MACD 设置

原文: https://www.backtrader.com/blog/posts/2016-07-30-macd-settings/macd-settings/

在Reddit的Algotrading站点中发现了一条关于优化 MACD 设置的线索。

因为交易你的金融自由之路——亚马逊链接而开始了反向交易者任务,我别无选择,只能发布一个答案并制作一个样本。

战略方法大致基于书中提出的一些想法。太阳底下没有什么新鲜事。并且参数已快速设置。没有过度装配,没有优化,什么都没有。大致:

-

如果

macd线穿过signal线向上,且控制Simple Moving Average在过去 x 个周期内有净负方向(当前SMA值低于x周期前的值),则输入 -

将

stop价格设置为close价格的N x ATR倍 -

如果

close价格低于stop价格,则退出市场 -

如果仍在市场中,则仅当

stop价格高于实际价格时,才更新stop价格

立桩通过以下方式完成:

- 拥有

Sizer分配百分比的可用现金用于运营。战略赢得越多,风险就越大……损失越多,风险就越小。

包括一个委员会。由于测试将使用股票进行,因此选择了一个百分比佣金,每次往返的佣金值为0.0033(又名0.33%。

为了发挥这一作用,将使用 3 个数据进行 3 次运行(总共 9 次运行)

-

手动选择的标准参数

-

将现金分配比例从

0.20增加到0.50 -

将停车点的 ATR 距离从

3.0增加到4.0,以避免被鞭打

为策略手动选择的参数:

params = (

# Standard MACD Parameters

('macd1', 12),

('macd2', 26),

('macdsig', 9),

('atrperiod', 14), # ATR Period (standard)

('atrdist', 3.0), # ATR distance for stop price

('smaperiod', 30), # SMA Period (pretty standard)

('dirperiod', 10), # Lookback period to consider SMA trend direction

)

和全系统:

parser.add_argument('--cash', required=False, action='store',

type=float, default=50000,

help=('Cash to start with'))

parser.add_argument('--cashalloc', required=False, action='store',

type=float, default=0.20,

help=('Perc (abs) of cash to allocate for ops'))

parser.add_argument('--commperc', required=False, action='store',

type=float, default=0.0033,

help=('Perc (abs) commision in each operation. '

'0.001 -> 0.1%%, 0.01 -> 1%%'))

日期范围为2005-01-01至2014-12-31,共 10 年。

分析者

为了获得一些目标数据,系统将添加 3 个分析仪:

-

整个期间有两个

TimeReturn-

对于战略本身

-

作为基准操作的数据

根据资产对战略进行有效基准测试

-

-

A

TimeReturn衡量年回报 -

A

SharpeRatio查看针对无风险资产的策略执行情况该值设置为

1%,可通过样本选项进行更改 -

A

SQN(系统质量编号),用于使用 Van K.Tharp 定义的绩效指标分析交易质量

此外,将向混合物中添加一个DrawDown观察者。

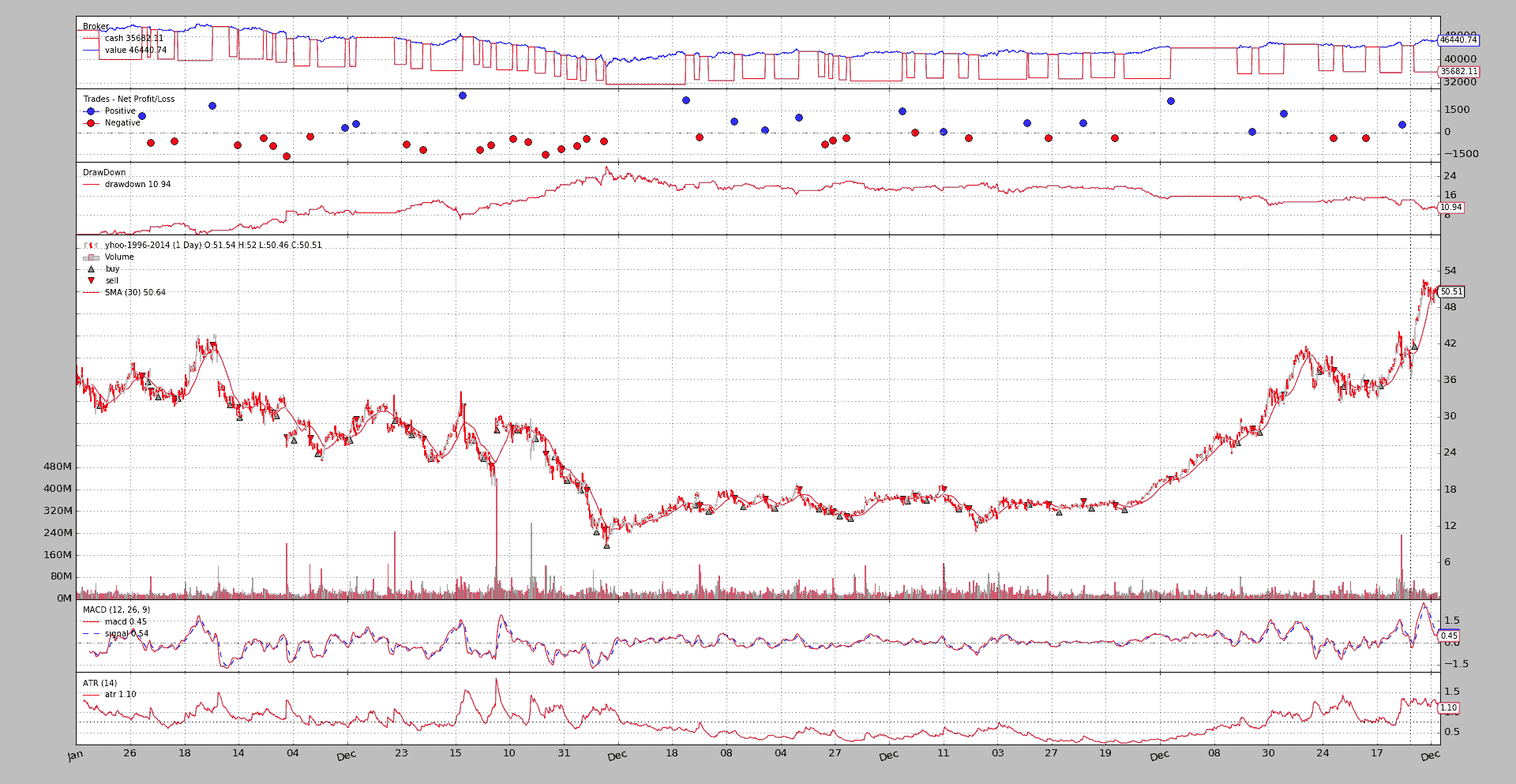

运行 1:标准参数

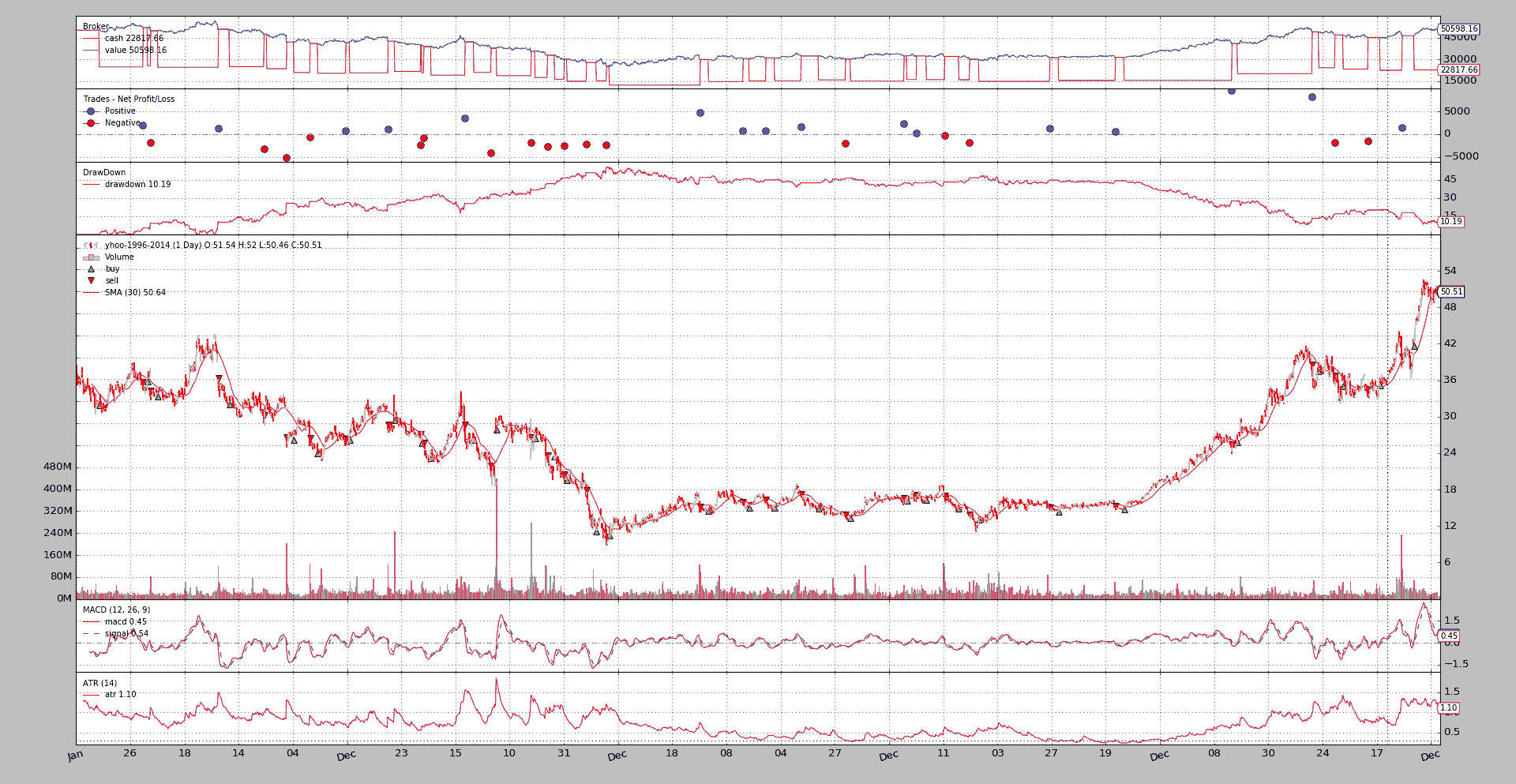

YHOO

$ ./macdsystem.py --plot --dataset yhoo

===============================================================================

TimeReturn:

- 9999-12-31 23:59:59.999999: -0.07118518868

===============================================================================

TimeReturn:

- 9999-12-31 23:59:59.999999: 0.316736183525

===============================================================================

TimeReturn:

- 2005-12-31: 0.02323119024

- 2006-12-31: -0.0813678018166

- 2007-12-31: -0.0144802141955

- 2008-12-31: -0.142301023804

- 2009-12-31: 0.0612152927491

- 2010-12-31: 0.00898269987778

- 2011-12-31: -0.00845048588578

- 2012-12-31: 0.0541362123146

- 2013-12-31: 0.0158705967774

- 2014-12-31: 0.0281978956007

===============================================================================

SharpeRatio:

- sharperatio: -0.261214264357

===============================================================================

SQN:

- sqn: -0.784558216044

- trades: 45

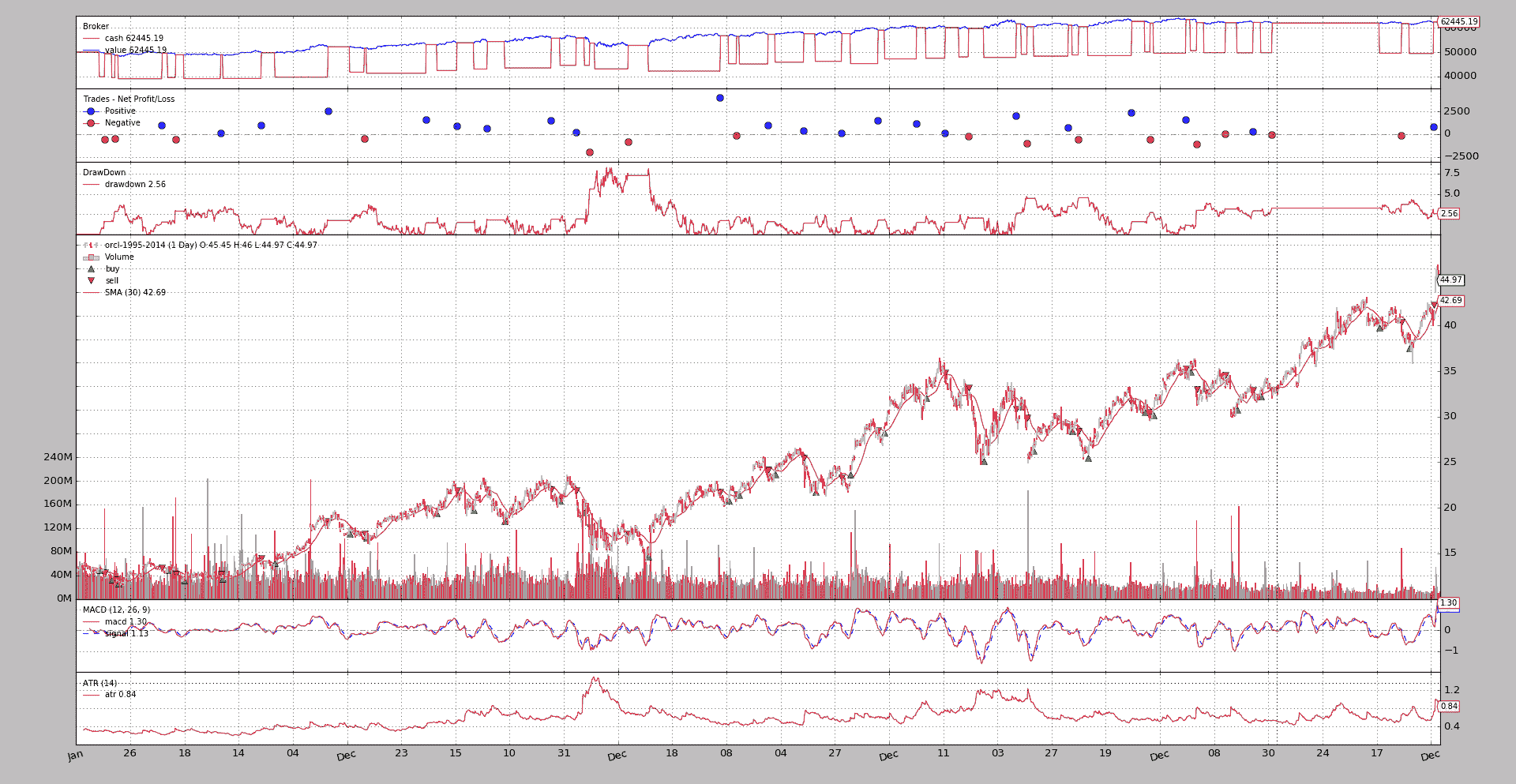

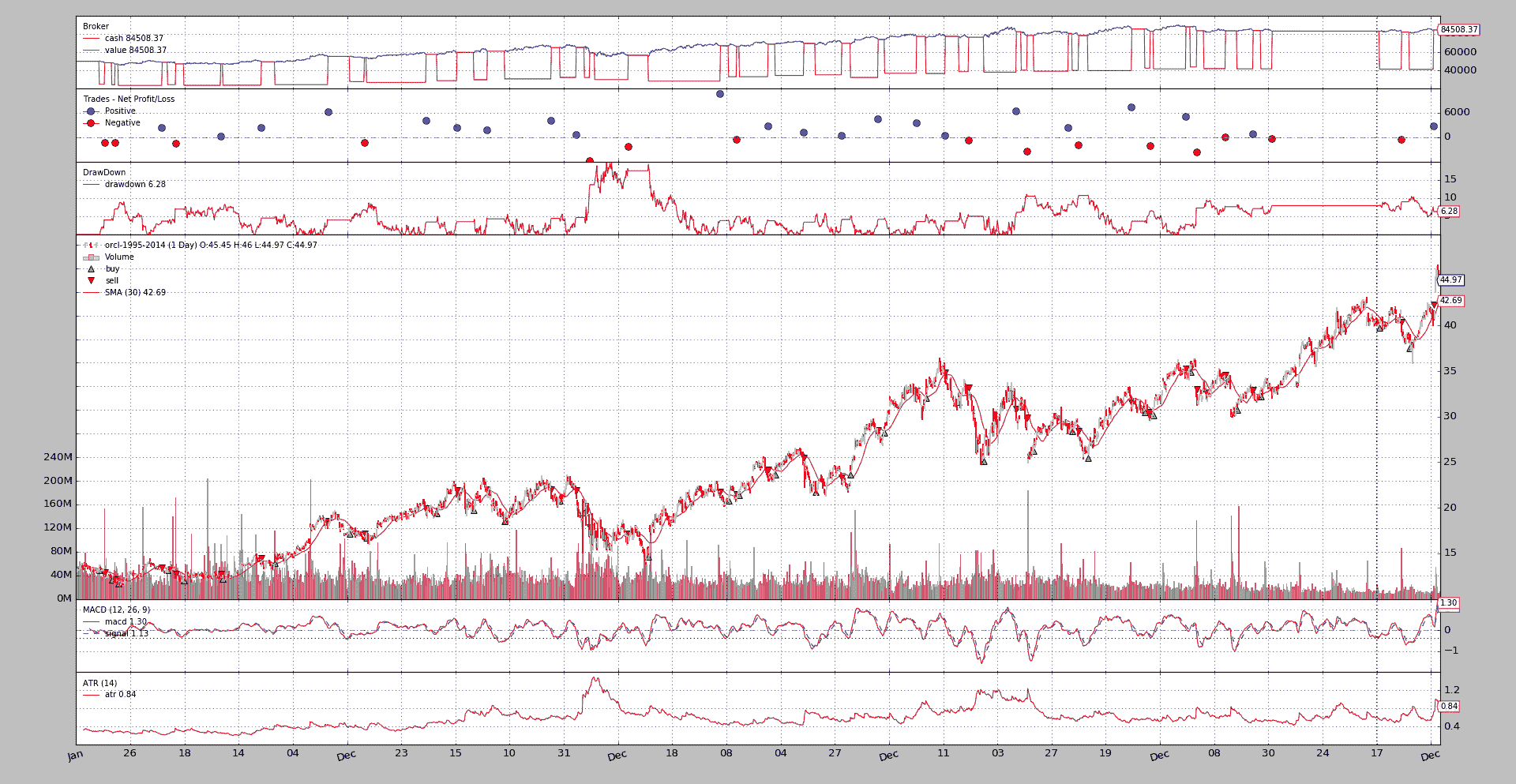

奥克尔

$ ./macdsystem.py --plot --dataset orcl

===============================================================================

TimeReturn:

- 9999-12-31 23:59:59.999999: 0.24890384718

===============================================================================

TimeReturn:

- 9999-12-31 23:59:59.999999: 2.23991354467

===============================================================================

TimeReturn:

- 2005-12-31: -0.02372911952

- 2006-12-31: 0.0692563226579

- 2007-12-31: 0.0551086853554

- 2008-12-31: -0.026707886256

- 2009-12-31: 0.0786118091383

- 2010-12-31: 0.037571919146

- 2011-12-31: 0.00846519206845

- 2012-12-31: 0.0402937469005

- 2013-12-31: -0.0147124502187

- 2014-12-31: 0.00710131291379

===============================================================================

SharpeRatio:

- sharperatio: 0.359712552054

===============================================================================

SQN:

- sqn: 1.76240859868

- trades: 37

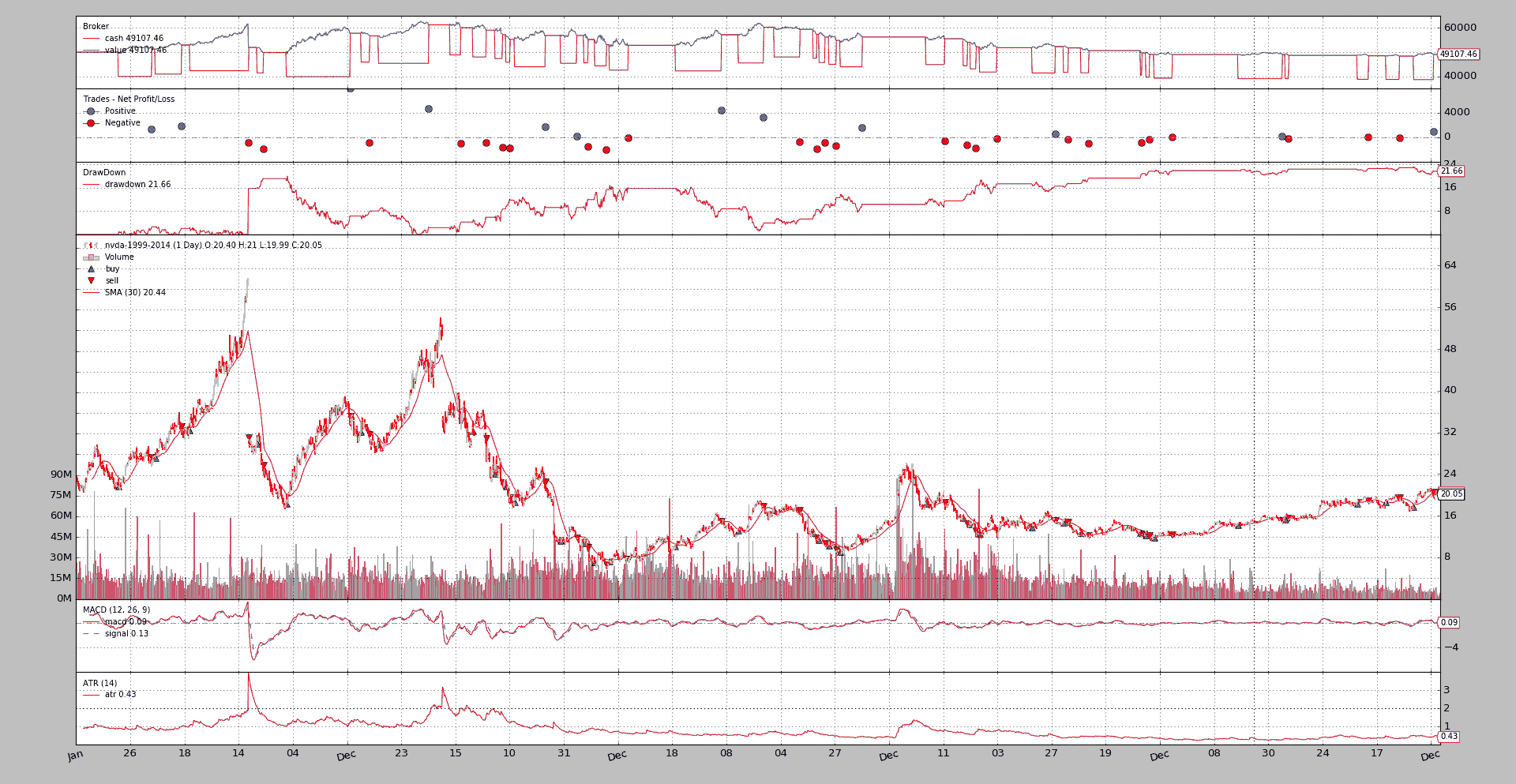

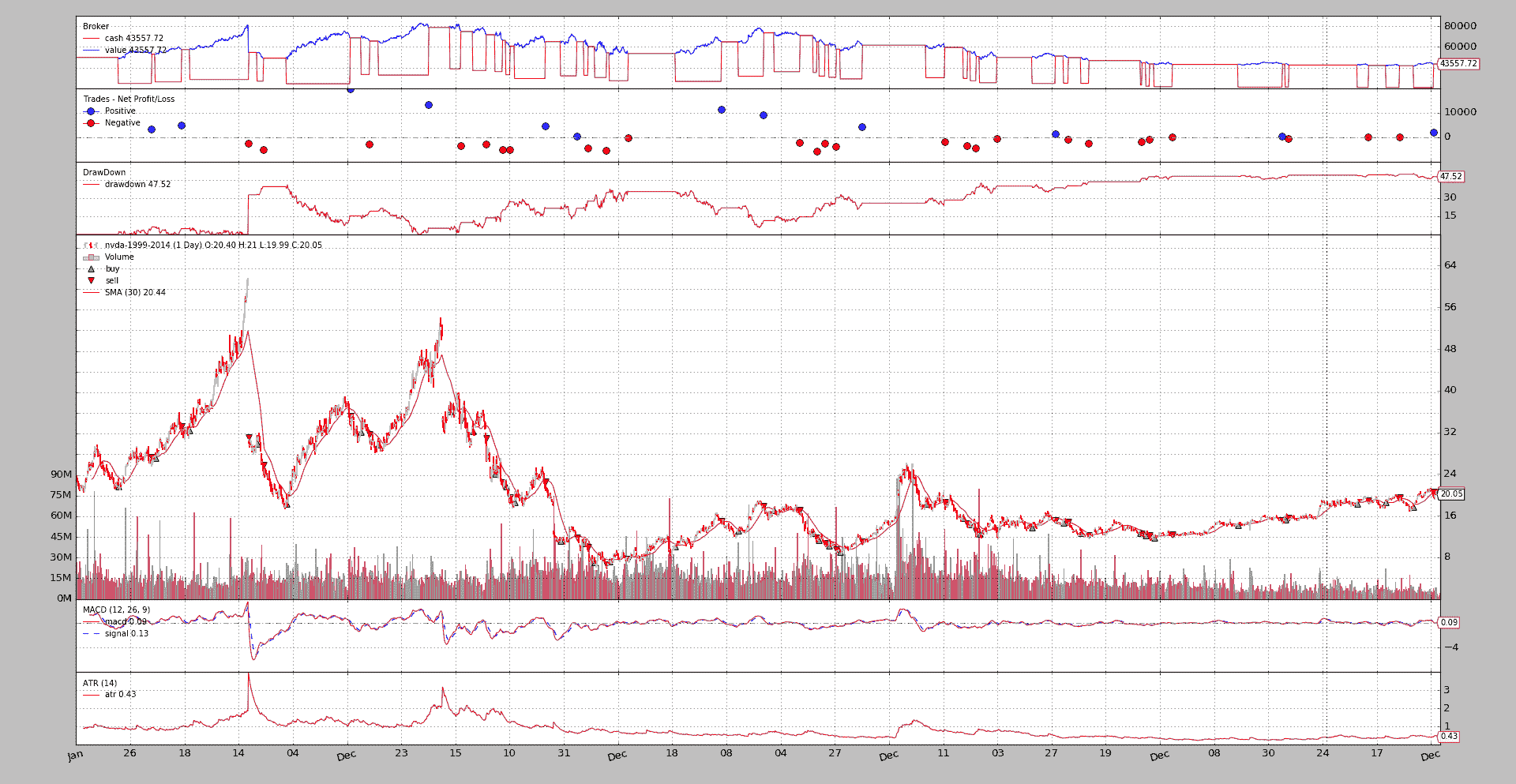

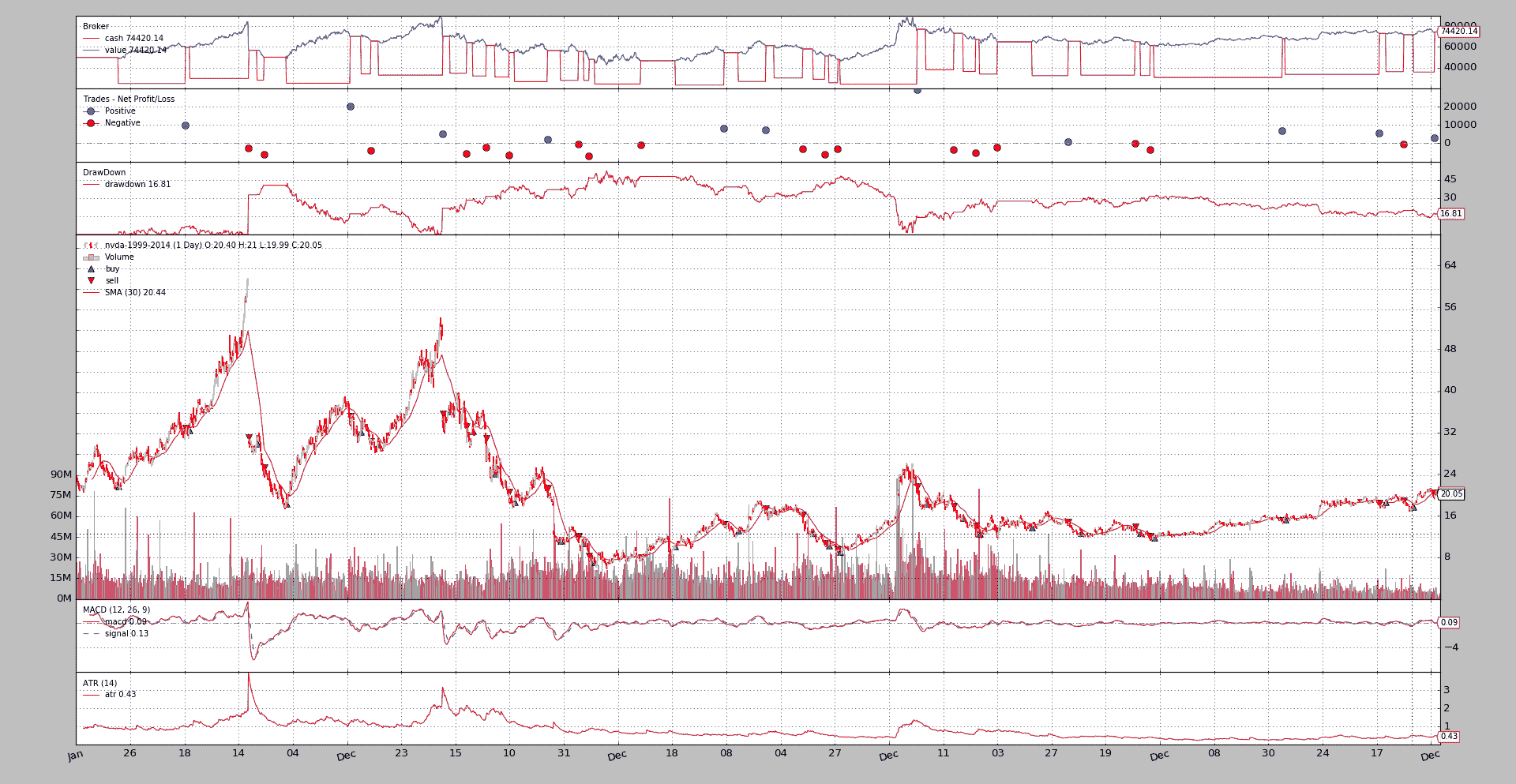

NVDA

$ ./macdsystem.py --plot --dataset nvda

===============================================================================

TimeReturn:

- 9999-12-31 23:59:59.999999: -0.0178507058999

===============================================================================

TimeReturn:

- 9999-12-31 23:59:59.999999: -0.177604931253

===============================================================================

TimeReturn:

- 2005-12-31: 0.0773031957141

- 2006-12-31: 0.105007457325

- 2007-12-31: 0.015286423657

- 2008-12-31: -0.109130552525

- 2009-12-31: 0.14716076542

- 2010-12-31: -0.0891638005423

- 2011-12-31: -0.0788216550171

- 2012-12-31: -0.0498231953066

- 2013-12-31: -0.0119166712361

- 2014-12-31: 0.00940493597076

===============================================================================

SharpeRatio:

- sharperatio: -0.102967601564

===============================================================================

SQN:

- sqn: -0.0700412395071

- trades: 38

运行 1 的分析

-

YHOO

1st和 2nd

TimeReturn分析工具(策略和资产本身)表明,策略已失去7.11%,而相关资产已升值31.67%。甚至不值得看一看其他分析仪

-

ORCL

A

24.89%用于战略,但资产本身的223.99%回报使其黯然失色。位于

0.35的夏普拉蒂奥距离通常的最低目标1仍然很远。SQN返回一个

1.76,该1.76至少在Van K.Tharp量表1.6 - 1.9 Below Average中获得一个等级。 -

NVDA

在这种情况下,a

-1.78%表示策略,a-17.76%表示资产。带有-0.10的 SharpeRatio 表明,即使该策略的表现优于该资产,也最好使用1%银行账户。SQN显然不在量表的底部。

运行 1 的结论

- 1 重大损失,一场平局,一场胜利,表现逊于资产。没有那么成功。

运行 2:cashaloc 到 0.50

YHOO

$ ./macdsystem.py --plot --dataset yhoo --cashalloc 0.50

===============================================================================

TimeReturn:

- 9999-12-31 23:59:59.999999: -0.20560369198

===============================================================================

TimeReturn:

- 9999-12-31 23:59:59.999999: 0.316736183525

===============================================================================

TimeReturn:

- 2005-12-31: 0.05517338686

- 2006-12-31: -0.195123836162

- 2007-12-31: -0.0441556438731

- 2008-12-31: -0.32426212721

- 2009-12-31: 0.153876836394

- 2010-12-31: 0.0167157437151

- 2011-12-31: -0.0202891373759

- 2012-12-31: 0.13289763017

