订单管理和执行

原文: https://www.backtrader.com/docu/order-creation-execution/order-creation-execution/

如果无法模拟订单,则回溯测试以及backtrader将无法完成。为此,平台中提供了以下内容。

对于订单管理 3 原语:

-

buy -

sell -

cancel

笔记

update原语显然是合乎逻辑的东西,但常识表明,这种方法主要由手动操作人员使用,他们使用的是判断性交易方法。

对于订单执行逻辑,以下执行类型:

-

Market -

Close -

Limit -

Stop -

StopLimit

订单管理

一些例子:

# buy the main date, with sizer default stake, Market order

order = self.buy()

# Market order - valid will be "IGNORED"

order = self.buy(valid=datetime.datetime.now() + datetime.timedelta(days=3))

# Market order - price will be IGNORED

order = self.buy(price=self.data.close[0] * 1.02)

# Market order - manual stake

order = self.buy(size=25)

# Limit order - want to set the price and can set a validity

order = self.buy(exectype=Order.Limit,

price=self.data.close[0] * 1.02,

valid=datetime.datetime.now() + datetime.timedelta(days=3)))

# StopLimit order - want to set the price, price limit

order = self.buy(exectype=Order.StopLimit,

price=self.data.close[0] * 1.02,

plimit=self.data.close[0] * 1.07)

# Canceling an existing order

self.broker.cancel(order)

笔记

所有订单类型都可以通过创建Order实例(或其子类之一)创建,然后通过以下方式传递给代理:

order = self.broker.submit(order)

笔记

在broker本身中有buy和sell原语,但它们对默认参数的宽容程度较低。

订单执行逻辑

broker使用两个主要准则(假设?)执行订单。

-

当前数据已发生,无法用于执行订单。

如果策略中的逻辑类似于:

py if self.data.close > self.sma: # where sma is a Simple Moving Average self.buy()不能期望订单将以逻辑中正在检查的

close价格执行,因为它已经发生了。订单可以在下一组开盘/高/低/收盘价格点(以及订单中规定的条件)的范围内执行 1st

-

音量不起作用

如果交易者选择非流动资产,或者恰好达到价格条的极端值(高/低),那么在实际交易中确实如此。

但触及高点/低点是很少发生的(如果你这样做了……你不需要

backtrader),所选资产将有足够的流动性来吸收任何常规交易的订单

集市

执行:

- 下一套开盘/高/低/收盘价开盘价(俗称条)

理论基础:

- 如果逻辑在时间点 X 执行并发出

Market订单,则下一个将发生的价格点是即将到来的open价格

笔记

此命令始终执行,并忽略用于创建它的任何price和valid参数

关

执行:

- 当下一个酒吧实际关闭时,使用下一个酒吧的

close价格

理论基础:

-

大多数回溯测试馈送包含已经关闭的条,订单将立即执行,下一条的

close价格。每日数据馈送是最常见的示例。但是系统可以输入“滴答”价格,并且实际的酒吧(时间/日期方面)会不断地使用新的滴答进行预测,而不会实际移动到下一个酒吧(因为时间和/或日期没有改变)

只有当时间或日期发生变化时,酒吧才真正关闭,订单才会执行

限度

执行:

-

如果

data触及price,则在订单创建时设置price,从下一个价格栏开始。如果设置了

valid且到达时间点,订单将被取消

价格匹配:

-

backtrader尝试为Limit订单提供最现实的执行价格。使用 4 个价格点(开盘/高位/低位/收盘),可以部分推断请求的

price是否可以改善。Buy订单-

案例 1:

如果棒材的

open价格低于限价,订单将立即以open价格执行。在会议的开幕阶段,秩序已被扫除 -

案例 2:

如果

open价格未渗透到限价以下,但low价格低于限价,则在会话期间已看到限价,可以执行订单

Sell顺序的逻辑显然是颠倒的。 -

停止

执行:

-

如果

data触到触发器price,则在订单创建时设置触发器price,从下一个价格栏开始。如果设置了

valid且到达时间点,订单将被取消

价格匹配:

-

backtrader尝试为Stop订单提供最现实的触发价格。使用 4 个价格点(开盘/高位/低位/收盘),可以部分推断请求的

price是否可以改善。对于

\停止orders which购买`-

案例 1:

如果棒材的

open价格高于停止价格,则立即以open价格执行订单。旨在在价格相对于现有空头头寸上扬时止损

-

案例 2:

如果

open价格未渗透到止损价格之上,但high价格高于止损价格,则在会话期间已看到止损价格,可以执行订单

对于

Sell的Stop顺序,逻辑明显颠倒。 -

止损

执行:

- 触发器

price设置从下一个价格条开始的移动订单。

价格匹配:

-

触发:使用

Stop匹配逻辑(但仅触发并将订单转换为Limit订单) -

限额:使用

Limit价格匹配逻辑

一些样品

像往常一样,图片(带代码)价值数百万条长长的解释。请注意,这些片段集中在订单创建部分。完整的代码在底部。

价格高于/低于一个简单的移动平均线策略将用于生成买入/卖出信号

信号显示在图表底部:使用交叉指示器的CrossOver。

将保留对生成的“购买”订单的引用,以便在系统中最多只允许一个同时订单。

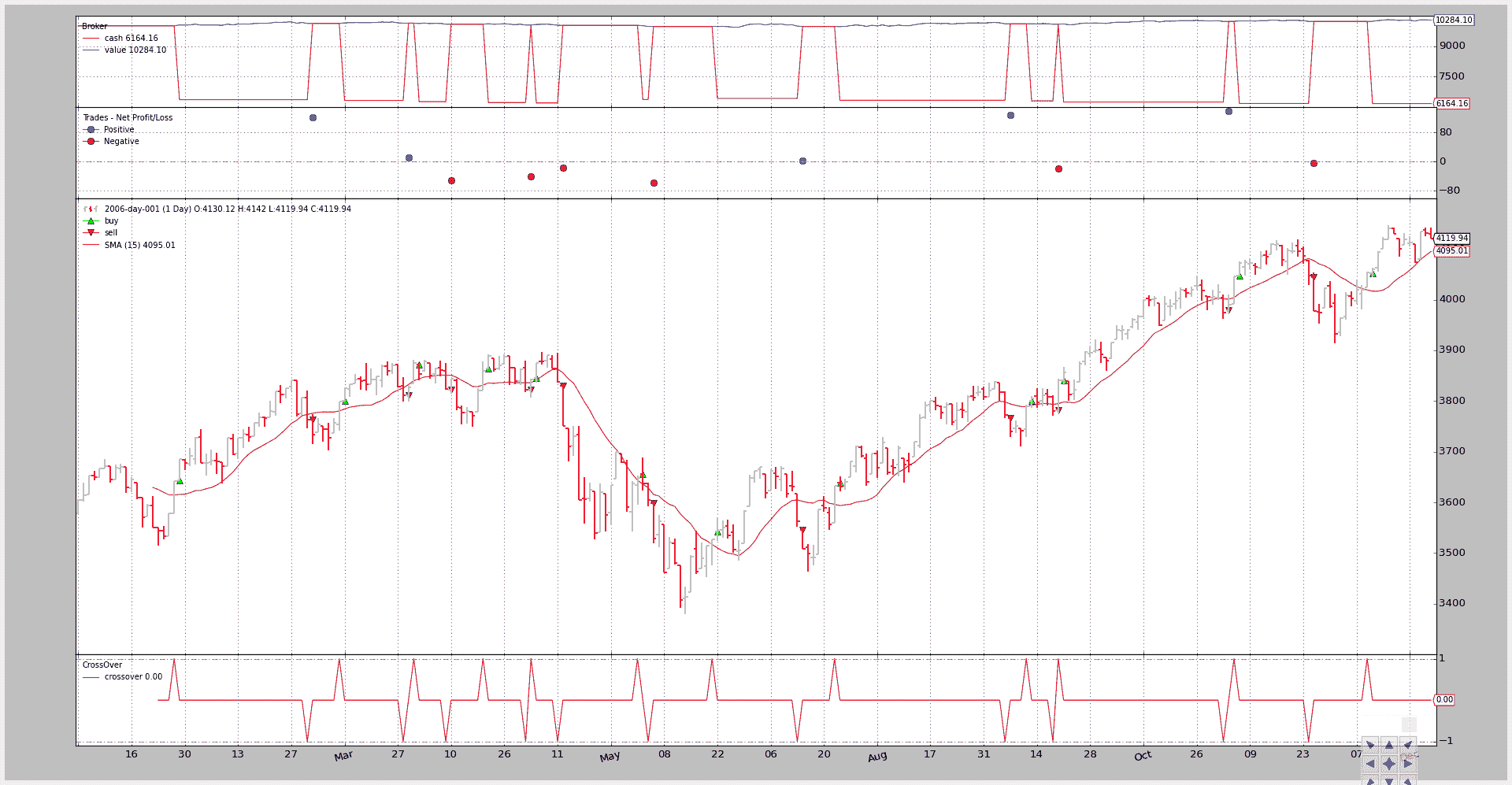

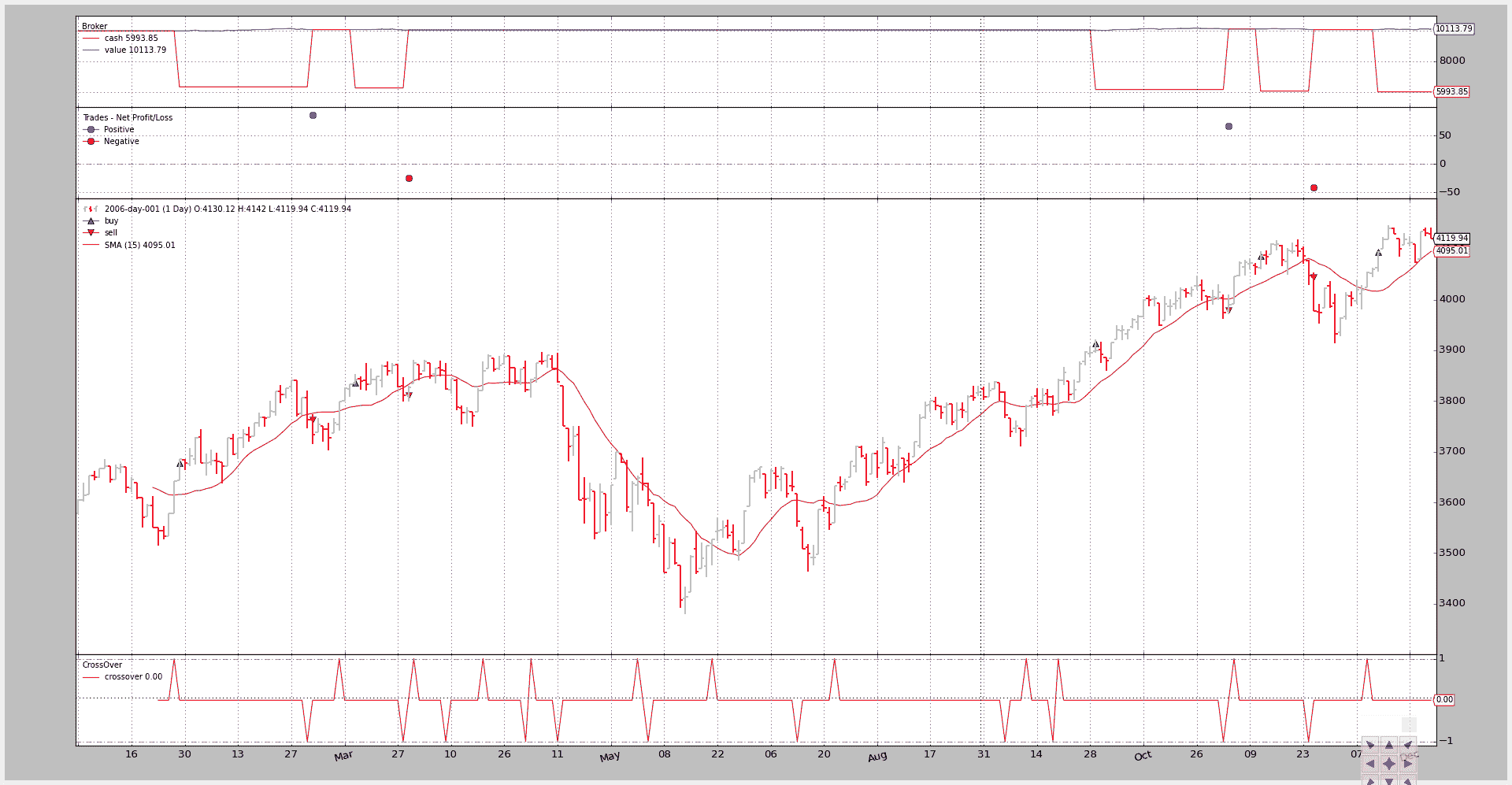

执行类型:市场

请参见图表中的订单如何在开盘价产生信号后一个小节执行。

if self.p.exectype == 'Market':

self.buy(exectype=bt.Order.Market) # default if not given

self.log('BUY CREATE, exectype Market, price %.2f' %

self.data.close[0])

