括号订单

原文: https://www.backtrader.com/blog/posts/2017-04-01-bracket/bracket/

发行版1.9.37.116增加了bracket订单,提供了非常广泛的订单,并得到了回溯测试经纪人的支持(Market、Limit、Close、Stop、StopLimit、StopTrail、StopTrailLimit、OCO)

笔记

这是为回溯测试和交互经纪人商店实施的

bracket订单不是单个订单,但它实际上由3订单组成。让我们考虑长边

-

主面

buy指令,通常设置为Limit或StopLimit指令 -

低端

sell指令,通常设置为Stop指令以限制损失 -

高端

sell订单,通常设置为Limit订单以获取利润

短端对应sell和 2 个buy订单。

低端/高端订单实际上在主端订单周围创建了一个括号。

要将一些逻辑放在其中,以下规则适用:

-

这 3 个订单一起提交,以避免单独触发其中任何一个订单

-

低端/高端订单标记为主端的子级

-

在执行主侧之前,子级不会处于活动状态

-

主侧的取消将同时取消低端和高端

-

主侧的执行同时激活低压侧和高压侧

-

活跃时

- 执行或取消任何低端/高端订单都会自动取消另一个订单

使用模式

创建订单的括号集有两种可能性

-

单次发出 3 份订单

-

手动发出 3 份订单

单次发出括号

反向交易者在Strategy中提供了两种新的方法来控制括号订单。

buy_bracket和sell_bracket

笔记

签名和信息在下方或Strategy参考部分。

用一条语句就可以得到一套完整的 3 个订单。例如:

brackets = self.buy_bracket(limitprice=14.00, price=13.50, stopprice=13.00)

注意stopprice和limitprice如何包装主price

这应该足够了。实际目标data将是data0,而size将由默认的大小器自动确定。当然,可以指定这两个参数和许多其他参数,以便对执行进行精细控制。

返回值为:

- A

list包含此订单中的 3 个订单:[main, stop, limit]

因为在发出sell_bracket指令时,低端和高端都会被调到 aound,参数的命名遵循约定stop和limit

-

stop用于停止损失(长时间运行时低压侧,短时间运行时高压侧) -

limit是为了获取利润(长操作高,短操作低)

人工签发括号

这涉及到 3 个命令的生成,以及对transmit和parent参数的处理。规则:

-

主侧订单必须创建 1st且有

transmit=False -

低端/高端订单必须有

parent=main_side_order -

要创建的 1st低端/高端订单必须有

transmit=False -

最后一个要创建的订单(低端或高端)设置为

transmit=True

下面是一个实际示例,它实现了上面的单个命令的功能:

mainside = self.buy(price=13.50, exectype=bt.Order.Limit, transmit=False)

lowside = self.sell(price=13.00, size=mainsize.size, exectype=bt.Order.Stop,

transmit=False, parent=mainside)

highside = self.sell(price=14.00, size=mainsize.size, exectype=bt.Order.Limit,

transmit=True, parent=mainside)

还有很多事情要做:

-

跟踪

mainside订单,表明它是其他订单的父项 -

控制

transmit以确保只有最后一个命令触发联合传输 -

指定执行类型

-

指定低侧和高侧的

size因为

size必须相同。如果没有手动指定参数,并且最终用户引入了一个 sizer,那么 sizer 实际上可以为订单指示一个不同的值。这就是为什么在为mainside订单设置后,必须手动将其添加到调用中。

