粉红鱼挑战赛

原文: https://www.backtrader.com/blog/posts/2016-07-29-pinkfish-challenge/pinkfish-challenge/

(样本和更改添加到 1.7.1.93 版)

一路上,反向交易者已经变得成熟,有了新的功能,当然还有复杂性。许多新功能是在用户提出请求、评论和问题后引入的。小挑战已经证明,大多数设计决策至少没有那么错误,即使有些事情本可以用许多其他方式完成,有时可能用更好的方式。

因此,这些小挑战似乎是为了测试平台对新的未计划和未预期情况的灵活性和适应性,而小鱼挑战是另一个挑战。pinkfish是另一个 Python 回溯测试框架(列在README中),可在pinkfish下找到。该网站包含需要解决的难题:

- “收盘买入”当天不允许“创下 20 天新高”

其中一个功能给出了平台如何操作的提示:

- 使用每日数据(vs 分钟或滴答数据)进行日内交易

此外,由于当时现有的回溯测试库的复杂性,作者被推迟了。对于反向交易者(当时还处于婴儿期)来说,这是否成立,是小粉鱼作者自己要回答的问题。

无 mod 解决方案

backtrader支持数据馈送过滤器和允许

breaking a *daily bar* in 2 parts to let people buy after having seen only the

opening price. The 2nd part of the day (high, low, close) is evaluated in a

2nd tick. This effectively achieves the *uses daily data (vs minute or tick

data) for intraday trading*.

此筛选器尝试在不涉及内置重放层的情况下执行完整的重放操作。

该过滤器的一个明显演变是,首先将每日酒吧分成 2 个酒吧(开放、高、低),然后是 2 个和完整酒吧(开放、高、低、关闭)。

收盘买入是通过发出以backtrader.Order.Close为执行类型的订单来实现的。

这在-no-replay提供的样本中。执行:

$ ./pinkfish-challenge.py --no-replay

部分输出:

...

0955,0478,0478,2006-11-22T00:00:00,27.51,28.56,27.29,28.49,16027900.00,0.00

High 28.56 > Highest 28.56

LAST 19 highs: array('d', [25.33, 25.6, 26.4, 26.7, 26.62, 26.6, 26.7, 26.7, 27.15, 27.25, 27.65, 27.5, 27.62, 27.5, 27.5, 27.33, 27.05, 27.04, 27.34])

-- BUY on date: 2006-11-22

-- BUY Completed on: 2006-11-22

-- BUY Price: 28.49

0956,0478,0478,2006-11-22T23:59:59.999989,27.51,28.56,27.29,28.49,32055800.00,0.00

...

它是有效的…

-

看完当天的 1st部分后(行:

0955 -

如果一个新的 20 天高点到位,将发出

Close指令 -

并且订单以当天第 2部分的收盘价执行(行:

0956收盘价为

28.49,这是策略中notify_order中的买入价

输出包含相当详细的部分,仅用于识别最后的20高点。样品销售也很快,让行为测试几次。但保持期可以用--sellafter N来更改,其中N是取消前要保持的条数(见末尾用法)

no mod解决方案的问题

这实际上不是一个回放解决方案,如果订单的执行类型从Close更改为Market就可以看出这一点。新的执行:

$ ./pinkfish-challenge.py --no-replay --market

现在,与上述同期的产量为:

...

0955,0478,0478,2006-11-22T00:00:00,27.51,28.56,27.29,28.49,16027900.00,0.00

High 28.56 > Highest 28.56

LAST 19 highs: array('d', [25.33, 25.6, 26.4, 26.7, 26.62, 26.6, 26.7, 26.7, 27.15, 27.25, 27.65, 27.5, 27.62, 27.5, 27.5, 27.33, 27.05, 27.04, 27.34])

-- BUY on date: 2006-11-22

-- BUY Completed on: 2006-11-22

-- BUY Price: 27.51

0956,0478,0478,2006-11-22T23:59:59.999989,27.51,28.56,27.29,28.49,32055800.00,0.00

...

