多数据策略

原文: https://www.backtrader.com/blog/posts/2015-09-03-multidata-strategy/multidata-strategy/

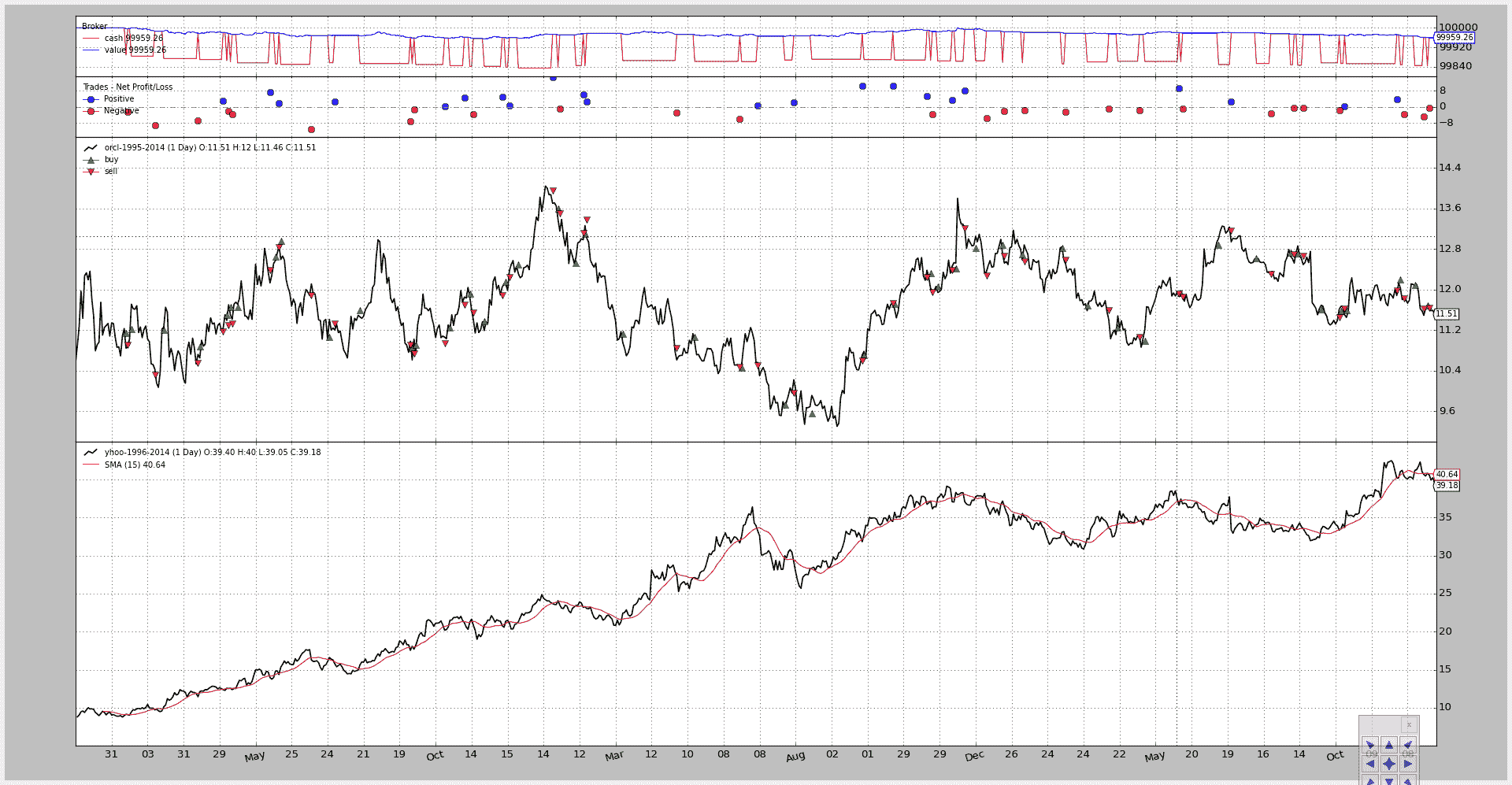

因为世界上没有什么东西是孤立存在的,所以购买一项资产的导火索很可能是另一项资产。

使用不同的分析技术,可能会发现两个不同数据之间存在相关性。

backtrader 支持同时使用不同的数据源,因此在大多数情况下,它可能用于此目的。

假设以下公司之间存在相关性:

-

Oracle -

Yahoo

可以想象,当雅虎一切顺利时,该公司会从甲骨文购买更多服务器、更多数据库和更多专业服务,这反过来又会推高股价。

因此,经过深入分析,制定了一项战略:

-

如果

Yahoo的收盘价超过简单移动平均线(第 15 期) -

购买

Oracle

要退出该位置,请执行以下操作:

- 使用收盘价向下的交叉点

订单执行类型:

- 集市

综上所述,使用backtrader进行设置需要什么:

-

创建一个

cerebro -

加载数据源 1(Oracle)并将其添加到 Cerbero

-

加载数据源 2(Yahoo)并将其添加到 Cerbero

-

加载我们设计的策略

该战略的细节:

-

在数据源 2(Yahoo)上创建一个简单的移动平均线

-

使用雅虎收盘价和移动平均线创建交叉指标

然后在数据源 1(Oracle)上执行购买/销售订单,如上所述。

以下脚本使用以下默认值:

-

Oracle(数据源 1)

-

雅虎(数据来源 2)

-

现金:10000(系统默认)

-

持股:10 股

-

佣金:每轮 0.5%(以 0.005 表示)

-

期间:15 个交易日

-

期间:2003 年、2004 年和 2005 年

脚本可以使用参数修改上述设置,如帮助文本中所示:

$ ./multidata-strategy.py --help

usage: multidata-strategy.py [-h] [--data0 DATA0] [--data1 DATA1]

[--fromdate FROMDATE] [--todate TODATE]

[--period PERIOD] [--cash CASH]

[--commperc COMMPERC] [--stake STAKE] [--plot]

[--numfigs NUMFIGS]

MultiData Strategy

optional arguments:

-h, --help show this help message and exit

--data0 DATA0, -d0 DATA0

1st data into the system

--data1 DATA1, -d1 DATA1

2nd data into the system

--fromdate FROMDATE, -f FROMDATE

Starting date in YYYY-MM-DD format

--todate TODATE, -t TODATE

Starting date in YYYY-MM-DD format

--period PERIOD Period to apply to the Simple Moving Average

--cash CASH Starting Cash

--commperc COMMPERC Percentage commission for operation (0.005 is 0.5%

--stake STAKE Stake to apply in each operation

--plot, -p Plot the read data

--numfigs NUMFIGS, -n NUMFIGS

Plot using numfigs figures

标准执行的结果:

$ ./multidata-strategy.py

2003-02-11T23:59:59+00:00, BUY CREATE , 9.14

2003-02-12T23:59:59+00:00, BUY COMPLETE, 11.14

2003-02-12T23:59:59+00:00, SELL CREATE , 9.09

2003-02-13T23:59:59+00:00, SELL COMPLETE, 10.90

2003-02-14T23:59:59+00:00, BUY CREATE , 9.45

2003-02-18T23:59:59+00:00, BUY COMPLETE, 11.22

2003-03-06T23:59:59+00:00, SELL CREATE , 9.72

2003-03-07T23:59:59+00:00, SELL COMPLETE, 10.32

...

...

2005-12-22T23:59:59+00:00, BUY CREATE , 40.83

2005-12-23T23:59:59+00:00, BUY COMPLETE, 11.68

2005-12-23T23:59:59+00:00, SELL CREATE , 40.63

2005-12-27T23:59:59+00:00, SELL COMPLETE, 11.63

==================================================

Starting Value - 100000.00

Ending Value - 99959.26

==================================================

经过两年完整的执行,该战略:

- 损失了 40.74 个货币单位

雅虎和甲骨文之间的关联就到此为止了

可视化输出(添加--plot生成图表)

以及脚本(已添加到samples/multidata-strategy目录下的backtrader源发行版中)。

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import argparse

import datetime

# The above could be sent to an independent module

import backtrader as bt

import backtrader.feeds as btfeeds

import backtrader.indicators as btind

class MultiDataStrategy(bt.Strategy):

'''