输出图表。

命令行和输出:

$ ./order-execution-samples.py --exectype Market

2006-01-26T23:59:59+00:00, BUY CREATE, exectype Market, price 3641.42

2006-01-26T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-01-27T23:59:59+00:00, BUY EXECUTED, Price: 3643.35, Cost: 3643.35, Comm 0.00

2006-03-02T23:59:59+00:00, SELL CREATE, 3763.73

2006-03-02T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-03-03T23:59:59+00:00, SELL EXECUTED, Price: 3763.95, Cost: 3763.95, Comm 0.00

...

...

2006-12-11T23:59:59+00:00, BUY CREATE, exectype Market, price 4052.89

2006-12-11T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-12-12T23:59:59+00:00, BUY EXECUTED, Price: 4052.55, Cost: 4052.55, Comm 0.00

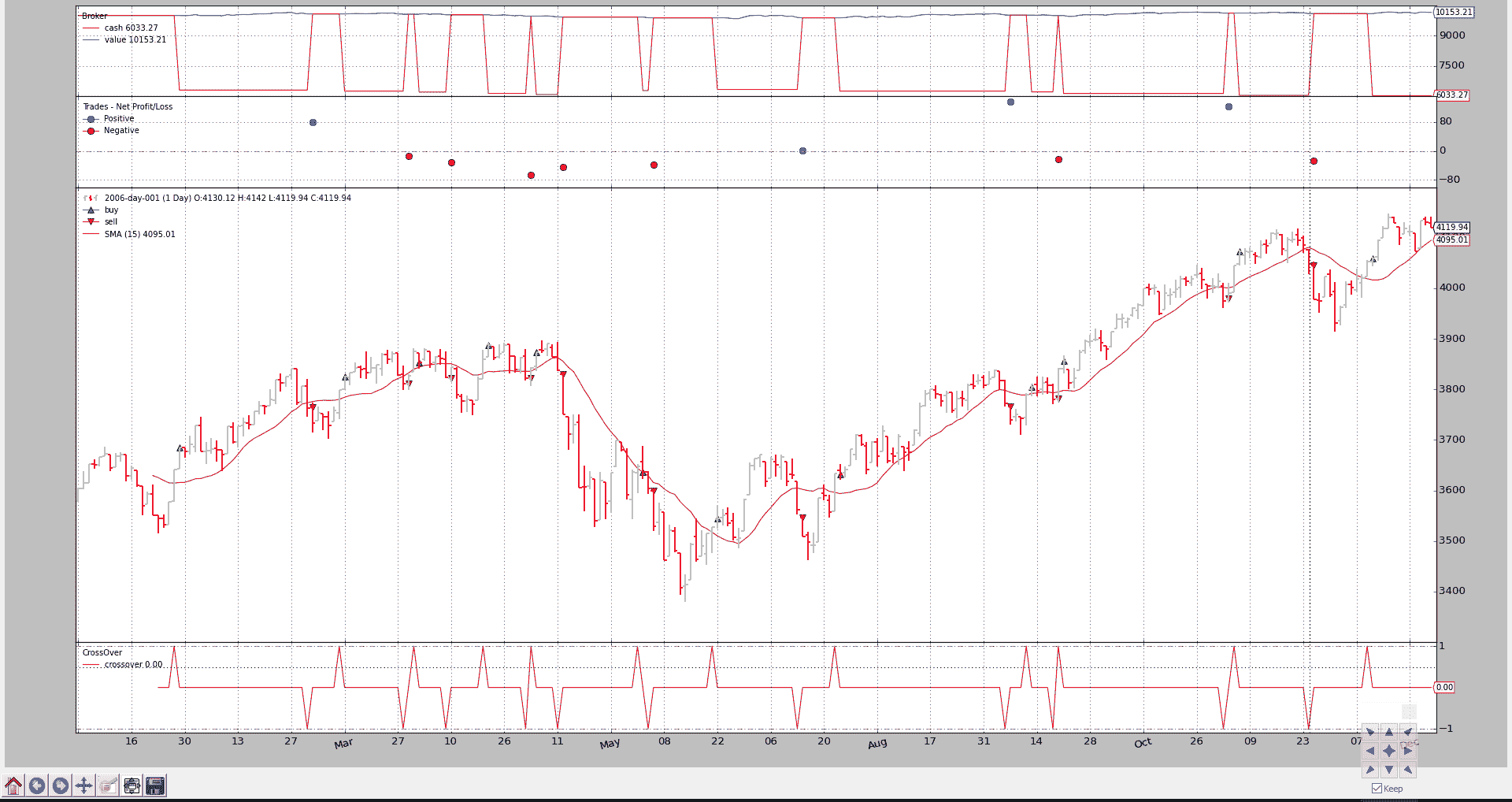

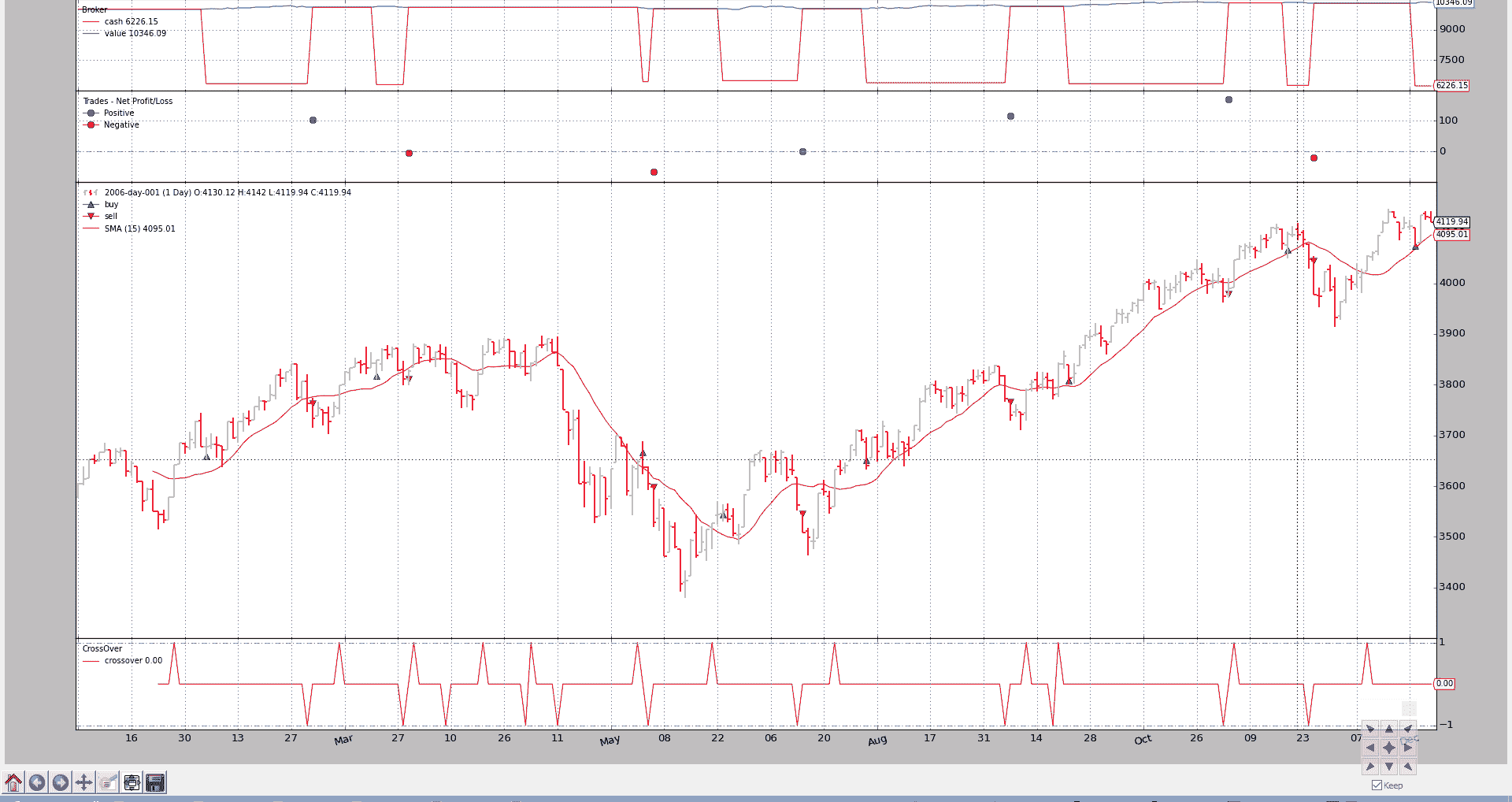

执行类型:关闭

现在,指令也在信号发出后一个小节执行,但以收盘价执行。

elif self.p.exectype == 'Close':

self.buy(exectype=bt.Order.Close)

self.log('BUY CREATE, exectype Close, price %.2f' %

self.data.close[0])

输出图表。

命令行和输出:

$ ./order-execution-samples.py --exectype Close

2006-01-26T23:59:59+00:00, BUY CREATE, exectype Close, price 3641.42

2006-01-26T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-01-27T23:59:59+00:00, BUY EXECUTED, Price: 3685.48, Cost: 3685.48, Comm 0.00

2006-03-02T23:59:59+00:00, SELL CREATE, 3763.73

2006-03-02T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-03-03T23:59:59+00:00, SELL EXECUTED, Price: 3763.95, Cost: 3763.95, Comm 0.00

...

...

2006-11-06T23:59:59+00:00, BUY CREATE, exectype Close, price 4045.22

2006-11-06T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-11-07T23:59:59+00:00, BUY EXECUTED, Price: 4072.86, Cost: 4072.86, Comm 0.00

2006-11-24T23:59:59+00:00, SELL CREATE, 4048.16

2006-11-24T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-11-27T23:59:59+00:00, SELL EXECUTED, Price: 4045.05, Cost: 4045.05, Comm 0.00

2006-12-11T23:59:59+00:00, BUY CREATE, exectype Close, price 4052.89

2006-12-11T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-12-12T23:59:59+00:00, BUY EXECUTED, Price: 4059.74, Cost: 4059.74, Comm 0.00