而且问题很容易识别

-

由于市场指令采用的是第二和栏中的第 1个价格,即

27.51,不幸的是开盘,因此该指令的执行价格不是收盘价格,而是开盘价格当日价格,不再提供。这是因为过滤器不是真正的重放,而是将棒分成两部分,并进行软重放**

*## 正确的“mod”解决方案

还获得了选择收盘价的Market订单。

这包括:

-

一种过滤器,它将条分成两部分

-

与backtrader中提供的标准回放功能兼容

在这种情况下,第 2和条将仅由

close价格组成,即使显示屏显示完整的条,内部机器也只会将订单与勾号匹配

在backtrader中链接过滤器已经是可能的,但未考虑此用例:

-

从单个数据“心跳”中生成 2 个数据“心跳”

在这次挑战之前,它是关于让酒吧合并成更大的酒吧。

在考虑新的数据心跳之前,核心机构加载条中的一个小延伸允许过滤器将条的 2第部分添加到内部存储中,以便重新处理。因为它是一个扩展而不是修改,所以它没有影响。

这项挑战还使我们有机会:

-

再看看在反向交易者开头为

Close订单编写的早期代码。这里对几行和

if条件进行了修改,使匹配的Close订单更具逻辑性,如果可能的话,可以立即将其交付给系统(在交付匹配之前,大多数情况下会延迟 1 个小节,即使匹配到正确的小节)

这些变化之后有一件好事:

- 过滤器中的逻辑要简单得多,因为没有微妙的重播尝试。回放由回放过滤器完成。

断条 1st部分过滤器解剖:

-

复制传入的数据栏

-

复制为OHL条(无关闭)

-

将时间更改为日期+会话开始时间

-

移除部分音量(与过滤器参数closevol指定)

-

取消

OpenInterest(当天结束时提供) -

删除

close价格,替换为OHL的平均值 -

将条添加到内部堆栈中,以便下一个过滤器或策略立即处理(由重播过滤器接管)

断棒的 2nd部分解剖:

-

复制传入的数据栏

-

将 OHL 价格替换为

Close价格 -

将时间更改为日期+会期和时间

-

移除体积的另一部分(与过滤器参数closevol指定)

-

设置

OpenInterest -

将该条添加到内部隐藏中,作为下一个数据心跳进行延迟处理,而不是从数据中获取价格

守则:

# Make a copy of current data for ohlbar

ohlbar = [data.lines[i][0] for i in range(data.size())]

closebar = ohlbar[:] # Make a copy for the close

# replace close price with o-h-l average

ohlprice = ohlbar[data.Open] + ohlbar[data.High] + ohlbar[data.Low]

ohlbar[data.Close] = ohlprice / 3.0

vol = ohlbar[data.Volume] # adjust volume

ohlbar[data.Volume] = vohl = int(vol * (1.0 - self.p.closevol))

oi = ohlbar[data.OpenInterest] # adjust open interst

ohlbar[data.OpenInterest] = 0

# Adjust times

dt = datetime.datetime.combine(datadt, data.p.sessionstart)

ohlbar[data.DateTime] = data.date2num(dt)

# Adjust closebar to generate a single tick -> close price

closebar[data.Open] = cprice = closebar[data.Close]

closebar[data.High] = cprice

closebar[data.Low] = cprice

closebar[data.Volume] = vol - vohl

ohlbar[data.OpenInterest] = oi

# Adjust times

dt = datetime.datetime.combine(datadt, data.p.sessionend)

closebar[data.DateTime] = data.date2num(dt)

# Update stream

data.backwards(force=True) # remove the copied bar from stream

data._add2stack(ohlbar) # add ohlbar to stack

# Add 2nd part to stash to delay processing to next round

data._add2stack(closebar, stash=True)

