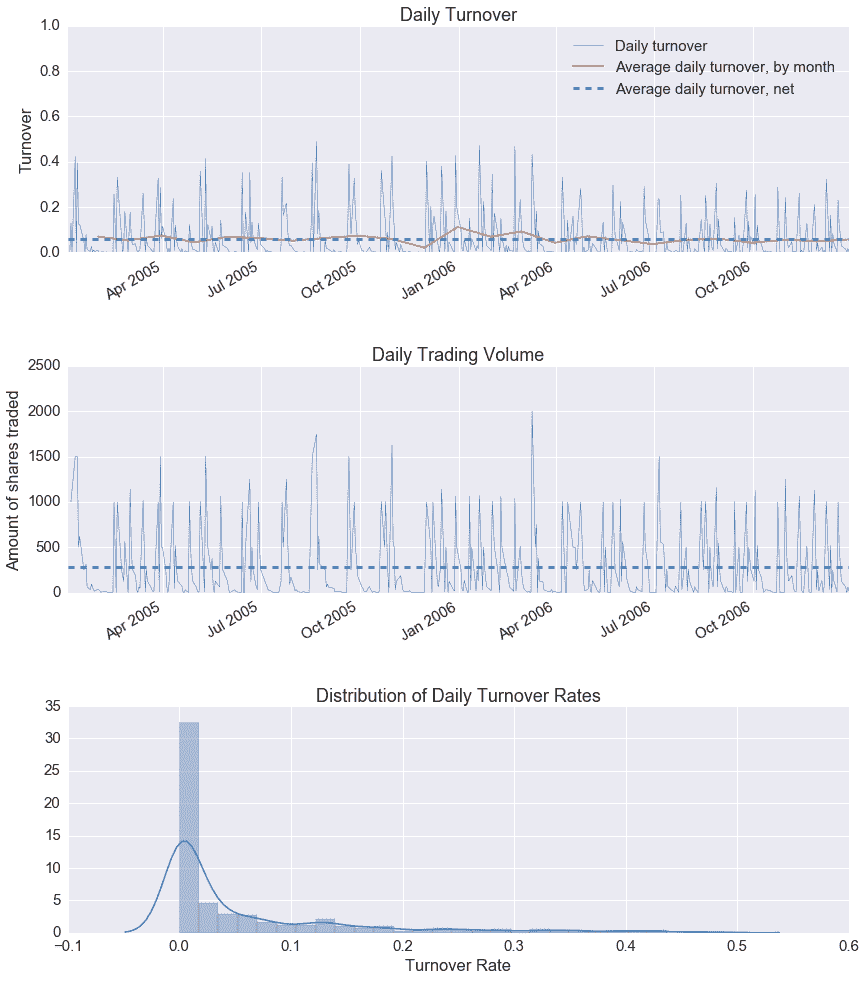

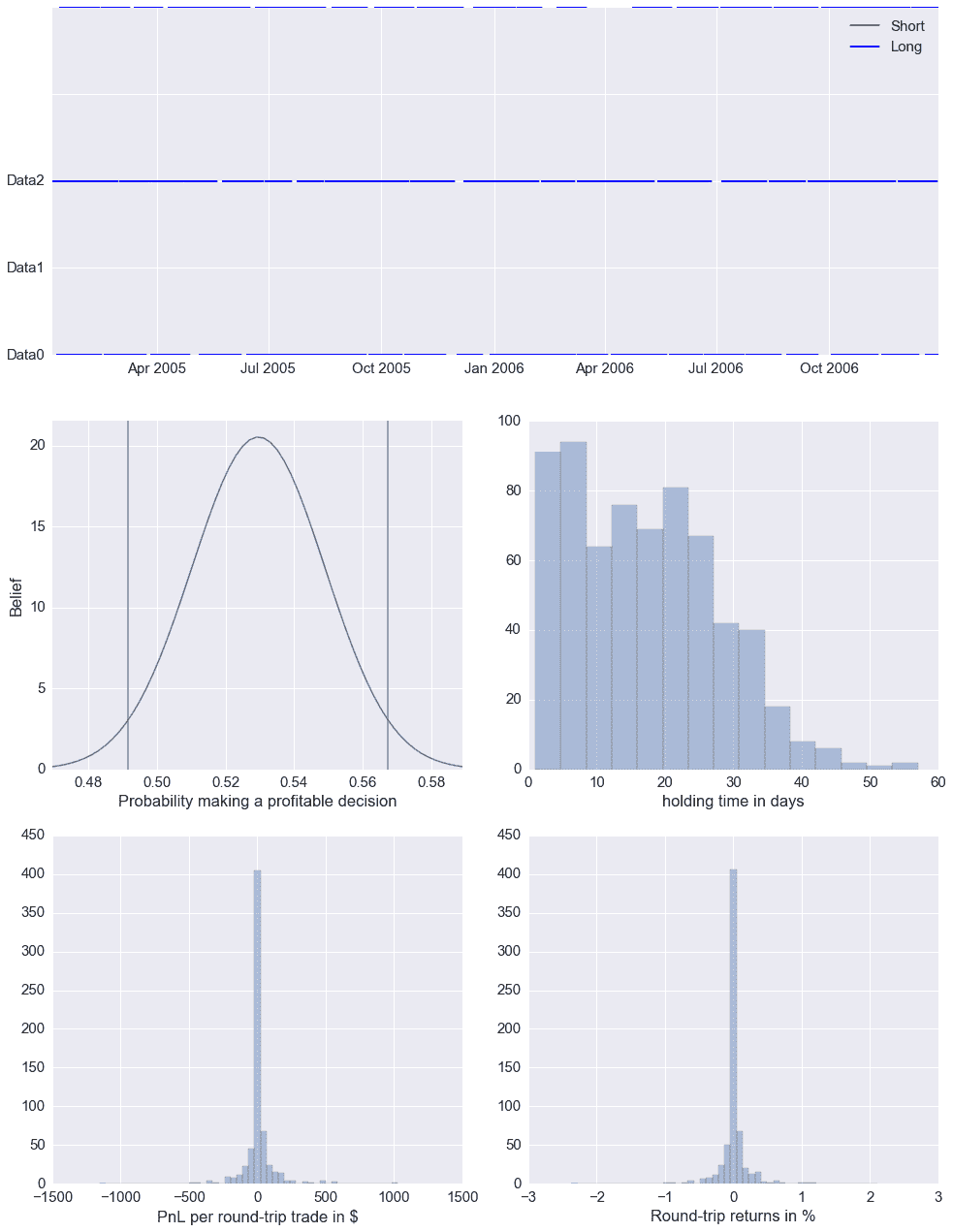

在测试运行的 2 年默认寿命期间,随机选择并分散了 3 个数据和几个买入和卖出操作

跑马场

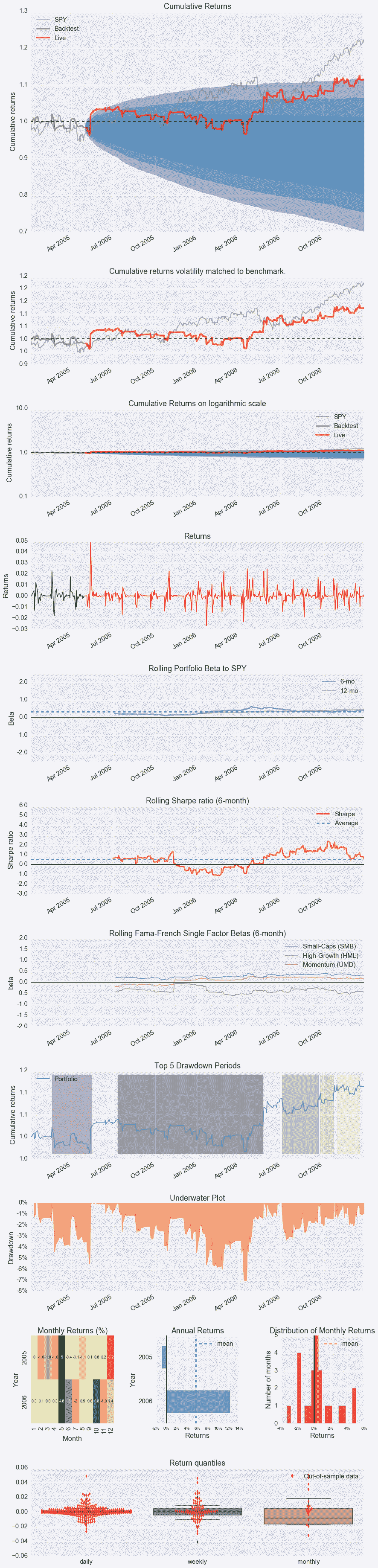

pyfolio在Jupyter 笔记本中运行时,包括内联绘图,一切正常。这是笔记本

笔记

runstrat获取此处[]作为参数,以使用默认参数运行,并跳过笔记本本身传递的参数

%matplotlib inline

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import argparse

import datetime

import random

import backtrader as bt

class St(bt.Strategy):

params = (

('printout', False),

('stake', 1000),

)

def __init__(self):

pass

def start(self):

if self.p.printout:

txtfields = list()

txtfields.append('Len')

txtfields.append('Datetime')

txtfields.append('Open')

txtfields.append('High')

txtfields.append('Low')

txtfields.append('Close')

txtfields.append('Volume')

txtfields.append('OpenInterest')

print(','.join(txtfields))

def next(self):

if self.p.printout:

# Print only 1st data ... is just a check that things are running

txtfields = list()

txtfields.append('%04d' % len(self))

txtfields.append(self.data.datetime.datetime(0).isoformat())

txtfields.append('%.2f' % self.data0.open[0])

txtfields.append('%.2f' % self.data0.high[0])

txtfields.append('%.2f' % self.data0.low[0])

txtfields.append('%.2f' % self.data0.close[0])

txtfields.append('%.2f' % self.data0.volume[0])

txtfields.append('%.2f' % self.data0.openinterest[0])

print(','.join(txtfields))

