停止交易

原文: https://www.backtrader.com/blog/posts/2018-02-01-stop-trading/stop-trading/

交易可能是危险的,使用止损单交易有助于避免巨额亏损或确保利润。反向交易者为您提供了几种机制来实施基于停止的策略

基本策略

将使用经典的Fast EMA交叉Slow EMA方法。但是:

-

发出

buy订单时,只考虑上十字 -

退出市场,即:

sell将通过Stop完成

因此,战略将从这个简单的框架开始

class BaseStrategy(bt.Strategy):

params = dict(

fast_ma=10,

slow_ma=20,

)

def __init__(self):

# omitting a data implies self.datas[0] (aka self.data and self.data0)

fast_ma = bt.ind.EMA(period=self.p.fast_ma)

slow_ma = bt.ind.EMA(period=self.p.slow_ma)

# our entry point

self.crossup = bt.ind.CrossUp(fast_ma, slow_ma)

使用继承,我们将研究出不同的方法来实现停止

人工进近

为了避免有太多的方法,我们基本策略的这个子类将允许:

-

或者以低于收购价格的百分比固定

Stop -

或者设置动态

StopTrail,在价格移动时追踪价格(本例中使用点)

class ManualStopOrStopTrail(BaseStrategy):

params = dict(

stop_loss=0.02, # price is 2% less than the entry point

trail=False,

)

def notify_order(self, order):

if not order.status == order.Completed:

return # discard any other notification

if not self.position: # we left the market

print('SELL@price: {:.2f}'.format(order.executed.price))

return

# We have entered the market

print('BUY @price: {:.2f}'.format(order.executed.price))

if not self.p.trail:

stop_price = order.executed.price * (1.0 - self.p.stop_loss)

self.sell(exectype=bt.Order.Stop, price=stop_price)

else:

self.sell(exectype=bt.Order.StopTrail, trailamount=self.p.trail)

def next(self):

if not self.position and self.crossup > 0:

# not in the market and signal triggered

self.buy()

正如您可能看到的,我们为

-

百分比:

stop_loss=0.02(2%) -

或

trail=False,当设置为数值时,将告知策略使用StopTrail

有关订单的文档,请参阅:

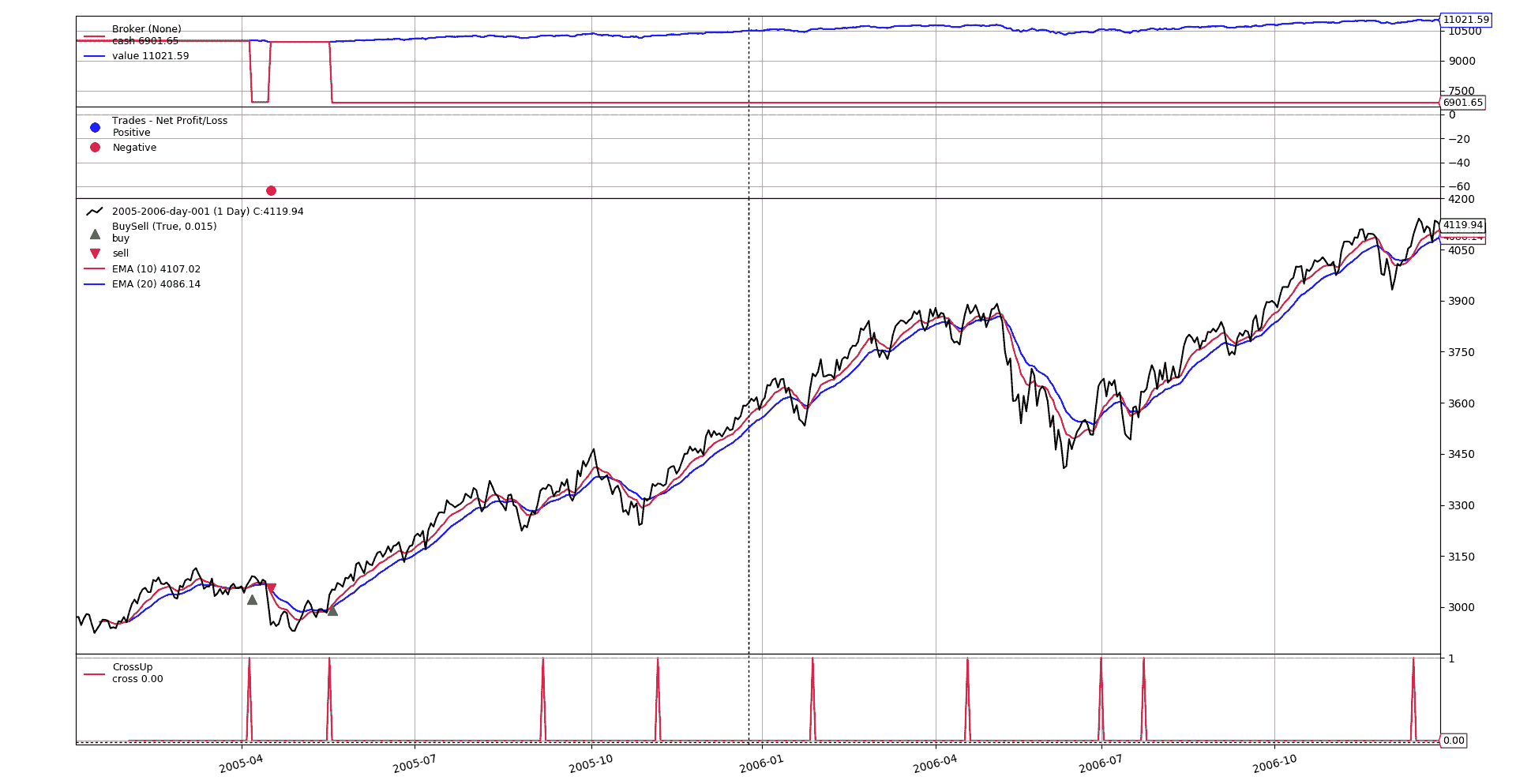

让我们用一个固定的Stop来执行我们的脚本:

$ ./stop-loss-approaches.py manual --plot

BUY @price: 3073.40

SELL@price: 3009.93

BUY @price: 3034.88

图表呢

正如我们看到的:

-

当有上十字交叉时,发出

buy -

当此

buy被通知为Completed时,我们发出Stop订单,价格比executed.price低stop_loss个百分点

结果:

-

第一个实例很快就被阻止了

-

但由于样本数据来自趋势市场……因此没有进一步的实例表明价格低于

stop_loss百分比

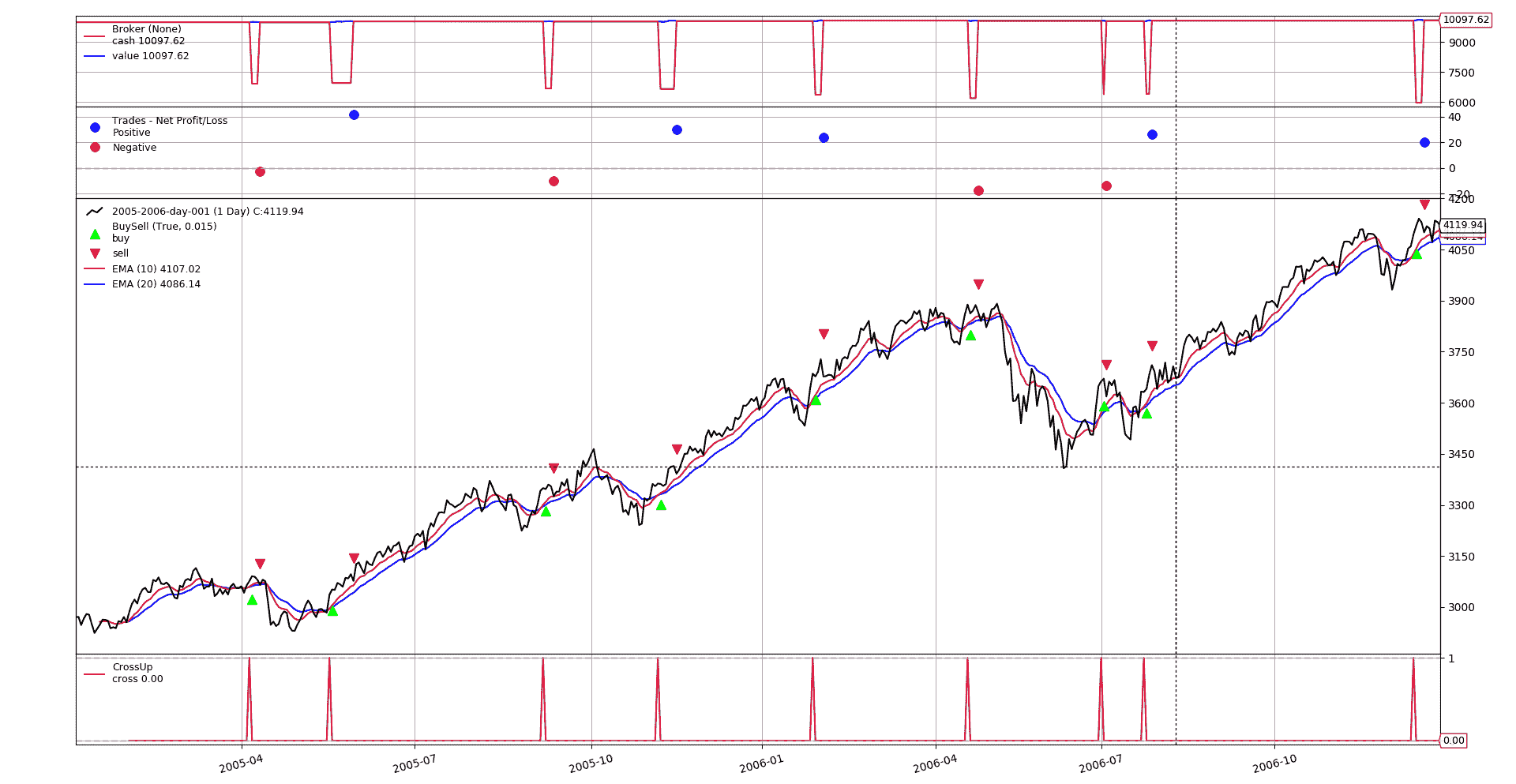

让我们使用相同的方法,但应用StopTrail顺序:

$ ./stop-loss-approaches.py manual --plot --strat trail=20

BUY @price: 3073.40

SELL@price: 3070.72

BUY @price: 3034.88

SELL@price: 3076.54

BUY @price: 3349.72

SELL@price: 3339.65

BUY @price: 3364.26

SELL@price: 3393.96

BUY @price: 3684.38

SELL@price: 3708.25

BUY @price: 3884.57

SELL@price: 3867.00

BUY @price: 3664.59

SELL@price: 3650.75

BUY @price: 3635.17

SELL@price: 3661.55

BUY @price: 4100.49

SELL@price: 4120.66

图表呢

现在我们看到,与前一种方法相比,这种方法的效率不高。

-

虽然市场正在走向,但价格下降了几倍于

20点(我们的轨迹值) -

这就把我们带出了市场

-

而且,由于市场正在走向,移动平均线需要时间才能在预期的方向上再次交叉

为什么使用notify_order?

因为这确保了必须由Stop控制的命令已实际执行。在回溯测试期间,这可能不是什么大问题,但在现场交易时却是如此。

让我们使用 backtrader 提供的cheat-on-close模式来简化回溯测试方法。

class ManualStopOrStopTrailCheat(BaseStrategy):

params = dict(

stop_loss=0.02, # price is 2% less than the entry point

trail=False,

)

def __init__(self):

super().__init__()

self.broker.set_coc(True)

def notify_order(self, order):

if not order.status == order.Completed:

return # discard any other notification

if not self.position: # we left the market

print('SELL@price: {:.2f}'.format(order.executed.price))

return

# We have entered the market

print('BUY @price: {:.2f}'.format(order.executed.price))

def next(self):

if not self.position and self.crossup > 0:

# not in the market and signal triggered

self.buy()

if not self.p.trail:

stop_price = self.data.close[0] * (1.0 - self.p.stop_loss)

self.sell(exectype=bt.Order.Stop, price=stop_price)

else:

self.sell(exectype=bt.Order.StopTrail,

trailamount=self.p.trail)

在这种情况下:

-

在策略的

__init__阶段,经纪人中的cheat-on-close模式被激活 -

StopOrder在buy订单发出后立即发出。这是因为cheat-on-close确保它将在不等待下一个条的情况下执行请注意,收盘价(

self.data.close[0]用于止损,因为还没有执行价。我们知道这将是由于cheat-on-close的收盘价 -

notify_order方法现在纯粹是一种记录方法,它告诉我们什么时候东西被买或卖。

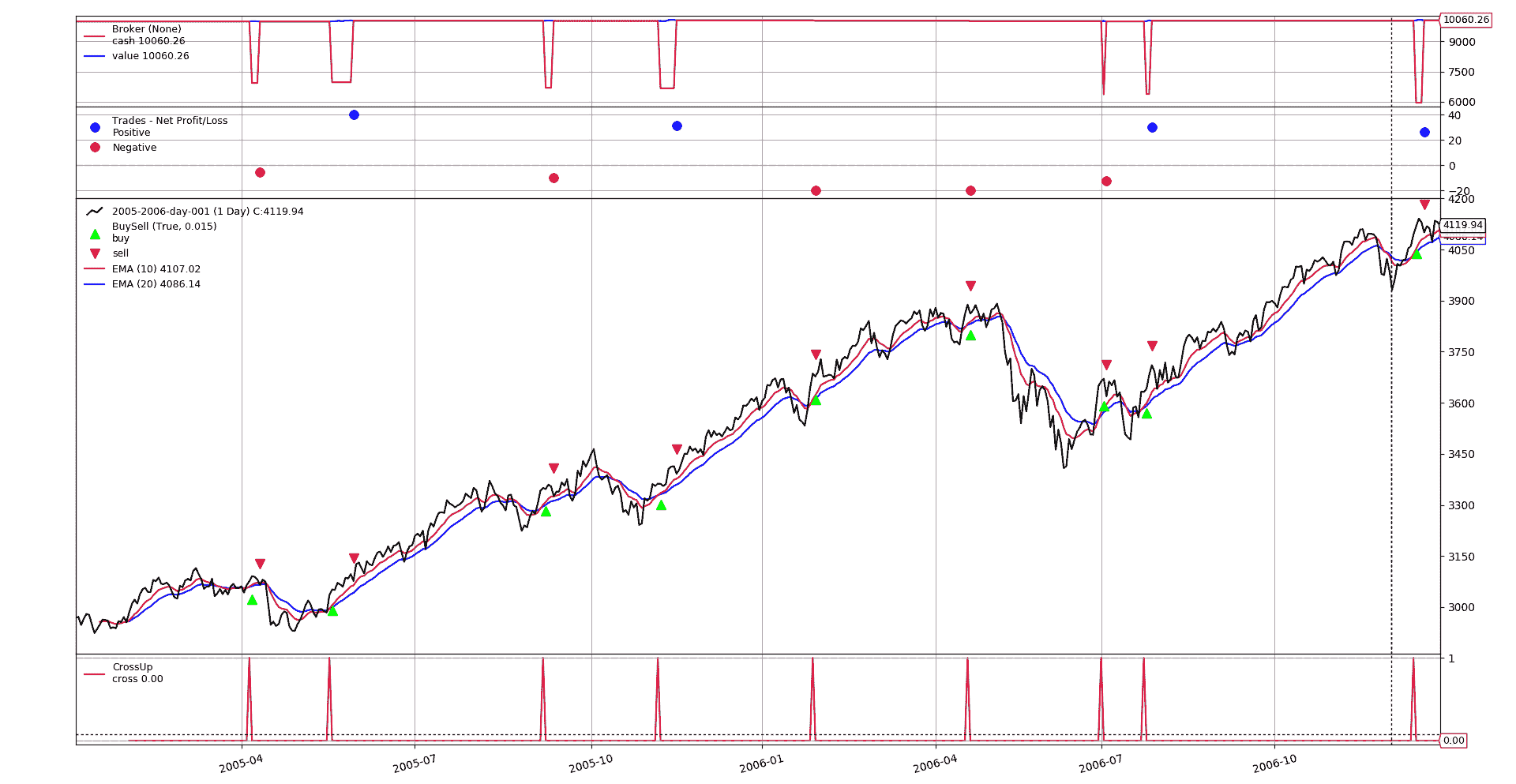

使用StopTrail的样本运行:

$ ./stop-loss-approaches.py manualcheat --plot --strat trail=20

BUY @price: 3076.23

SELL@price: 3070.72

BUY @price: 3036.30

SELL@price: 3076.54

BUY @price: 3349.46

SELL@price: 3339.65

BUY @price: 3362.83

SELL@price: 3393.96

SELL@price: 3685.48

SELL@price: 3665.48

SELL@price: 3888.46

SELL@price: 3868.46

BUY @price: 3662.92

SELL@price: 3650.75

BUY @price: 3631.50

SELL@price: 3661.55

BUY @price: 4094.33

SELL@price: 4120.66

图表呢

请注意:

-

结果非常相似,但与以前不同

这是因为

cheat-on-close给策略提供了收盘价(这是不现实的,但可能是一个很好的近似值),而不是下一个可用价格(即下一个开盘价)

使方法自动化

如果订单的逻辑可以保存在next中,而不必使用cheat-on-close,那就太完美了。这是可以做到的!!!

让我们使用

- 亲子订单

笔记

这是Bracket Order功能的一部分。

参见:括号订单

class AutoStopOrStopTrail(BaseStrategy):

params = dict(

stop_loss=0.02, # price is 2% less than the entry point