return False # the length of the stream was not changed

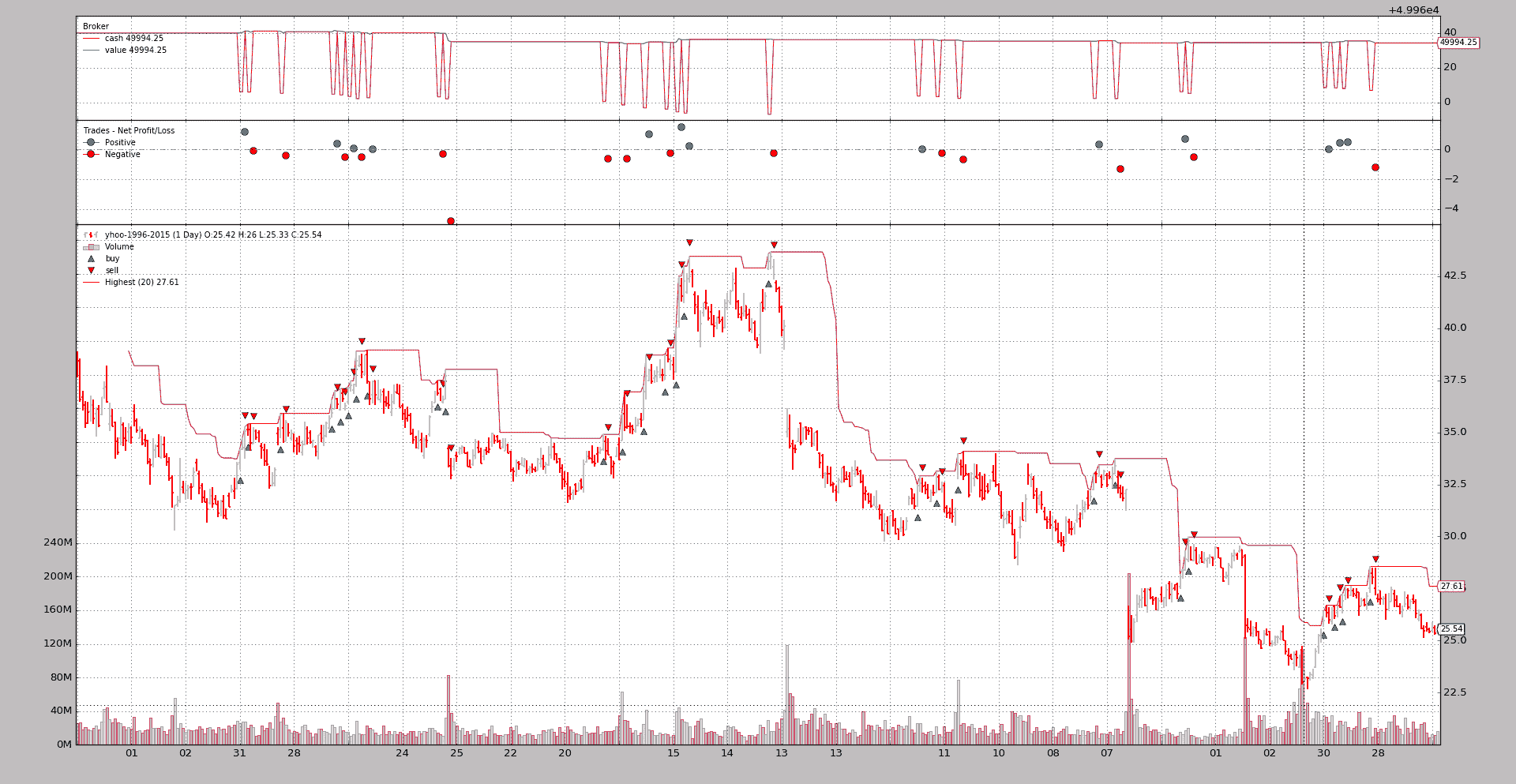

在不禁用回放和Close的情况下执行(让我们添加绘图):

$ ./pinkfish-challenge.py --plot

同期产量:

...

0955,0478,0478,2006-11-22T00:00:00,27.51,28.56,27.29,27.79,16027900.00,0.00

High 28.56 > Highest 28.56

LAST 19 highs: array('d', [25.33, 25.6, 26.4, 26.7, 26.62, 26.6, 26.7, 26.7, 27.15, 27.25, 27.65, 27.5, 27.62, 27.5, 27.5, 27.33, 27.05, 27.04, 27.34])

-- BUY on date: 2006-11-22

-- BUY Completed on: 2006-11-22

-- BUY Price: 28.49

0956,0478,0478,2006-11-22T23:59:59.999989,27.51,28.56,27.29,28.49,32055800.00,0.00

...

一切正常,28.49的收盘价已经取下。

还有图表。

最后但并非最不重要的是检查修改是否合理:

$ ./pinkfish-challenge.py --market

同期产量:

...

0955,0478,0478,2006-11-22T00:00:00,27.51,28.56,27.29,27.79,16027900.00,0.00

High 28.56 > Highest 28.56

LAST 19 highs: array('d', [25.33, 25.6, 26.4, 26.7, 26.62, 26.6, 26.7, 26.7, 27.15, 27.25, 27.65, 27.5, 27.62, 27.5, 27.5, 27.33, 27.05, 27.04, 27.34])

-- BUY on date: 2006-11-22

-- BUY Completed on: 2006-11-22

-- BUY Price: 28.49

0956,0478,0478,2006-11-22T23:59:59.999989,27.51,28.56,27.29,28.49,32055800.00,0.00

..