它的样本

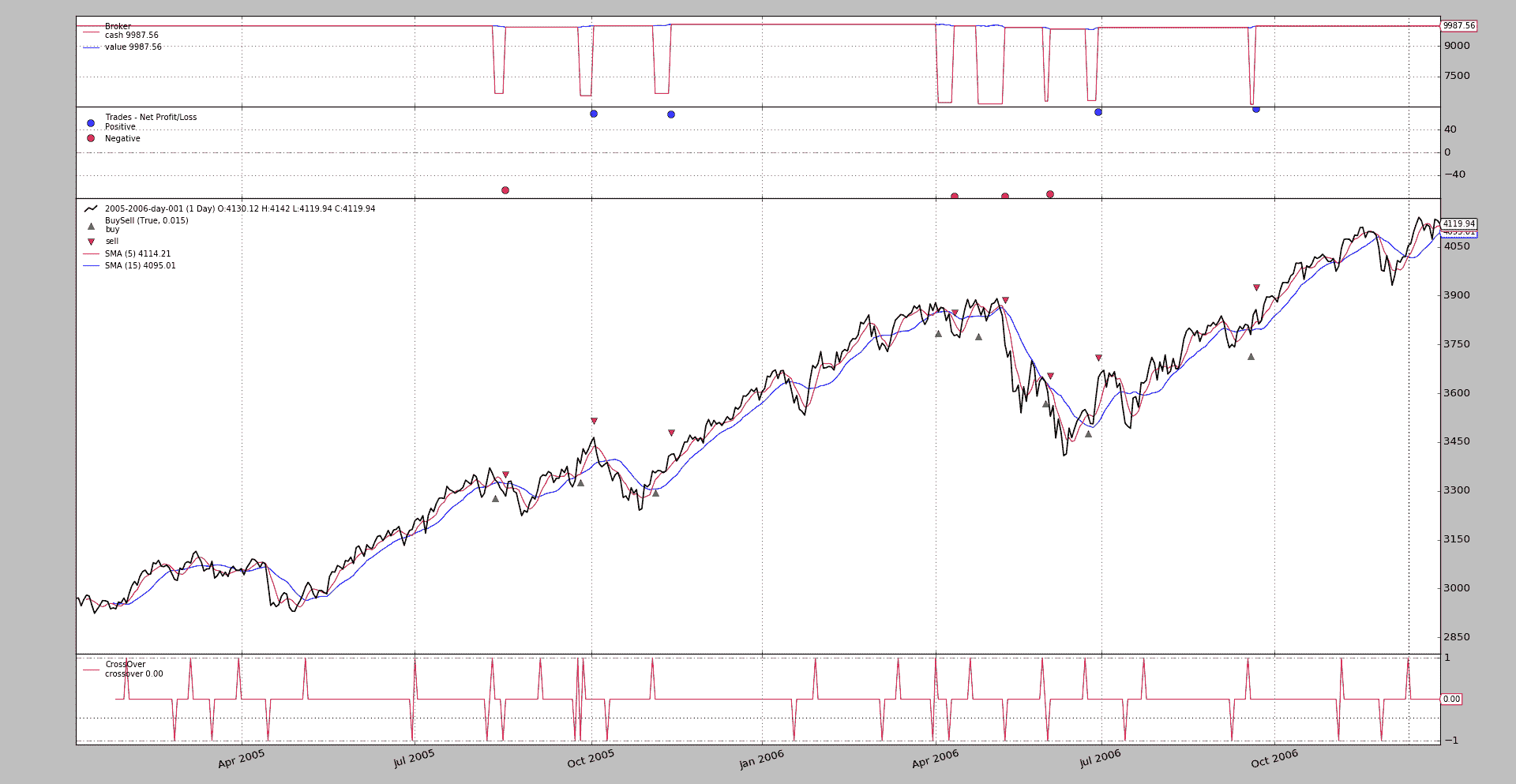

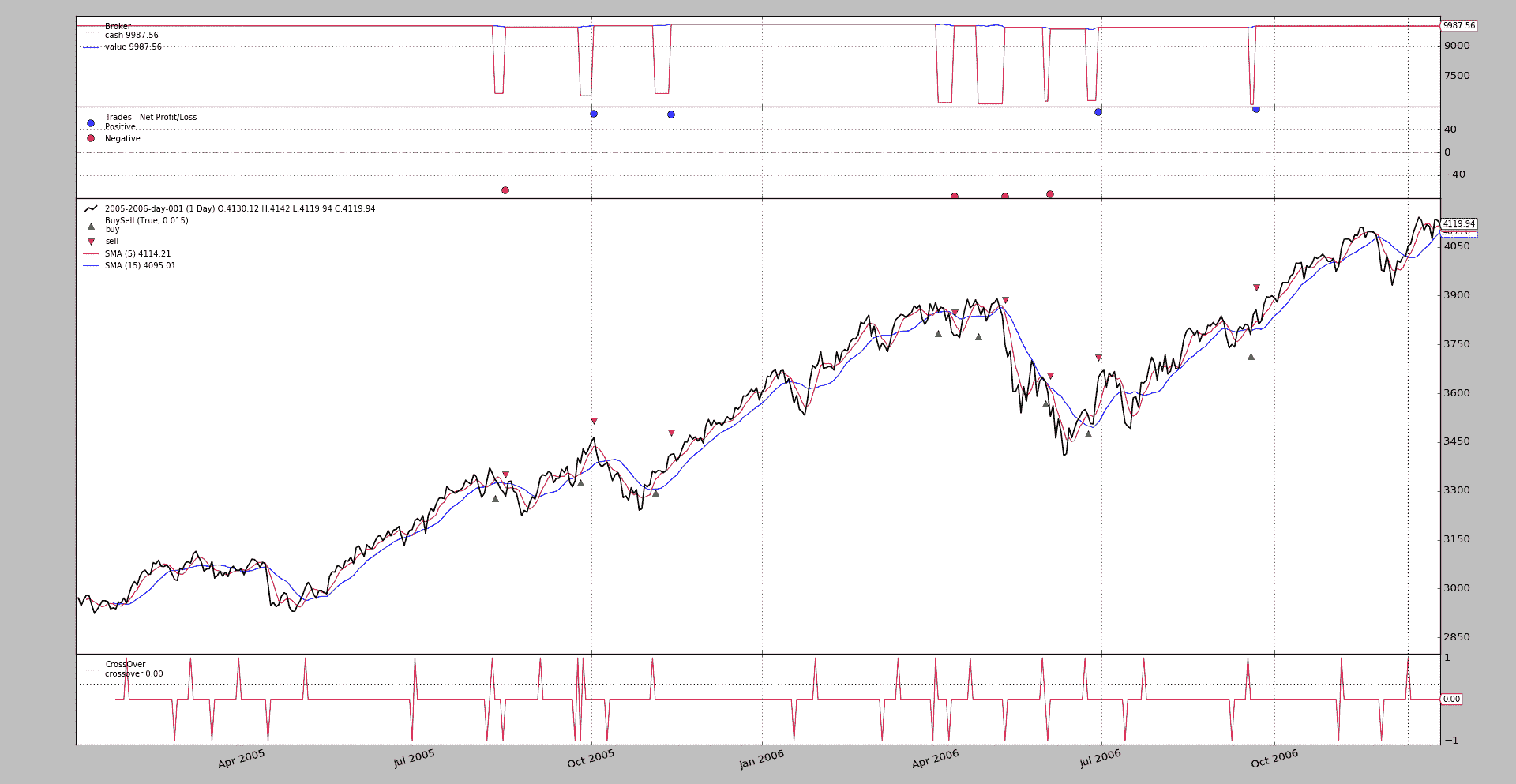

从下面运行示例将生成此输出(为简洁起见,设置了上限)

$ ./bracket.py --plot

2005-01-28: Oref 1 / Buy at 2941.11055

2005-01-28: Oref 2 / Sell Stop at 2881.99275

2005-01-28: Oref 3 / Sell Limit at 3000.22835

2005-01-31: Order ref: 1 / Type Buy / Status Submitted

2005-01-31: Order ref: 2 / Type Sell / Status Submitted

2005-01-31: Order ref: 3 / Type Sell / Status Submitted

2005-01-31: Order ref: 1 / Type Buy / Status Accepted

2005-01-31: Order ref: 2 / Type Sell / Status Accepted

2005-01-31: Order ref: 3 / Type Sell / Status Accepted

2005-02-01: Order ref: 1 / Type Buy / Status Expired

2005-02-01: Order ref: 2 / Type Sell / Status Canceled

2005-02-01: Order ref: 3 / Type Sell / Status Canceled

...