# Data 0

for data in self.datas:

toss = random.randint(1, 10)

curpos = self.getposition(data)

if curpos.size:

if toss > 5:

size = curpos.size // 2

self.sell(data=data, size=size)

if self.p.printout:

print('SELL {} @%{}'.format(size, data.close[0]))

elif toss < 5:

self.buy(data=data, size=self.p.stake)

if self.p.printout:

print('BUY {} @%{}'.format(self.p.stake, data.close[0]))

def runstrat(args=None):

args = parse_args(args)

cerebro = bt.Cerebro()

cerebro.broker.set_cash(args.cash)

dkwargs = dict()

if args.fromdate:

fromdate = datetime.datetime.strptime(args.fromdate, '%Y-%m-%d')

dkwargs['fromdate'] = fromdate

if args.todate:

todate = datetime.datetime.strptime(args.todate, '%Y-%m-%d')

dkwargs['todate'] = todate

data0 = bt.feeds.BacktraderCSVData(dataname=args.data0, **dkwargs)

cerebro.adddata(data0, name='Data0')

data1 = bt.feeds.BacktraderCSVData(dataname=args.data1, **dkwargs)

cerebro.adddata(data1, name='Data1')

data2 = bt.feeds.BacktraderCSVData(dataname=args.data2, **dkwargs)

cerebro.adddata(data2, name='Data2')

cerebro.addstrategy(St, printout=args.printout)

if not args.no_pyfolio:

cerebro.addanalyzer(bt.analyzers.PyFolio, _name='pyfolio')

results = cerebro.run()

if not args.no_pyfolio:

strat = results[0]

pyfoliozer = strat.analyzers.getbyname('pyfolio')

returns, positions, transactions, gross_lev = pyfoliozer.get_pf_items()

if args.printout:

print('-- RETURNS')

print(returns)

print('-- POSITIONS')

print(positions)

print('-- TRANSACTIONS')

print(transactions)

print('-- GROSS LEVERAGE')

print(gross_lev)

import pyfolio as pf

pf.create_full_tear_sheet(

returns,

positions=positions,

transactions=transactions,

gross_lev=gross_lev,

live_start_date='2005-05-01',

round_trips=True)

if args.plot:

cerebro.plot(style=args.plot_style)

def parse_args(args=None):

parser = argparse.ArgumentParser(

formatter_class=argparse.ArgumentDefaultsHelpFormatter,

description='Sample for pivot point and cross plotting')

parser.add_argument('--data0', required=False,

default='../../datas/yhoo-1996-2015.txt',

help='Data to be read in')

parser.add_argument('--data1', required=False,

default='../../datas/orcl-1995-2014.txt',

help='Data to be read in')

parser.add_argument('--data2', required=False,

default='../../datas/nvda-1999-2014.txt',

help='Data to be read in')

parser.add_argument('--fromdate', required=False,

default='2005-01-01',

help='Starting date in YYYY-MM-DD format')

parser.add_argument('--todate', required=False,

default='2006-12-31',

help='Ending date in YYYY-MM-DD format')

parser.add_argument('--printout', required=False, action='store_true',

help=('Print data lines'))

parser.add_argument('--cash', required=False, action='store',

type=float, default=50000,

help=('Cash to start with'))

parser.add_argument('--plot', required=False, action='store_true',

help=('Plot the result'))

parser.add_argument('--plot-style', required=False, action='store',

default='bar', choices=['bar', 'candle', 'line'],

help=('Plot style'))

parser.add_argument('--no-pyfolio', required=False, action='store_true',

help=('Do not do pyfolio things'))

import sys

aargs = args if args is not None else sys.argv[1:]

return parser.parse_args(aargs)

runstrat([])

Entire data start date: 2005-01-03

Entire data end date: 2006-12-29

Out-of-Sample Months: 20

Backtest Months: 3

[-0.012 -0.025]

D:drobinWinPython-64bit-2.7.10.3python-2.7.10.amd64libsite-packagespyfolioplotting.py:1210: FutureWarning: .resample() is now a deferred operation

use .resample(...).mean() instead of .resample(...)

**kwargs)

<matplotlib.figure.Figure at 0x23982b70>

样本的使用:

$ ./pyfoliotest.py --help

usage: pyfoliotest.py [-h] [--data0 DATA0] [--data1 DATA1] [--data2 DATA2]

[--fromdate FROMDATE] [--todate TODATE] [--printout]

[--cash CASH] [--plot] [--plot-style {bar,candle,line}]

[--no-pyfolio]

Sample for pivot point and cross plotting

optional arguments:

-h, --help show this help message and exit

--data0 DATA0 Data to be read in (default:

../../datas/yhoo-1996-2015.txt)

--data1 DATA1 Data to be read in (default:

../../datas/orcl-1995-2014.txt)

--data2 DATA2 Data to be read in (default:

../../datas/nvda-1999-2014.txt)

--fromdate FROMDATE Starting date in YYYY-MM-DD format (default:

2005-01-01)

--todate TODATE Ending date in YYYY-MM-DD format (default: 2006-12-31)

--printout Print data lines (default: False)

--cash CASH Cash to start with (default: 50000)

--plot Plot the result (default: False)

--plot-style {bar,candle,line}

Plot style (default: bar)

--no-pyfolio Do not do pyfolio things (default: False)