- 2013-12-31: 0.0408192946307

- 2014-12-31: 0.0685527133815

===============================================================================

SharpeRatio:

- sharperatio: -0.154427699146

===============================================================================

SQN:

- sqn: -0.97846453428

- trades: 45

奥克尔

$ ./macdsystem.py --plot --dataset orcl --cashalloc 0.50

===============================================================================

TimeReturn:

- 9999-12-31 23:59:59.999999: 0.69016747856

===============================================================================

TimeReturn:

- 9999-12-31 23:59:59.999999: 2.23991354467

===============================================================================

TimeReturn:

- 2005-12-31: -0.0597533502

- 2006-12-31: 0.176988400688

- 2007-12-31: 0.140268851352

- 2008-12-31: -0.0685193675128

- 2009-12-31: 0.195760054561

- 2010-12-31: 0.0956386594392

- 2011-12-31: 0.018709882089

- 2012-12-31: 0.100122407053

- 2013-12-31: -0.0375741196261

- 2014-12-31: 0.017570390931

===============================================================================

SharpeRatio:

- sharperatio: 0.518921692742

===============================================================================

SQN:

- sqn: 1.68844251174

- trades: 37

NVDA

$ ./macdsystem.py --plot --dataset nvda --cashalloc 0.50

===============================================================================

TimeReturn:

- 9999-12-31 23:59:59.999999: -0.128845648113

===============================================================================

TimeReturn:

- 9999-12-31 23:59:59.999999: -0.177604931253

===============================================================================

TimeReturn:

- 2005-12-31: 0.200593209479

- 2006-12-31: 0.219254906522

- 2007-12-31: 0.0407793562989

- 2008-12-31: -0.259567975403

- 2009-12-31: 0.380971100974

- 2010-12-31: -0.208860409742

- 2011-12-31: -0.189068154062

- 2012-12-31: -0.122095056225

- 2013-12-31: -0.0296495770432

- 2014-12-31: 0.0232050942344

===============================================================================

SharpeRatio:

- sharperatio: -0.0222780544339

===============================================================================

SQN:

- sqn: -0.190661428812

- trades: 38

运行 2 的结论

-

将每次操作中的现金分配百分比从

20%增加到50%增加了先前结果的影响-

YHOO和NVDA上的策略比以前损失更多

-

而ORCL上的策略比以前赢了更多,仍然没有接近资产的220%以上。

-

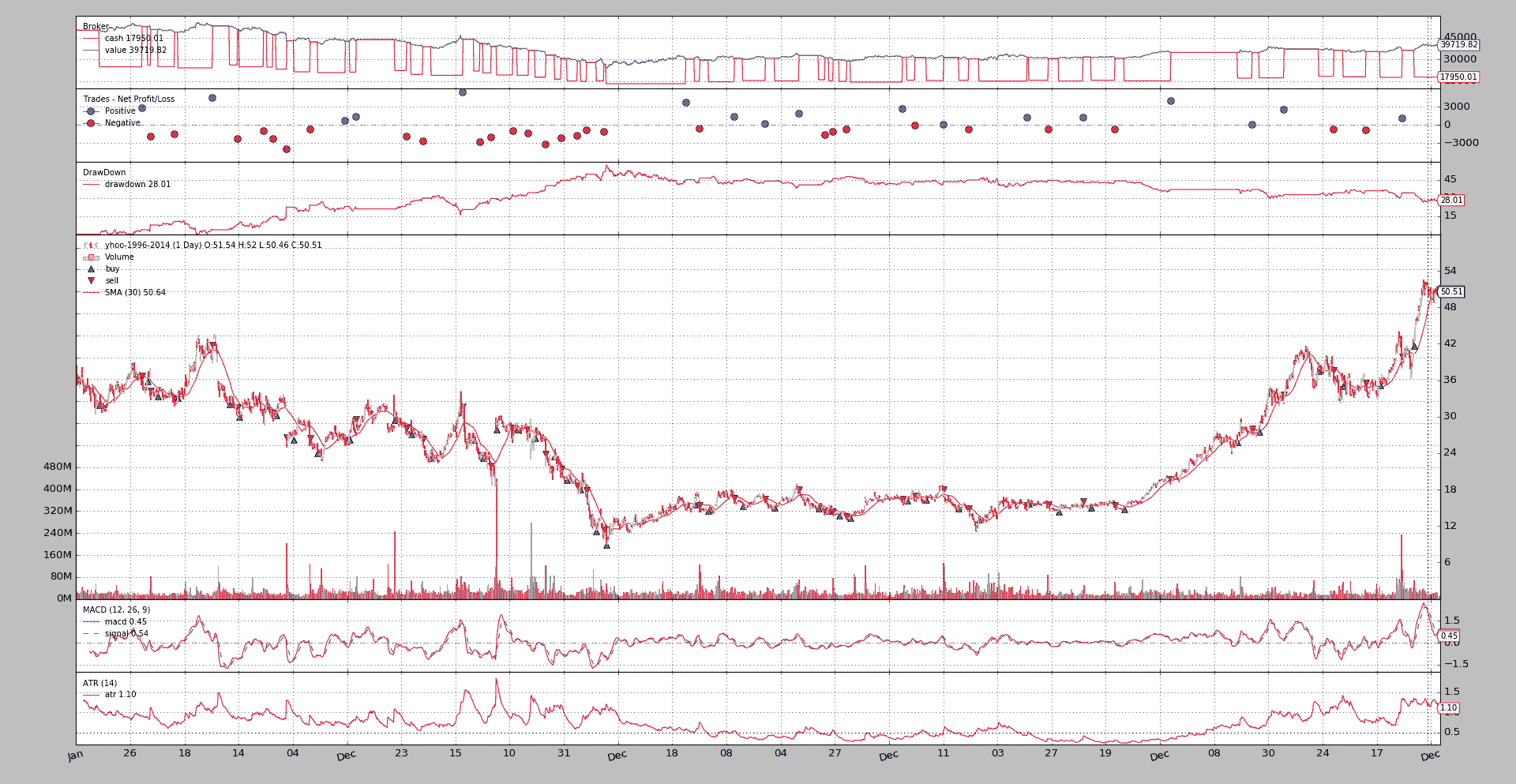

运行 3:ATR 距离到 4.0

仍将之前增加的现金分配保持在50%。这样做是为了避免过早退出市场。

YHOO

$ ./macdsystem.py --plot --dataset yhoo --cashalloc 0.50 --atrdist 4.0

===============================================================================

TimeReturn:

- 9999-12-31 23:59:59.999999: 0.01196310622

===============================================================================

TimeReturn:

- 9999-12-31 23:59:59.999999: 0.316736183525

===============================================================================

TimeReturn:

- 2005-12-31: 0.06476232676

- 2006-12-31: -0.220219327475

- 2007-12-31: -0.0525484648039

- 2008-12-31: -0.314772526784

- 2009-12-31: 0.179631995594

- 2010-12-31: 0.0579495723922

- 2011-12-31: -0.0248948026947

- 2012-12-31: 0.10922621981

- 2013-12-31: 0.406711050602

- 2014-12-31: -0.0113108751022

===============================================================================

SharpeRatio:

- sharperatio: 0.0495181271704

===============================================================================

SQN:

- sqn: -0.211652416441

- trades: 33

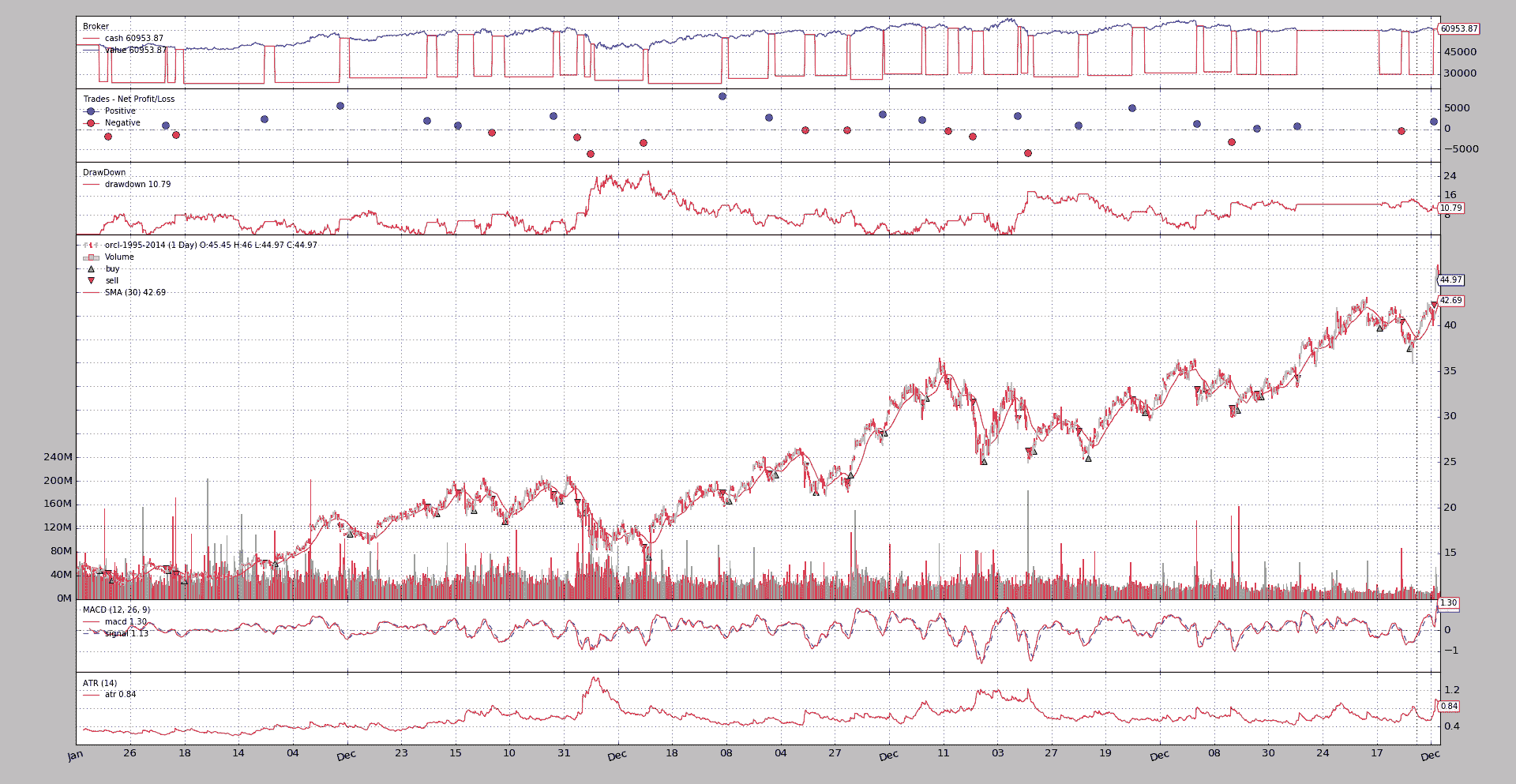

奥克尔

$ ./macdsystem.py --plot --dataset orcl --cashalloc 0.50 --atrdist 4.0

===============================================================================

TimeReturn:

- 9999-12-31 23:59:59.999999: 0.21907748452

===============================================================================

TimeReturn:

- 9999-12-31 23:59:59.999999: 2.23991354467

===============================================================================

TimeReturn:

- 2005-12-31: -0.06660102614

- 2006-12-31: 0.169334910265

- 2007-12-31: 0.10620478758

- 2008-12-31: -0.167615289704

- 2009-12-31: 0.17616784045

- 2010-12-31: 0.0591200431984

- 2011-12-31: -0.100238247103

- 2012-12-31: 0.135096589522

- 2013-12-31: -0.0630483842399

- 2014-12-31: 0.0175914485158

===============================================================================

SharpeRatio:

- sharperatio: 0.144210776122

===============================================================================

SQN:

- sqn: 0.646519270815

- trades: 30

NVDA

$ ./macdsystem.py --plot --dataset nvda --cashalloc 0.50 --atrdist 4.0

===============================================================================

TimeReturn:

- 9999-12-31 23:59:59.999999: 0.48840287049

===============================================================================

TimeReturn:

- 9999-12-31 23:59:59.999999: -0.177604931253

===============================================================================

TimeReturn:

- 2005-12-31: 0.246510998277

- 2006-12-31: 0.194958106054

- 2007-12-31: -0.123140650516

- 2008-12-31: -0.246174938322

- 2009-12-31: 0.33121185861

- 2010-12-31: -0.0442212647256

- 2011-12-31: 0.0368388717861

- 2012-12-31: -0.048473112136

- 2013-12-31: 0.10657587649

- 2014-12-31: 0.0883112536534

===============================================================================

SharpeRatio:

- sharperatio: 0.264551262551

===============================================================================

SQN:

- sqn: 0.564151633588

- trades: 29

运行 3 的结论

-

鸡肉,鸡肉,赢家晚餐!!

该战略通过这三项资产赚钱

-

YHOO:

1.19%与资产本身的31.67%收益 -

ORCL:

21.90%对该资产的223.99%

在这种情况下,增加

ATRDist参数会减少运行 2之前在69.01%的返回- NVDA:资产的

48.84%对-17.76%。

令人惊讶的是,SharpeRatio和SQN正在告诉我们这一点

-

样本的使用

$ ./macdsystem.py --help

usage: macdsystem.py [-h] (--data DATA | --dataset {yhoo,orcl,nvda})

[--fromdate FROMDATE] [--todate TODATE] [--cash CASH]

[--cashalloc CASHALLOC] [--commperc COMMPERC]

[--macd1 MACD1] [--macd2 MACD2] [--macdsig MACDSIG]

[--atrperiod ATRPERIOD] [--atrdist ATRDIST]

[--smaperiod SMAPERIOD] [--dirperiod DIRPERIOD]

[--riskfreerate RISKFREERATE] [--plot [kwargs]]

Sample for Tharp example with MACD

optional arguments:

-h, --help show this help message and exit

--data DATA Specific data to be read in (default: None)

--dataset {yhoo,orcl,nvda}

Choose one of the predefined data sets (default: None)

--fromdate FROMDATE Starting date in YYYY-MM-DD format (default:

2005-01-01)

--todate TODATE Ending date in YYYY-MM-DD format (default: None)

--cash CASH Cash to start with (default: 50000)

--cashalloc CASHALLOC

Perc (abs) of cash to allocate for ops (default: 0.2)

--commperc COMMPERC Perc (abs) commision in each operation. 0.001 -> 0.1%,

0.01 -> 1% (default: 0.0033)

--macd1 MACD1 MACD Period 1 value (default: 12)

--macd2 MACD2 MACD Period 2 value (default: 26)

--macdsig MACDSIG MACD Signal Period value (default: 9)

--atrperiod ATRPERIOD

ATR Period To Consider (default: 14)

--atrdist ATRDIST ATR Factor for stop price calculation (default: 3.0)

--smaperiod SMAPERIOD

Period for the moving average (default: 30)

--dirperiod DIRPERIOD

Period for SMA direction calculation (default: 10)

--riskfreerate RISKFREERATE

Risk free rate in Perc (abs) of the asset for the

Sharpe Ratio (default: 0.01)

--plot [kwargs], -p [kwargs]

Plot the read data applying any kwargs passed For

example: --plot style="candle" (to plot candles)

(default: None)

还有代码本身

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import argparse

import datetime

import random

import backtrader as bt

BTVERSION = tuple(int(x) for x in bt.__version__.split('.'))

class FixedPerc(bt.Sizer):

'''This sizer simply returns a fixed size for any operation

Params:

- ``perc`` (default: ``0.20``) Perc of cash to allocate for operation

'''

params = (

('perc', 0.20), # perc of cash to use for operation

)

def _getsizing(self, comminfo, cash, data, isbuy):

cashtouse = self.p.perc * cash

if BTVERSION > (1, 7, 1, 93):

size = comminfo.getsize(data.close[0], cashtouse)

else:

size = cashtouse // data.close[0]

return size

class TheStrategy(bt.Strategy):

'''

This strategy is loosely based on some of the examples from the Van

K. Tharp book: *Trade Your Way To Financial Freedom*. The logic:

- Enter the market if:

- The MACD.macd line crosses the MACD.signal line to the upside

- The Simple Moving Average has a negative direction in the last x

periods (actual value below value x periods ago)

- Set a stop price x times the ATR value away from the close

- If in the market:

- Check if the current close has gone below the stop price. If yes,

exit.