2005-08-11: Oref 16 / Buy at 3337.3892

2005-08-11: Oref 17 / Sell Stop at 3270.306

2005-08-11: Oref 18 / Sell Limit at 3404.4724

2005-08-12: Order ref: 16 / Type Buy / Status Submitted

2005-08-12: Order ref: 17 / Type Sell / Status Submitted

2005-08-12: Order ref: 18 / Type Sell / Status Submitted

2005-08-12: Order ref: 16 / Type Buy / Status Accepted

2005-08-12: Order ref: 17 / Type Sell / Status Accepted

2005-08-12: Order ref: 18 / Type Sell / Status Accepted

2005-08-12: Order ref: 16 / Type Buy / Status Completed

2005-08-18: Order ref: 17 / Type Sell / Status Completed

2005-08-18: Order ref: 18 / Type Sell / Status Canceled

...

2005-09-26: Oref 22 / Buy at 3383.92535

2005-09-26: Oref 23 / Sell Stop at 3315.90675

2005-09-26: Oref 24 / Sell Limit at 3451.94395

2005-09-27: Order ref: 22 / Type Buy / Status Submitted

2005-09-27: Order ref: 23 / Type Sell / Status Submitted

2005-09-27: Order ref: 24 / Type Sell / Status Submitted

2005-09-27: Order ref: 22 / Type Buy / Status Accepted

2005-09-27: Order ref: 23 / Type Sell / Status Accepted

2005-09-27: Order ref: 24 / Type Sell / Status Accepted

2005-09-27: Order ref: 22 / Type Buy / Status Completed

2005-10-04: Order ref: 24 / Type Sell / Status Completed

2005-10-04: Order ref: 23 / Type Sell / Status Canceled

...

其中显示了 3 种不同的结果:

-

在 1st案例中,主辅助订单过期,自动取消了其他两个

-

在第 2和案例中,主侧订单已完成,低(买入案例中的停止)已执行,以限制损失

-

在 3rd案例中,完成了主侧指令,并执行了高侧(限制)

可以注意到这一点,因为完成的id 为

22和24,而高侧订单最后发出,这意味着未执行的低侧订单 id 为 23。

视觉上

可以立即看到,亏损交易与赢家交易的价值相同,这就是回笼的目的。控制双方。

样本运行时手动发出 3 个订单,但可以告知使用buy_bracket。让我们看看输出:

$ ./bracket.py --strat usebracket=True

同样的结果

一些参考资料

参见新的buy_bracket和sell_bracket方法

def buy_bracket(self, data=None, size=None, price=None, plimit=None,

exectype=bt.Order.Limit, valid=None, tradeid=0,

trailamount=None, trailpercent=None, oargs={},

stopprice=None, stopexec=bt.Order.Stop, stopargs={},

limitprice=None, limitexec=bt.Order.Limit, limitargs={},

**kwargs):

'''

Create a bracket order group (low side - buy order - high side). The

default behavior is as follows:

- Issue a **buy** order with execution ``Limit``

- Issue a *low side* bracket **sell** order with execution ``Stop``

- Issue a *high side* bracket **sell** order with execution

``Limit``.

See below for the different parameters

- ``data`` (default: ``None``)

For which data the order has to be created. If ``None`` then the

first data in the system, ``self.datas[0] or self.data0`` (aka

``self.data``) will be used

- ``size`` (default: ``None``)

Size to use (positive) of units of data to use for the order.

If ``None`` the ``sizer`` instance retrieved via ``getsizer`` will

be used to determine the size.

**Note**: The same size is applied to all 3 orders of the bracket

- ``price`` (default: ``None``)

Price to use (live brokers may place restrictions on the actual

format if it does not comply to minimum tick size requirements)

``None`` is valid for ``Market`` and ``Close`` orders (the market

determines the price)

For ``Limit``, ``Stop`` and ``StopLimit`` orders this value

determines the trigger point (in the case of ``Limit`` the trigger

is obviously at which price the order should be matched)

- ``plimit`` (default: ``None``)

Only applicable to ``StopLimit`` orders. This is the price at which

to set the implicit *Limit* order, once the *Stop* has been

triggered (for which ``price`` has been used)

- ``trailamount`` (default: ``None``)

If the order type is StopTrail or StopTrailLimit, this is an

absolute amount which determines the distance to the price (below

for a Sell order and above for a buy order) to keep the trailing

stop

- ``trailpercent`` (default: ``None``)