trail=False,

buy_limit=False,

)

buy_order = None # default value for a potential buy_order

def notify_order(self, order):

if order.status == order.Cancelled:

print('CANCEL@price: {:.2f} {}'.format(

order.executed.price, 'buy' if order.isbuy() else 'sell'))

return

if not order.status == order.Completed:

return # discard any other notification

if not self.position: # we left the market

print('SELL@price: {:.2f}'.format(order.executed.price))

return

# We have entered the market

print('BUY @price: {:.2f}'.format(order.executed.price))

def next(self):

if not self.position and self.crossup > 0:

if self.buy_order: # something was pending

self.cancel(self.buy_order)

# not in the market and signal triggered

if not self.p.buy_limit:

self.buy_order = self.buy(transmit=False)

else:

price = self.data.close[0] * (1.0 - self.p.buy_limit)

# transmit = False ... await child order before transmission

self.buy_order = self.buy(price=price, exectype=bt.Order.Limit,

transmit=False)

# Setting parent=buy_order ... sends both together

if not self.p.trail:

stop_price = self.data.close[0] * (1.0 - self.p.stop_loss)

self.sell(exectype=bt.Order.Stop, price=stop_price,

parent=self.buy_order)

else:

self.sell(exectype=bt.Order.StopTrail,

trailamount=self.p.trail,

parent=self.buy_order)

这一新战略仍然建立在BaseStrategy的基础上,其作用是:

-

添加将

buy订单发布为Limit订单的可能性参数

buy_limit(非False时)为当前价格的一个百分比,用于设置预期购买点。 -

为

buy订单设置transmit=False。这意味着订单不会立即发送给经纪人。它将等待来自子订单的传输信号 -

立即使用

parent=buy_order发出子指令-

这将触发将两个订单发送给经纪人

-

当父订单执行完毕后,会标记子订单进行调度。

在

buy订单到位之前,不存在Stop订单执行的风险。- 如果父订单被取消,子订单也将被取消

- 作为一个样本和趋势市场,

Limit订单可能永远不会执行,并且在收到新信号时仍然有效。在这种情况下,样品将简单地取消待定的buy订单,并以当前价格水平继续执行新订单。

如上所述,这将取消儿童

Stop订单。 -

-

取消的订单将被记录

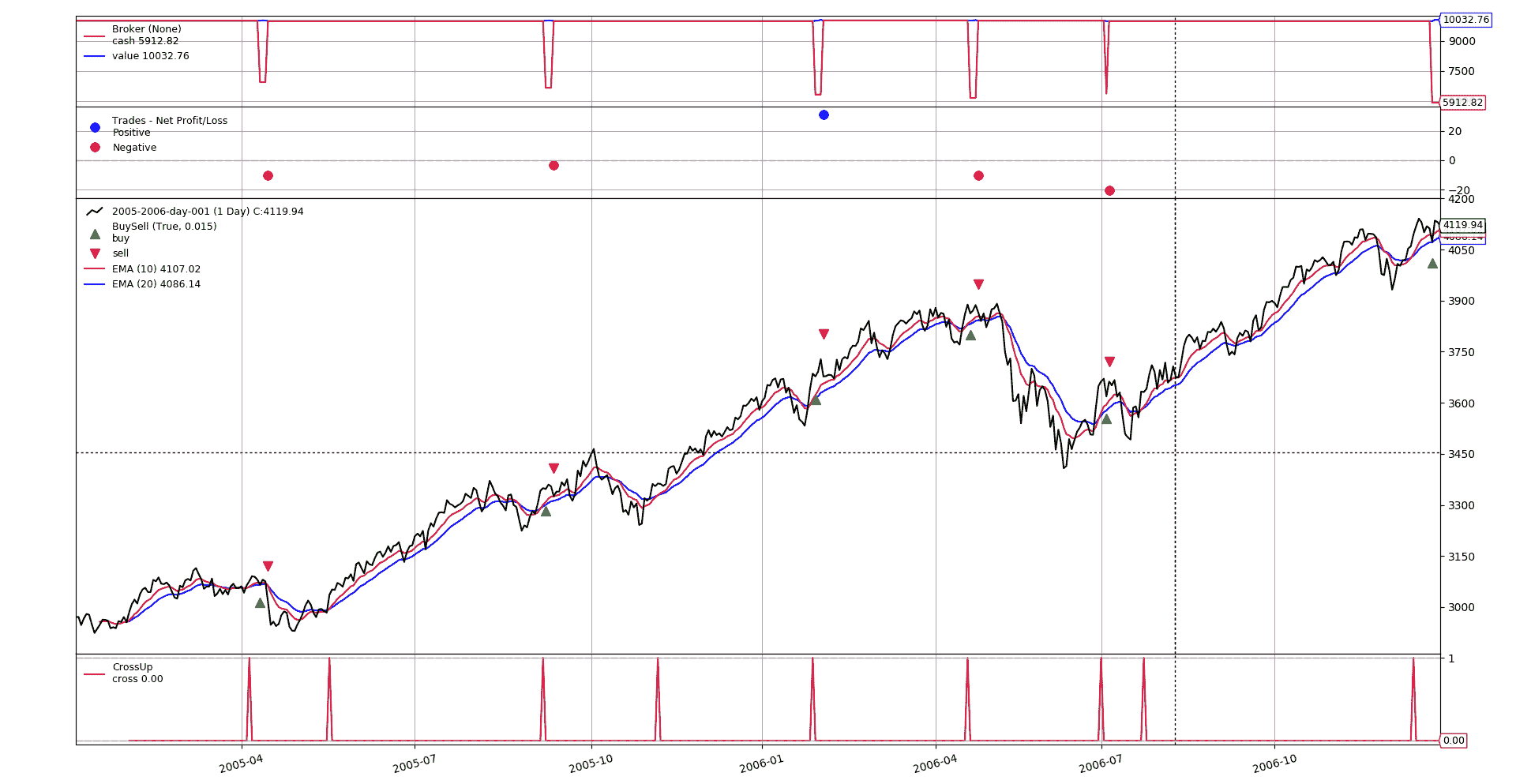

让我们试着在当前收盘价下方以trail=30买入0.5%

使用StopTrail的样本运行:

$ ./stop-loss-approaches.py auto --plot --strat trail=30,buy_limit=0.005

BUY @price: 3060.85

SELL@price: 3050.54

CANCEL@price: 0.00 buy

CANCEL@price: 0.00 sell

BUY @price: 3332.71

SELL@price: 3329.65

CANCEL@price: 0.00 buy

CANCEL@price: 0.00 sell

BUY @price: 3667.05

SELL@price: 3698.25

BUY @price: 3869.02

SELL@price: 3858.46

BUY @price: 3644.61

SELL@price: 3624.02

CANCEL@price: 0.00 buy

CANCEL@price: 0.00 sell

BUY @price: 4073.86

图表呢

日志和图表上的买入/卖出标志表明,没有执行任何sell订单,但没有相应的buy订单,并且取消了buy订单,紧接着取消了子sell订单(没有任何手动编码)

结论

已经展示了如何使用不同的方法进行止损交易。这可以用来避免损失或确保利润。

注意:如果止损点设置在正常的价格变动范围内,非常紧的止损单也可能会使你的头寸脱离市场。

脚本使用

$ ./stop-loss-approaches.py --help

usage: stop-loss-approaches.py [-h] [--data0 DATA0] [--fromdate FROMDATE]

[--todate TODATE] [--cerebro kwargs]

[--broker kwargs] [--sizer kwargs]

[--strat kwargs] [--plot [kwargs]]

{manual,manualcheat,auto}

Stop-Loss Approaches

positional arguments:

{manual,manualcheat,auto}

Stop approach to use

optional arguments:

-h, --help show this help message and exit

--data0 DATA0 Data to read in (default:

../../datas/2005-2006-day-001.txt)

--fromdate FROMDATE Date[time] in YYYY-MM-DD[THH:MM:SS] format (default: )

--todate TODATE Date[time] in YYYY-MM-DD[THH:MM:SS] format (default: )

--cerebro kwargs kwargs in key=value format (default: )

--broker kwargs kwargs in key=value format (default: )

--sizer kwargs kwargs in key=value format (default: )

--strat kwargs kwargs in key=value format (default: )

--plot [kwargs] kwargs in key=value format (default: )

代码

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import argparse

import datetime

import backtrader as bt

class BaseStrategy(bt.Strategy):

params = dict(

fast_ma=10,

slow_ma=20,

)

def __init__(self):

# omitting a data implies self.datas[0] (aka self.data and self.data0)

fast_ma = bt.ind.EMA(period=self.p.fast_ma)

slow_ma = bt.ind.EMA(period=self.p.slow_ma)

# our entry point

self.crossup = bt.ind.CrossUp(fast_ma, slow_ma)

class ManualStopOrStopTrail(BaseStrategy):

params = dict(

stop_loss=0.02, # price is 2% less than the entry point

trail=False,

)

def notify_order(self, order):

if not order.status == order.Completed:

return # discard any other notification

if not self.position: # we left the market

print('SELL@price: {:.2f}'.format(order.executed.price))

return

# We have entered the market

print('BUY @price: {:.2f}'.format(order.executed.price))

if not self.p.trail:

stop_price = order.executed.price * (1.0 - self.p.stop_loss)

self.sell(exectype=bt.Order.Stop, price=stop_price)

else:

self.sell(exectype=bt.Order.StopTrail, trailamount=self.p.trail)

def next(self):

if not self.position and self.crossup > 0:

# not in the market and signal triggered

self.buy()

class ManualStopOrStopTrailCheat(BaseStrategy):

params = dict(

stop_loss=0.02, # price is 2% less than the entry point

trail=False,

)

def __init__(self):

super().__init__()

self.broker.set_coc(True)

def notify_order(self, order):

if not order.status == order.Completed:

return # discard any other notification

if not self.position: # we left the market

print('SELL@price: {:.2f}'.format(order.executed.price))

return

# We have entered the market

print('BUY @price: {:.2f}'.format(order.executed.price))

def next(self):

if not self.position and self.crossup > 0:

# not in the market and signal triggered

self.buy()

if not self.p.trail:

stop_price = self.data.close[0] * (1.0 - self.p.stop_loss)

self.sell(exectype=bt.Order.Stop, price=stop_price)

else:

self.sell(exectype=bt.Order.StopTrail,

trailamount=self.p.trail)

class AutoStopOrStopTrail(BaseStrategy):

params = dict(

stop_loss=0.02, # price is 2% less than the entry point

trail=False,

buy_limit=False,

)

buy_order = None # default value for a potential buy_order

def notify_order(self, order):

if order.status == order.Cancelled:

print('CANCEL@price: {:.2f} {}'.format(

order.executed.price, 'buy' if order.isbuy() else 'sell'))

return

if not order.status == order.Completed:

return # discard any other notification

if not self.position: # we left the market

print('SELL@price: {:.2f}'.format(order.executed.price))

return

# We have entered the market

print('BUY @price: {:.2f}'.format(order.executed.price))

def next(self):

if not self.position and self.crossup > 0:

if self.buy_order: # something was pending

self.cancel(self.buy_order)

# not in the market and signal triggered

if not self.p.buy_limit:

self.buy_order = self.buy(transmit=False)

else:

price = self.data.close[0] * (1.0 - self.p.buy_limit)

# transmit = False ... await child order before transmission

self.buy_order = self.buy(price=price, exectype=bt.Order.Limit,

transmit=False)

# Setting parent=buy_order ... sends both together

if not self.p.trail:

stop_price = self.data.close[0] * (1.0 - self.p.stop_loss)

self.sell(exectype=bt.Order.Stop, price=stop_price,

parent=self.buy_order)

else:

self.sell(exectype=bt.Order.StopTrail,

trailamount=self.p.trail,

parent=self.buy_order)

APPROACHES = dict(

manual=ManualStopOrStopTrail,

manualcheat=ManualStopOrStopTrailCheat,

auto=AutoStopOrStopTrail,

)

def runstrat(args=None):

args = parse_args(args)

cerebro = bt.Cerebro()

# Data feed kwargs

kwargs = dict()

# Parse from/to-date

dtfmt, tmfmt = '%Y-%m-%d', 'T%H:%M:%S'

for a, d in ((getattr(args, x), x) for x in ['fromdate', 'todate']):

if a:

strpfmt = dtfmt + tmfmt * ('T' in a)

kwargs[d] = datetime.datetime.strptime(a, strpfmt)

data0 = bt.feeds.BacktraderCSVData(dataname=args.data0, **kwargs)

cerebro.adddata(data0)

# Broker

cerebro.broker = bt.brokers.BackBroker(**eval('dict(' + args.broker + ')'))

# Sizer

cerebro.addsizer(bt.sizers.FixedSize, **eval('dict(' + args.sizer + ')'))

# Strategy

StClass = APPROACHES[args.approach]

cerebro.addstrategy(StClass, **eval('dict(' + args.strat + ')'))

# Execute

cerebro.run(**eval('dict(' + args.cerebro + ')'))

if args.plot: # Plot if requested to

cerebro.plot(**eval('dict(' + args.plot + ')'))

def parse_args(pargs=None):

parser = argparse.ArgumentParser(

formatter_class=argparse.ArgumentDefaultsHelpFormatter,

description=(

'Stop-Loss Approaches'

)

)

parser.add_argument('--data0', default='../../datas/2005-2006-day-001.txt',

required=False, help='Data to read in')

# Strategy to choose

parser.add_argument('approach', choices=APPROACHES.keys(),

help='Stop approach to use')

# Defaults for dates

parser.add_argument('--fromdate', required=False, default='',

help='Date[time] in YYYY-MM-DD[THH:MM:SS] format')

parser.add_argument('--todate', required=False, default='',

help='Date[time] in YYYY-MM-DD[THH:MM:SS] format')

parser.add_argument('--cerebro', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--broker', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--sizer', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--strat', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--plot', required=False, default='',

nargs='?', const='{}',

metavar='kwargs', help='kwargs in key=value format')

return parser.parse_args(pargs)

if __name__ == '__main__':

runstrat()