This strategy operates on 2 datas. The expectation is that the 2 datas are

correlated and the 2nd data is used to generate signals on the 1st

- Buy/Sell Operationss will be executed on the 1st data

- The signals are generated using a Simple Moving Average on the 2nd data

when the close price crosses upwwards/downwards

The strategy is a long-only strategy

'''

params = dict(

period=15,

stake=10,

printout=True,

)

def log(self, txt, dt=None):

if self.p.printout:

dt = dt or self.data.datetime[0]

dt = bt.num2date(dt)

print('%s, %s' % (dt.isoformat(), txt))

def notify_order(self, order):

if order.status in [bt.Order.Submitted, bt.Order.Accepted]:

return # Await further notifications

if order.status == order.Completed:

if order.isbuy():

buytxt = 'BUY COMPLETE, %.2f' % order.executed.price

self.log(buytxt, order.executed.dt)

else:

selltxt = 'SELL COMPLETE, %.2f' % order.executed.price

self.log(selltxt, order.executed.dt)

elif order.status in [order.Expired, order.Canceled, order.Margin]:

self.log('%s ,' % order.Status[order.status])

pass # Simply log

# Allow new orders

self.orderid = None

def __init__(self):

# To control operation entries

self.orderid = None

# Create SMA on 2nd data

sma = btind.MovAv.SMA(self.data1, period=self.p.period)

# Create a CrossOver Signal from close an moving average

self.signal = btind.CrossOver(self.data1.close, sma)

def next(self):

if self.orderid:

return # if an order is active, no new orders are allowed

if not self.position: # not yet in market

if self.signal > 0.0: # cross upwards

self.log('BUY CREATE , %.2f' % self.data1.close[0])

self.buy(size=self.p.stake)

else: # in the market

if self.signal < 0.0: # crosss downwards

self.log('SELL CREATE , %.2f' % self.data1.close[0])

self.sell(size=self.p.stake)

def stop(self):

print('==================================================')

print('Starting Value - %.2f' % self.broker.startingcash)

print('Ending Value - %.2f' % self.broker.getvalue())

print('==================================================')

def runstrategy():

args = parse_args()

# Create a cerebro

cerebro = bt.Cerebro()

# Get the dates from the args

fromdate = datetime.datetime.strptime(args.fromdate, '%Y-%m-%d')

todate = datetime.datetime.strptime(args.todate, '%Y-%m-%d')

# Create the 1st data

data0 = btfeeds.YahooFinanceCSVData(

dataname=args.data0,

fromdate=fromdate,

todate=todate)

# Add the 1st data to cerebro

cerebro.adddata(data0)

# Create the 2nd data

data1 = btfeeds.YahooFinanceCSVData(

dataname=args.data1,

fromdate=fromdate,

todate=todate)

# Add the 2nd data to cerebro

cerebro.adddata(data1)

# Add the strategy

cerebro.addstrategy(MultiDataStrategy,

period=args.period,

stake=args.stake)

# Add the commission - only stocks like a for each operation

cerebro.broker.setcash(args.cash)

# Add the commission - only stocks like a for each operation

cerebro.broker.setcommission(commission=args.commperc)

# And run it

cerebro.run()

# Plot if requested

if args.plot:

cerebro.plot(numfigs=args.numfigs, volume=False, zdown=False)

def parse_args():

parser = argparse.ArgumentParser(description='MultiData Strategy')

parser.add_argument('--data0', '-d0',

default='../../datas/orcl-1995-2014.txt',

help='1st data into the system')

parser.add_argument('--data1', '-d1',

default='../../datas/yhoo-1996-2014.txt',

help='2nd data into the system')

parser.add_argument('--fromdate', '-f',

default='2003-01-01',

help='Starting date in YYYY-MM-DD format')

parser.add_argument('--todate', '-t',

default='2005-12-31',

help='Starting date in YYYY-MM-DD format')

parser.add_argument('--period', default=15, type=int,

help='Period to apply to the Simple Moving Average')

parser.add_argument('--cash', default=100000, type=int,

help='Starting Cash')

parser.add_argument('--commperc', default=0.005, type=float,

help='Percentage commission for operation (0.005 is 0.5%%')

parser.add_argument('--stake', default=10, type=int,

help='Stake to apply in each operation')

parser.add_argument('--plot', '-p', action='store_true',

help='Plot the read data')

parser.add_argument('--numfigs', '-n', default=1,

help='Plot using numfigs figures')

return parser.parse_args()

if __name__ == '__main__':

runstrategy()