If the order type is StopTrail or StopTrailLimit, this is a

percentage amount which determines the distance to the price (below

for a Sell order and above for a buy order) to keep the trailing

stop (if ``trailamount`` is also specified it will be used)

- ``exectype`` (default: ``bt.Order.Limit``)

Possible values: (see the documentation for the method ``buy``

- ``valid`` (default: ``None``)

Possible values: (see the documentation for the method ``buy``

- ``tradeid`` (default: ``0``)

Possible values: (see the documentation for the method ``buy``

- ``oargs`` (default: ``{}``)

Specific keyword arguments (in a ``dict``) to pass to the main side

order. Arguments from the default ``**kwargs`` will be applied on

top of this.

- ``**kwargs``: additional broker implementations may support extra

parameters. ``backtrader`` will pass the *kwargs* down to the

created order objects

Possible values: (see the documentation for the method ``buy``

**Note**: this ``kwargs`` will be applied to the 3 orders of a

bracket. See below for specific keyword arguments for the low and

high side orders

- ``stopprice`` (default: ``None``)

Specific price for the *low side* stop order

- ``stopexec`` (default: ``bt.Order.Stop``)

Specific execution type for the *low side* order

- ``stopargs`` (default: ``{}``)

Specific keyword arguments (in a ``dict``) to pass to the low side

order. Arguments from the default ``**kwargs`` will be applied on

top of this.

- ``limitprice`` (default: ``None``)

Specific price for the *high side* stop order

- ``stopexec`` (default: ``bt.Order.Limit``)

Specific execution type for the *high side* order

- ``limitargs`` (default: ``{}``)

Specific keyword arguments (in a ``dict``) to pass to the high side

order. Arguments from the default ``**kwargs`` will be applied on

top of this.

Returns:

- A list containing the 3 orders [order, stop side, limit side]

'''

def sell_bracket(self, data=None,

size=None, price=None, plimit=None,

exectype=bt.Order.Limit, valid=None, tradeid=0,

trailamount=None, trailpercent=None,

oargs={},

stopprice=None, stopexec=bt.Order.Stop, stopargs={},

limitprice=None, limitexec=bt.Order.Limit, limitargs={},

**kwargs):

'''

Create a bracket order group (low side - buy order - high side). The

default behavior is as follows:

- Issue a **sell** order with execution ``Limit``

- Issue a *high side* bracket **buy** order with execution ``Stop``

- Issue a *low side* bracket **buy** order with execution ``Limit``.

See ``bracket_buy`` for the meaning of the parameters

Returns:

- A list containing the 3 orders [order, stop side, limit side]

'''

样本使用

$ ./bracket.py --help

usage: bracket.py [-h] [--data0 DATA0] [--fromdate FROMDATE] [--todate TODATE]

[--cerebro kwargs] [--broker kwargs] [--sizer kwargs]

[--strat kwargs] [--plot [kwargs]]

Sample Skeleton

optional arguments:

-h, --help show this help message and exit

--data0 DATA0 Data to read in (default:

../../datas/2005-2006-day-001.txt)

--fromdate FROMDATE Date[time] in YYYY-MM-DD[THH:MM:SS] format (default: )

--todate TODATE Date[time] in YYYY-MM-DD[THH:MM:SS] format (default: )

--cerebro kwargs kwargs in key=value format (default: )

--broker kwargs kwargs in key=value format (default: )

--sizer kwargs kwargs in key=value format (default: )

--strat kwargs kwargs in key=value format (default: )

--plot [kwargs] kwargs in key=value format (default: )