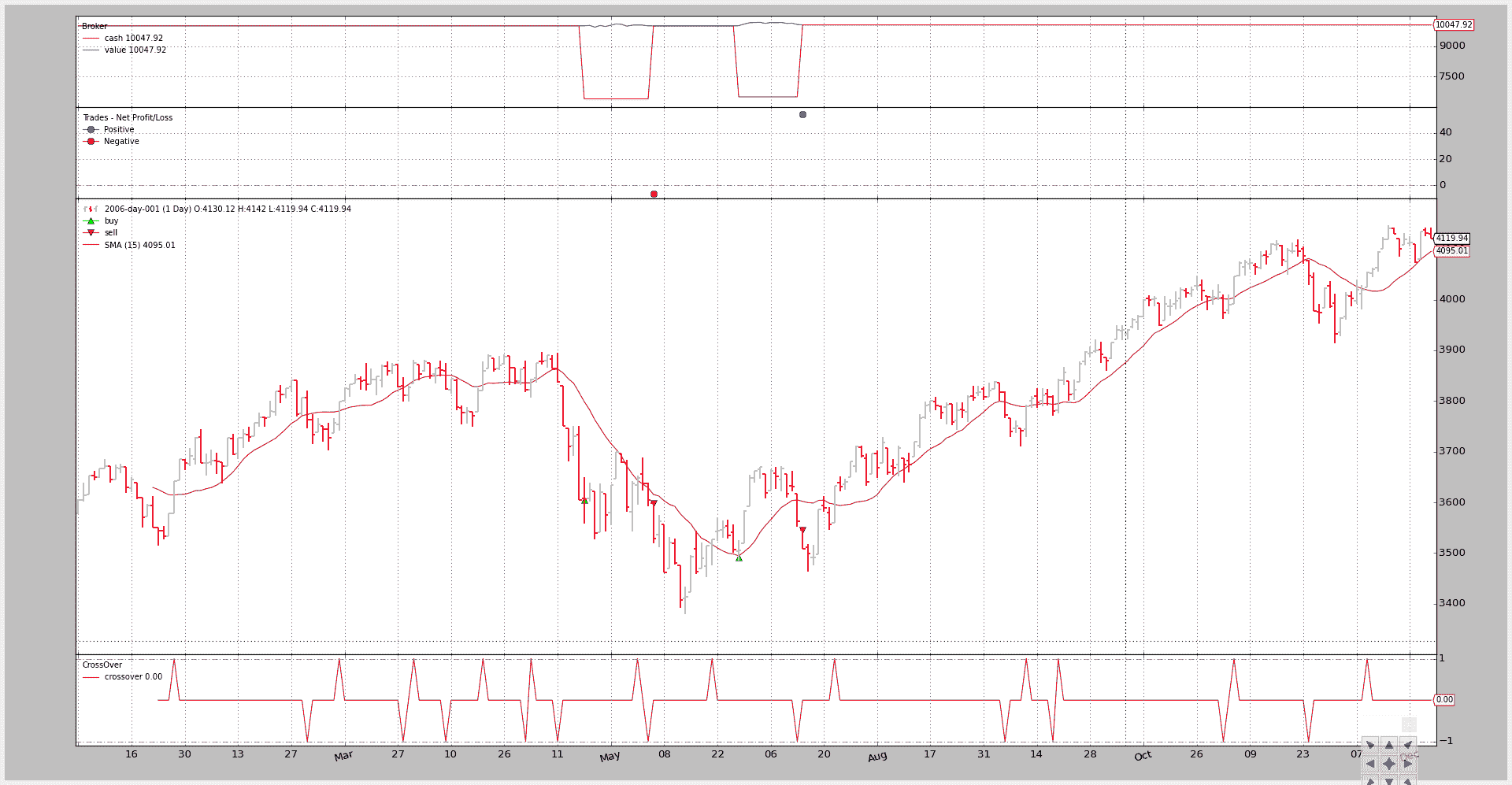

执行类型:限制

有效性在前几行计算,以防它作为参数传递。

if self.p.valid:

valid = self.data.datetime.date(0) + \

datetime.timedelta(days=self.p.valid)

else:

valid = None

设定了低于信号生成价格(信号条收盘价)1%的限价。请注意,这是如何阻止执行上述许多命令的。

elif self.p.exectype == 'Limit':

price = self.data.close * (1.0 - self.p.perc1 / 100.0)

self.buy(exectype=bt.Order.Limit, price=price, valid=valid)

if self.p.valid:

txt = 'BUY CREATE, exectype Limit, price %.2f, valid: %s'

self.log(txt % (price, valid.strftime('%Y-%m-%d')))

else:

txt = 'BUY CREATE, exectype Limit, price %.2f'

self.log(txt % price)

输出图表。

仅发出了 4 份订单。限制价格以赶上小幅下跌,已经完全改变了产量。

命令行和输出:

$ ./order-execution-samples.py --exectype Limit --perc1 1

2006-01-26T23:59:59+00:00, BUY CREATE, exectype Limit, price 3605.01

2006-01-26T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-05-18T23:59:59+00:00, BUY EXECUTED, Price: 3605.01, Cost: 3605.01, Comm 0.00

2006-06-05T23:59:59+00:00, SELL CREATE, 3604.33

2006-06-05T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-06-06T23:59:59+00:00, SELL EXECUTED, Price: 3598.58, Cost: 3598.58, Comm 0.00

2006-06-21T23:59:59+00:00, BUY CREATE, exectype Limit, price 3491.57

2006-06-21T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-06-28T23:59:59+00:00, BUY EXECUTED, Price: 3491.57, Cost: 3491.57, Comm 0.00

2006-07-13T23:59:59+00:00, SELL CREATE, 3562.56

2006-07-13T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-07-14T23:59:59+00:00, SELL EXECUTED, Price: 3545.92, Cost: 3545.92, Comm 0.00