- If not, update the stop price if the new stop price would be higher

than the current

'''

params = (

# Standard MACD Parameters

('macd1', 12),

('macd2', 26),

('macdsig', 9),

('atrperiod', 14), # ATR Period (standard)

('atrdist', 3.0), # ATR distance for stop price

('smaperiod', 30), # SMA Period (pretty standard)

('dirperiod', 10), # Lookback period to consider SMA trend direction

)

def notify_order(self, order):

if order.status == order.Completed:

pass

if not order.alive():

self.order = None # indicate no order is pending

def __init__(self):

self.macd = bt.indicators.MACD(self.data,

period_me1=self.p.macd1,

period_me2=self.p.macd2,

period_signal=self.p.macdsig)

# Cross of macd.macd and macd.signal

self.mcross = bt.indicators.CrossOver(self.macd.macd, self.macd.signal)

# To set the stop price

self.atr = bt.indicators.ATR(self.data, period=self.p.atrperiod)

# Control market trend

self.sma = bt.indicators.SMA(self.data, period=self.p.smaperiod)

self.smadir = self.sma - self.sma(-self.p.dirperiod)

def start(self):

self.order = None # sentinel to avoid operrations on pending order

def next(self):

if self.order:

return # pending order execution

if not self.position: # not in the market

if self.mcross[0] > 0.0 and self.smadir < 0.0:

self.order = self.buy()

pdist = self.atr[0] * self.p.atrdist

self.pstop = self.data.close[0] - pdist

else: # in the market

pclose = self.data.close[0]

pstop = self.pstop

if pclose < pstop:

self.close() # stop met - get out

else:

pdist = self.atr[0] * self.p.atrdist

# Update only if greater than

self.pstop = max(pstop, pclose - pdist)

DATASETS = {

'yhoo': '../../datas/yhoo-1996-2014.txt',

'orcl': '../../datas/orcl-1995-2014.txt',

'nvda': '../../datas/nvda-1999-2014.txt',

}

def runstrat(args=None):

args = parse_args(args)

cerebro = bt.Cerebro()

cerebro.broker.set_cash(args.cash)

comminfo = bt.commissions.CommInfo_Stocks_Perc(commission=args.commperc,

percabs=True)

cerebro.broker.addcommissioninfo(comminfo)

dkwargs = dict()

if args.fromdate is not None:

fromdate = datetime.datetime.strptime(args.fromdate, '%Y-%m-%d')

dkwargs['fromdate'] = fromdate

if args.todate is not None:

todate = datetime.datetime.strptime(args.todate, '%Y-%m-%d')

dkwargs['todate'] = todate

# if dataset is None, args.data has been given

dataname = DATASETS.get(args.dataset, args.data)

data0 = bt.feeds.YahooFinanceCSVData(dataname=dataname, **dkwargs)

cerebro.adddata(data0)

cerebro.addstrategy(TheStrategy,

macd1=args.macd1, macd2=args.macd2,

macdsig=args.macdsig,

atrperiod=args.atrperiod,

atrdist=args.atrdist,

smaperiod=args.smaperiod,

dirperiod=args.dirperiod)

cerebro.addsizer(FixedPerc, perc=args.cashalloc)

# Add TimeReturn Analyzers for self and the benchmark data

cerebro.addanalyzer(bt.analyzers.TimeReturn, _name='alltime_roi',

timeframe=bt.TimeFrame.NoTimeFrame)

cerebro.addanalyzer(bt.analyzers.TimeReturn, data=data0, _name='benchmark',

timeframe=bt.TimeFrame.NoTimeFrame)

# Add TimeReturn Analyzers fot the annuyl returns

cerebro.addanalyzer(bt.analyzers.TimeReturn, timeframe=bt.TimeFrame.Years)

# Add a SharpeRatio

cerebro.addanalyzer(bt.analyzers.SharpeRatio, timeframe=bt.TimeFrame.Years,

riskfreerate=args.riskfreerate)

# Add SQN to qualify the trades

cerebro.addanalyzer(bt.analyzers.SQN)

cerebro.addobserver(bt.observers.DrawDown) # visualize the drawdown evol

results = cerebro.run()

st0 = results[0]

for alyzer in st0.analyzers:

alyzer.print()

if args.plot:

pkwargs = dict(style='bar')

if args.plot is not True: # evals to True but is not True

npkwargs = eval('dict(' + args.plot + ')') # args were passed

pkwargs.update(npkwargs)

cerebro.plot(**pkwargs)

def parse_args(pargs=None):

parser = argparse.ArgumentParser(

formatter_class=argparse.ArgumentDefaultsHelpFormatter,

description='Sample for Tharp example with MACD')

group1 = parser.add_mutually_exclusive_group(required=True)

group1.add_argument('--data', required=False, default=None,

help='Specific data to be read in')

group1.add_argument('--dataset', required=False, action='store',

default=None, choices=DATASETS.keys(),

help='Choose one of the predefined data sets')

parser.add_argument('--fromdate', required=False,

default='2005-01-01',

help='Starting date in YYYY-MM-DD format')

parser.add_argument('--todate', required=False,

default=None,

help='Ending date in YYYY-MM-DD format')

parser.add_argument('--cash', required=False, action='store',

type=float, default=50000,

help=('Cash to start with'))

parser.add_argument('--cashalloc', required=False, action='store',

type=float, default=0.20,

help=('Perc (abs) of cash to allocate for ops'))

parser.add_argument('--commperc', required=False, action='store',

type=float, default=0.0033,

help=('Perc (abs) commision in each operation. '

'0.001 -> 0.1%%, 0.01 -> 1%%'))

parser.add_argument('--macd1', required=False, action='store',

type=int, default=12,

help=('MACD Period 1 value'))

parser.add_argument('--macd2', required=False, action='store',

type=int, default=26,

help=('MACD Period 2 value'))

parser.add_argument('--macdsig', required=False, action='store',

type=int, default=9,

help=('MACD Signal Period value'))

parser.add_argument('--atrperiod', required=False, action='store',

type=int, default=14,

help=('ATR Period To Consider'))

parser.add_argument('--atrdist', required=False, action='store',

type=float, default=3.0,

help=('ATR Factor for stop price calculation'))

parser.add_argument('--smaperiod', required=False, action='store',

type=int, default=30,

help=('Period for the moving average'))

parser.add_argument('--dirperiod', required=False, action='store',

type=int, default=10,

help=('Period for SMA direction calculation'))

parser.add_argument('--riskfreerate', required=False, action='store',

type=float, default=0.01,

help=('Risk free rate in Perc (abs) of the asset for '

'the Sharpe Ratio'))

# Plot options

parser.add_argument('--plot', '-p', nargs='?', required=False,

metavar='kwargs', const=True,

help=('Plot the read data applying any kwargs passed\n'

'\n'

'For example:\n'

'\n'

' --plot style="candle" (to plot candles)\n'))

if pargs is not None:

return parser.parse_args(pargs)

return parser.parse_args()

if __name__ == '__main__':

runstrat()