示例代码

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import argparse

import datetime

import backtrader as bt

class St(bt.Strategy):

params = dict(

ma=bt.ind.SMA,

p1=5,

p2=15,

limit=0.005,

limdays=3,

limdays2=1000,

hold=10,

usebracket=False, # use order_target_size

switchp1p2=False, # switch prices of order1 and order2

)

def notify_order(self, order):

print('{}: Order ref: {} / Type {} / Status {}'.format(

self.data.datetime.date(0),

order.ref, 'Buy' * order.isbuy() or 'Sell',

order.getstatusname()))

if order.status == order.Completed:

self.holdstart = len(self)

if not order.alive() and order.ref in self.orefs:

self.orefs.remove(order.ref)

def __init__(self):

ma1, ma2 = self.p.ma(period=self.p.p1), self.p.ma(period=self.p.p2)

self.cross = bt.ind.CrossOver(ma1, ma2)

self.orefs = list()

if self.p.usebracket:

print('-' * 5, 'Using buy_bracket')

def next(self):

if self.orefs:

return # pending orders do nothing

if not self.position:

if self.cross > 0.0: # crossing up

close = self.data.close[0]

p1 = close * (1.0 - self.p.limit)

p2 = p1 - 0.02 * close

p3 = p1 + 0.02 * close

valid1 = datetime.timedelta(self.p.limdays)

valid2 = valid3 = datetime.timedelta(self.p.limdays2)

if self.p.switchp1p2:

p1, p2 = p2, p1

valid1, valid2 = valid2, valid1

if not self.p.usebracket:

o1 = self.buy(exectype=bt.Order.Limit,

price=p1,

valid=valid1,

transmit=False)

print('{}: Oref {} / Buy at {}'.format(

self.datetime.date(), o1.ref, p1))

o2 = self.sell(exectype=bt.Order.Stop,

price=p2,

valid=valid2,

parent=o1,

transmit=False)

print('{}: Oref {} / Sell Stop at {}'.format(

self.datetime.date(), o2.ref, p2))

o3 = self.sell(exectype=bt.Order.Limit,

price=p3,

valid=valid3,

parent=o1,

transmit=True)

print('{}: Oref {} / Sell Limit at {}'.format(

self.datetime.date(), o3.ref, p3))

self.orefs = [o1.ref, o2.ref, o3.ref]

else:

os = self.buy_bracket(

price=p1, valid=valid1,

stopprice=p2, stopargs=dict(valid=valid2),

limitprice=p3, limitargs=dict(valid=valid3),)

self.orefs = [o.ref for o in os]

else: # in the market

if (len(self) - self.holdstart) >= self.p.hold:

pass # do nothing in this case

def runstrat(args=None):

args = parse_args(args)

cerebro = bt.Cerebro()

# Data feed kwargs

kwargs = dict()

# Parse from/to-date

dtfmt, tmfmt = '%Y-%m-%d', 'T%H:%M:%S'

for a, d in ((getattr(args, x), x) for x in ['fromdate', 'todate']):

if a:

strpfmt = dtfmt + tmfmt * ('T' in a)

kwargs[d] = datetime.datetime.strptime(a, strpfmt)

# Data feed

data0 = bt.feeds.BacktraderCSVData(dataname=args.data0, **kwargs)

cerebro.adddata(data0)

# Broker

cerebro.broker = bt.brokers.BackBroker(**eval('dict(' + args.broker + ')'))

# Sizer

cerebro.addsizer(bt.sizers.FixedSize, **eval('dict(' + args.sizer + ')'))

# Strategy

cerebro.addstrategy(St, **eval('dict(' + args.strat + ')'))

# Execute

cerebro.run(**eval('dict(' + args.cerebro + ')'))

if args.plot: # Plot if requested to

cerebro.plot(**eval('dict(' + args.plot + ')'))

def parse_args(pargs=None):

parser = argparse.ArgumentParser(

formatter_class=argparse.ArgumentDefaultsHelpFormatter,

description=(

'Sample Skeleton'

)

)

parser.add_argument('--data0', default='../../datas/2005-2006-day-001.txt',

required=False, help='Data to read in')

# Defaults for dates

parser.add_argument('--fromdate', required=False, default='',

help='Date[time] in YYYY-MM-DD[THH:MM:SS] format')

parser.add_argument('--todate', required=False, default='',

help='Date[time] in YYYY-MM-DD[THH:MM:SS] format')

parser.add_argument('--cerebro', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--broker', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--sizer', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--strat', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--plot', required=False, default='',

nargs='?', const='{}',

metavar='kwargs', help='kwargs in key=value format')

return parser.parse_args(pargs)

if __name__ == '__main__':

runstrat()