2006-07-24T23:59:59+00:00, BUY CREATE, exectype Limit, price 3596.60

2006-07-24T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

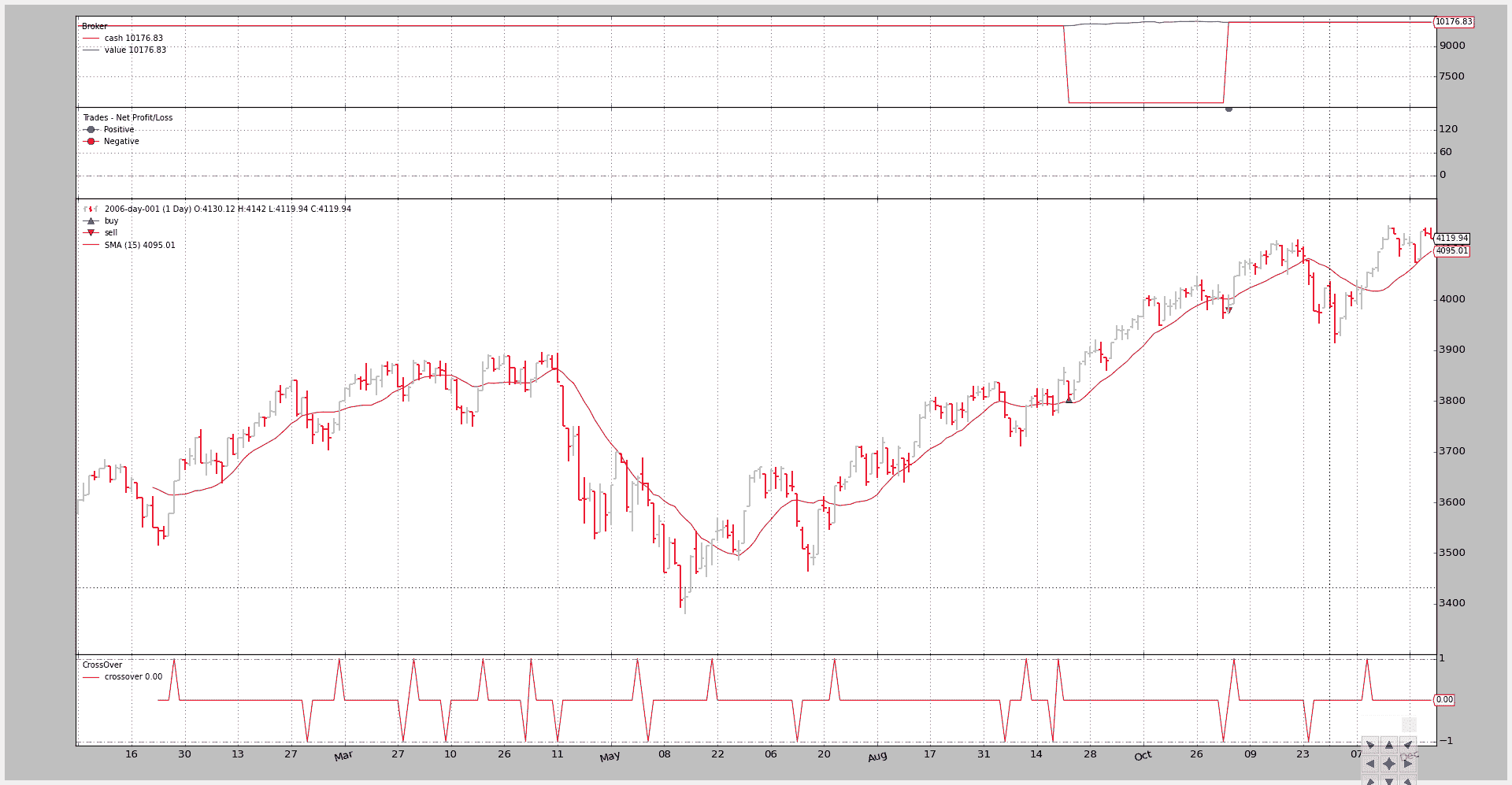

执行类型:具有有效性的限制

为了避免在限价单上永远等待,限价单只能在价格与“买入”订单相反时执行,该订单的有效期仅为 4(日历)天。

输出图表。

生成了更多订单,但除一个“购买”订单外,所有订单均已过期,进一步限制了操作量。

命令行和输出:

$ ./order-execution-samples.py --exectype Limit --perc1 1 --valid 4

2006-01-26T23:59:59+00:00, BUY CREATE, exectype Limit, price 3605.01, valid: 2006-01-30

2006-01-26T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-01-30T23:59:59+00:00, BUY EXPIRED

2006-03-10T23:59:59+00:00, BUY CREATE, exectype Limit, price 3760.48, valid: 2006-03-14

2006-03-10T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-03-14T23:59:59+00:00, BUY EXPIRED

2006-03-30T23:59:59+00:00, BUY CREATE, exectype Limit, price 3835.86, valid: 2006-04-03

2006-03-30T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-04-03T23:59:59+00:00, BUY EXPIRED

2006-04-20T23:59:59+00:00, BUY CREATE, exectype Limit, price 3821.40, valid: 2006-04-24

2006-04-20T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-04-24T23:59:59+00:00, BUY EXPIRED

2006-05-04T23:59:59+00:00, BUY CREATE, exectype Limit, price 3804.65, valid: 2006-05-08

2006-05-04T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-05-08T23:59:59+00:00, BUY EXPIRED

2006-06-01T23:59:59+00:00, BUY CREATE, exectype Limit, price 3611.85, valid: 2006-06-05

2006-06-01T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-06-05T23:59:59+00:00, BUY EXPIRED

2006-06-21T23:59:59+00:00, BUY CREATE, exectype Limit, price 3491.57, valid: 2006-06-25

2006-06-21T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-06-26T23:59:59+00:00, BUY EXPIRED

2006-07-24T23:59:59+00:00, BUY CREATE, exectype Limit, price 3596.60, valid: 2006-07-28

2006-07-24T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-07-28T23:59:59+00:00, BUY EXPIRED

2006-09-12T23:59:59+00:00, BUY CREATE, exectype Limit, price 3751.07, valid: 2006-09-16

2006-09-12T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-09-18T23:59:59+00:00, BUY EXPIRED

2006-09-20T23:59:59+00:00, BUY CREATE, exectype Limit, price 3802.90, valid: 2006-09-24

2006-09-20T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-09-22T23:59:59+00:00, BUY EXECUTED, Price: 3802.90, Cost: 3802.90, Comm 0.00

2006-11-02T23:59:59+00:00, SELL CREATE, 3974.62

2006-11-02T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-11-03T23:59:59+00:00, SELL EXECUTED, Price: 3979.73, Cost: 3979.73, Comm 0.00

2006-11-06T23:59:59+00:00, BUY CREATE, exectype Limit, price 4004.77, valid: 2006-11-10

2006-11-06T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-11-10T23:59:59+00:00, BUY EXPIRED

2006-12-11T23:59:59+00:00, BUY CREATE, exectype Limit, price 4012.36, valid: 2006-12-15

2006-12-11T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-12-15T23:59:59+00:00, BUY EXPIRED

执行类型:停止

设定高于信号价 1%的止损价。这意味着,只有当信号产生且价格继续攀升时,该策略才会买入,这可能被视为实力的信号。

这完全改变了执行全景。

elif self.p.exectype == 'Stop':

price = self.data.close * (1.0 + self.p.perc1 / 100.0)

self.buy(exectype=bt.Order.Stop, price=price, valid=valid)

if self.p.valid:

txt = 'BUY CREATE, exectype Stop, price %.2f, valid: %s'

self.log(txt % (price, valid.strftime('%Y-%m-%d')))

else:

txt = 'BUY CREATE, exectype Stop, price %.2f'

self.log(txt % price)

输出图表。

命令行和输出:

$ ./order-execution-samples.py --exectype Stop --perc1 1

2006-01-26T23:59:59+00:00, BUY CREATE, exectype Stop, price 3677.83

2006-01-26T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-01-27T23:59:59+00:00, BUY EXECUTED, Price: 3677.83, Cost: 3677.83, Comm 0.00

2006-03-02T23:59:59+00:00, SELL CREATE, 3763.73

2006-03-02T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-03-03T23:59:59+00:00, SELL EXECUTED, Price: 3763.95, Cost: 3763.95, Comm 0.00

2006-03-10T23:59:59+00:00, BUY CREATE, exectype Stop, price 3836.44

2006-03-10T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-03-15T23:59:59+00:00, BUY EXECUTED, Price: 3836.44, Cost: 3836.44, Comm 0.00

2006-03-28T23:59:59+00:00, SELL CREATE, 3811.45

2006-03-28T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-03-29T23:59:59+00:00, SELL EXECUTED, Price: 3811.85, Cost: 3811.85, Comm 0.00

2006-03-30T23:59:59+00:00, BUY CREATE, exectype Stop, price 3913.36

2006-03-30T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-09-29T23:59:59+00:00, BUY EXECUTED, Price: 3913.36, Cost: 3913.36, Comm 0.00

2006-11-02T23:59:59+00:00, SELL CREATE, 3974.62

2006-11-02T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-11-03T23:59:59+00:00, SELL EXECUTED, Price: 3979.73, Cost: 3979.73, Comm 0.00

2006-11-06T23:59:59+00:00, BUY CREATE, exectype Stop, price 4085.67

2006-11-06T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-11-13T23:59:59+00:00, BUY EXECUTED, Price: 4085.67, Cost: 4085.67, Comm 0.00

2006-11-24T23:59:59+00:00, SELL CREATE, 4048.16

2006-11-24T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-11-27T23:59:59+00:00, SELL EXECUTED, Price: 4045.05, Cost: 4045.05, Comm 0.00

2006-12-11T23:59:59+00:00, BUY CREATE, exectype Stop, price 4093.42

2006-12-11T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-12-13T23:59:59+00:00, BUY EXECUTED, Price: 4093.42, Cost: 4093.42, Comm 0.00

执行类型:StopLimit

设定高于信号价 1%的止损价。但限价设定为高于信号(收盘)价 0.5%,这可以解释为:等待涨势出现,但不要买入峰值。等待下潜。

有效期上限为 20(日历)天

elif self.p.exectype == 'StopLimit':

price = self.data.close * (1.0 + self.p.perc1 / 100.0)

plimit = self.data.close * (1.0 + self.p.perc2 / 100.0)

self.buy(exectype=bt.Order.StopLimit, price=price, valid=valid,

plimit=plimit)

if self.p.valid:

txt = ('BUY CREATE, exectype StopLimit, price %.2f,'

' valid: %s, pricelimit: %.2f')

self.log(txt % (price, valid.strftime('%Y-%m-%d'), plimit))

else:

txt = ('BUY CREATE, exectype StopLimit, price %.2f,'

' pricelimit: %.2f')

self.log(txt % (price, plimit))

输出图表。

命令行和输出:

$ ./order-execution-samples.py --exectype StopLimit --perc1 1 --perc2 0.5 --valid 20

2006-01-26T23:59:59+00:00, BUY CREATE, exectype StopLimit, price 3677.83, valid: 2006-02-15, pricelimit: 3659.63

2006-01-26T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-02-03T23:59:59+00:00, BUY EXECUTED, Price: 3659.63, Cost: 3659.63, Comm 0.00

2006-03-02T23:59:59+00:00, SELL CREATE, 3763.73

2006-03-02T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-03-03T23:59:59+00:00, SELL EXECUTED, Price: 3763.95, Cost: 3763.95, Comm 0.00

2006-03-10T23:59:59+00:00, BUY CREATE, exectype StopLimit, price 3836.44, valid: 2006-03-30, pricelimit: 3817.45

2006-03-10T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-03-21T23:59:59+00:00, BUY EXECUTED, Price: 3817.45, Cost: 3817.45, Comm 0.00

2006-03-28T23:59:59+00:00, SELL CREATE, 3811.45

2006-03-28T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-03-29T23:59:59+00:00, SELL EXECUTED, Price: 3811.85, Cost: 3811.85, Comm 0.00

2006-03-30T23:59:59+00:00, BUY CREATE, exectype StopLimit, price 3913.36, valid: 2006-04-19, pricelimit: 3893.98

2006-03-30T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-04-19T23:59:59+00:00, BUY EXPIRED

...

...

2006-12-11T23:59:59+00:00, BUY CREATE, exectype StopLimit, price 4093.42, valid: 2006-12-31, pricelimit: 4073.15

2006-12-11T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-12-22T23:59:59+00:00, BUY EXECUTED, Price: 4073.15, Cost: 4073.15, Comm 0.00

测试脚本执行

在命令行help中详细说明:

$ ./order-execution-samples.py --help

usage: order-execution-samples.py [-h] [--infile INFILE]

[--csvformat {bt,visualchart,sierrachart,yahoo,yahoo_unreversed}]

[--fromdate FROMDATE] [--todate TODATE]

[--plot] [--plotstyle {bar,line,candle}]

[--numfigs NUMFIGS] [--smaperiod SMAPERIOD]

[--exectype EXECTYPE] [--valid VALID]

[--perc1 PERC1] [--perc2 PERC2]

Showcase for Order Execution Types

optional arguments:

-h, --help show this help message and exit

--infile INFILE, -i INFILE

File to be read in

--csvformat {bt,visualchart,sierrachart,yahoo,yahoo_unreversed},

-c {bt,visualchart,sierrachart,yahoo,yahoo_unreversed}

CSV Format

--fromdate FROMDATE, -f FROMDATE

Starting date in YYYY-MM-DD format

--todate TODATE, -t TODATE

Ending date in YYYY-MM-DD format

--plot, -p Plot the read data

--plotstyle {bar,line,candle}, -ps {bar,line,candle}

Plot the read data

--numfigs NUMFIGS, -n NUMFIGS

Plot using n figures

--smaperiod SMAPERIOD, -s SMAPERIOD

Simple Moving Average Period

--exectype EXECTYPE, -e EXECTYPE

Execution Type: Market (default), Close, Limit,

Stop, StopLimit

--valid VALID, -v VALID

Validity for Limit sample: default 0 days

--perc1 PERC1, -p1 PERC1

% distance from close price at order creation time for

the limit/trigger price in Limit/Stop orders

--perc2 PERC2, -p2 PERC2

% distance from close price at order creation time for

the limit price in StopLimit orders

完整代码

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import argparse

import datetime

import os.path

import time

import sys

import backtrader as bt

import backtrader.feeds as btfeeds

import backtrader.indicators as btind

class OrderExecutionStrategy(bt.Strategy):

params = (

('smaperiod', 15),

('exectype', 'Market'),

('perc1', 3),

('perc2', 1),

('valid', 4),

)

def log(self, txt, dt=None):

''' Logging function fot this strategy'''

dt = dt or self.data.datetime[0]

if isinstance(dt, float):

dt = bt.num2date(dt)

print('%s, %s' % (dt.isoformat(), txt))

def notify_order(self, order):

if order.status in [order.Submitted, order.Accepted]:

# Buy/Sell order submitted/accepted to/by broker - Nothing to do

self.log('ORDER ACCEPTED/SUBMITTED', dt=order.created.dt)

self.order = order

return

if order.status in [order.Expired]:

self.log('BUY EXPIRED')

elif order.status in [order.Completed]:

if order.isbuy():

self.log(

'BUY EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

else: # Sell

self.log('SELL EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

# Sentinel to None: new orders allowed

self.order = None

def __init__(self):

# SimpleMovingAverage on main data

# Equivalent to -> sma = btind.SMA(self.data, period=self.p.smaperiod)

sma = btind.SMA(period=self.p.smaperiod)

# CrossOver (1: up, -1: down) close / sma

self.buysell = btind.CrossOver(self.data.close, sma, plot=True)

# Sentinel to None: new ordersa allowed

self.order = None

def next(self):

if self.order:

# An order is pending ... nothing can be done

return

# Check if we are in the market

if self.position:

# In the maerket - check if it's the time to sell

if self.buysell < 0:

self.log('SELL CREATE, %.2f' % self.data.close[0])

self.sell()

elif self.buysell > 0:

if self.p.valid:

valid = self.data.datetime.date(0) + \

datetime.timedelta(days=self.p.valid)

else:

valid = None

# Not in the market and signal to buy

if self.p.exectype == 'Market':

self.buy(exectype=bt.Order.Market) # default if not given

self.log('BUY CREATE, exectype Market, price %.2f' %

self.data.close[0])

elif self.p.exectype == 'Close':

self.buy(exectype=bt.Order.Close)

self.log('BUY CREATE, exectype Close, price %.2f' %

self.data.close[0])

elif self.p.exectype == 'Limit':

price = self.data.close * (1.0 - self.p.perc1 / 100.0)

self.buy(exectype=bt.Order.Limit, price=price, valid=valid)

if self.p.valid:

txt = 'BUY CREATE, exectype Limit, price %.2f, valid: %s'

self.log(txt % (price, valid.strftime('%Y-%m-%d')))

else:

txt = 'BUY CREATE, exectype Limit, price %.2f'

self.log(txt % price)

elif self.p.exectype == 'Stop':

price = self.data.close * (1.0 + self.p.perc1 / 100.0)

self.buy(exectype=bt.Order.Stop, price=price, valid=valid)

if self.p.valid:

txt = 'BUY CREATE, exectype Stop, price %.2f, valid: %s'

self.log(txt % (price, valid.strftime('%Y-%m-%d')))

else:

txt = 'BUY CREATE, exectype Stop, price %.2f'

self.log(txt % price)

elif self.p.exectype == 'StopLimit':

price = self.data.close * (1.0 + self.p.perc1 / 100.0)

plimit = self.data.close * (1.0 + self.p.perc2 / 100.0)

self.buy(exectype=bt.Order.StopLimit, price=price, valid=valid,

plimit=plimit)

if self.p.valid:

txt = ('BUY CREATE, exectype StopLimit, price %.2f,'

' valid: %s, pricelimit: %.2f')

self.log(txt % (price, valid.strftime('%Y-%m-%d'), plimit))

else:

txt = ('BUY CREATE, exectype StopLimit, price %.2f,'

' pricelimit: %.2f')

self.log(txt % (price, plimit))

def runstrat():

args = parse_args()

cerebro = bt.Cerebro()

data = getdata(args)

cerebro.adddata(data)

cerebro.addstrategy(

OrderExecutionStrategy,

exectype=args.exectype,

perc1=args.perc1,

perc2=args.perc2,

valid=args.valid,

smaperiod=args.smaperiod

)

cerebro.run()

if args.plot:

cerebro.plot(numfigs=args.numfigs, style=args.plotstyle)

def getdata(args):

dataformat = dict(

bt=btfeeds.BacktraderCSVData,

visualchart=btfeeds.VChartCSVData,

sierrachart=btfeeds.SierraChartCSVData,

yahoo=btfeeds.YahooFinanceCSVData,

yahoo_unreversed=btfeeds.YahooFinanceCSVData

)

dfkwargs = dict()

if args.csvformat == 'yahoo_unreversed':

dfkwargs['reverse'] = True

if args.fromdate:

fromdate = datetime.datetime.strptime(args.fromdate, '%Y-%m-%d')

dfkwargs['fromdate'] = fromdate

if args.todate:

fromdate = datetime.datetime.strptime(args.todate, '%Y-%m-%d')

dfkwargs['todate'] = todate

dfkwargs['dataname'] = args.infile

dfcls = dataformat[args.csvformat]

return dfcls(**dfkwargs)

def parse_args():

parser = argparse.ArgumentParser(

description='Showcase for Order Execution Types')

parser.add_argument('--infile', '-i', required=False,

default='../../datas/2006-day-001.txt',

help='File to be read in')

parser.add_argument('--csvformat', '-c', required=False, default='bt',

choices=['bt', 'visualchart', 'sierrachart',

'yahoo', 'yahoo_unreversed'],

help='CSV Format')

parser.add_argument('--fromdate', '-f', required=False, default=None,

help='Starting date in YYYY-MM-DD format')

parser.add_argument('--todate', '-t', required=False, default=None,

help='Ending date in YYYY-MM-DD format')

parser.add_argument('--plot', '-p', action='store_false', required=False,

help='Plot the read data')

parser.add_argument('--plotstyle', '-ps', required=False, default='bar',

choices=['bar', 'line', 'candle'],

help='Plot the read data')

parser.add_argument('--numfigs', '-n', required=False, default=1,

help='Plot using n figures')

parser.add_argument('--smaperiod', '-s', required=False, default=15,

help='Simple Moving Average Period')

parser.add_argument('--exectype', '-e', required=False, default='Market',

help=('Execution Type: Market (default), Close, Limit,'

' Stop, StopLimit'))

parser.add_argument('--valid', '-v', required=False, default=0, type=int,

help='Validity for Limit sample: default 0 days')

parser.add_argument('--perc1', '-p1', required=False, default=0.0,

type=float,

help=('%% distance from close price at order creation'

' time for the limit/trigger price in Limit/Stop'

' orders'))

parser.add_argument('--perc2', '-p2', required=False, default=0.0,

type=float,

help=('%% distance from close price at order creation'

' time for the limit price in StopLimit orders'))

return parser.parse_args()

if __name__ == '__main__':

runstrat()