现在Market订单选择的28.49价格与Close订单的价格相同,在这个特定的用例中,这是预期的,因为重放正在发生,而破损的日线的第 2和部分有一个滴答28.49,这就是收盘价格

样本的使用

$ ./pinkfish-challenge.py --help

usage: pinkfish-challenge.py [-h] [--data DATA] [--fromdate FROMDATE]

[--todate TODATE] [--cash CASH]

[--sellafter SELLAFTER] [--highperiod HIGHPERIOD]

[--no-replay] [--market] [--oldbuysell]

[--plot [kwargs]]

Sample for pinkfish challenge

optional arguments:

-h, --help show this help message and exit

--data DATA Data to be read in (default:

../../datas/yhoo-1996-2015.txt)

--fromdate FROMDATE Starting date in YYYY-MM-DD format (default:

2005-01-01)

--todate TODATE Ending date in YYYY-MM-DD format (default: 2006-12-31)

--cash CASH Cash to start with (default: 50000)

--sellafter SELLAFTER

Sell after so many bars in market (default: 2)

--highperiod HIGHPERIOD

Period to look for the highest (default: 20)

--no-replay Use Replay + replay filter (default: False)

--market Use Market exec instead of Close (default: False)

--oldbuysell Old buysell plot behavior - ON THE PRICE (default:

False)

--plot [kwargs], -p [kwargs]

Plot the read data applying any kwargs passed For

example (escape the quotes if needed): --plot

style="candle" (to plot candles) (default: None)

还有代码本身

```py from future import (absolute_import, division, print_function, unicode_literals)

import argparse import datetime

import backtrader as bt import backtrader.indicators as btind

class DayStepsCloseFilter(bt.with_metaclass(bt.MetaParams, object)): ''' Replays a bar in 2 steps:

- In the 1st step the "Open-High-Low" could be evaluated to decide if to

act on the close (the close is still there ... should not be evaluated)

- If a "Close" order has been executed

In this 1st fragment the "Close" is replaced through the "open" althoug

other alternatives would be possible like high - low average, or an

algorithm based on where the "close" ac

and

- Open-High-Low-Close

'''

params = (

('cvol', 0.5), # 0 -> 1 amount of volume to keep for close

)

def __init__(self, data):

self.pendingbar = None

def __call__(self, data):

# Make a copy of the new bar and remove it from stream

closebar = [data.lines[i][0] for i in range(data.size())]

datadt = data.datetime.date() # keep the date

ohlbar = closebar[:] # Make an open-high-low bar

# Adjust volume

ohlbar[data.Volume] = int(closebar[data.Volume] * (1.0 - self.p.cvol))

dt = datetime.datetime.combine(datadt, data.p.sessionstart)

ohlbar[data.DateTime] = data.date2num(dt)

dt = datetime.datetime.combine(datadt, data.p.sessionend)

closebar[data.DateTime] = data.date2num(dt)

# Update stream

data.backwards() # remove the copied bar from stream

# Overwrite the new data bar with our pending data - except start point

if self.pendingbar is not None:

data._updatebar(self.pendingbar)

self.pendingbar = closebar # update the pending bar to the new bar

data._add2stack(ohlbar) # Add the openbar to the stack for processing

return False # the length of the stream was not changed

def last(self, data):

'''Called when the data is no longer producing bars

Can be called multiple times. It has the chance to (for example)

produce extra bars'''

if self.pendingbar is not None:

data.backwards() # remove delivered open bar

data._add2stack(self.pendingbar) # add remaining

self.pendingbar = None # No further action

return True # something delivered

return False # nothing delivered here

class DayStepsReplayFilter(bt.with_metaclass(bt.MetaParams, object)): ''' Replays a bar in 2 steps:

- In the 1st step the "Open-High-Low" could be evaluated to decide if to

act on the close (the close is still there ... should not be evaluated)

- If a "Close" order has been executed

In this 1st fragment the "Close" is replaced through the "open" althoug

other alternatives would be possible like high - low average, or an

algorithm based on where the "close" ac

and

- Open-High-Low-Close

'''

params = (

('closevol', 0.5), # 0 -> 1 amount of volume to keep for close

)

# replaying = True

def __init__(self, data):

self.lastdt = None

pass

def __call__(self, data):

# Make a copy of the new bar and remove it from stream

datadt = data.datetime.date() # keep the date

if self.lastdt == datadt:

return False # skip bars that come again in the filter

self.lastdt = datadt # keep ref to last seen bar

# Make a copy of current data for ohlbar

ohlbar = [data.lines[i][0] for i in range(data.size())]

closebar = ohlbar[:] # Make a copy for the close

# replace close price with o-h-l average

ohlprice = ohlbar[data.Open] + ohlbar[data.High] + ohlbar[data.Low]

ohlbar[data.Close] = ohlprice / 3.0

vol = ohlbar[data.Volume] # adjust volume

ohlbar[data.Volume] = vohl = int(vol * (1.0 - self.p.closevol))

oi = ohlbar[data.OpenInterest] # adjust open interst

ohlbar[data.OpenInterest] = 0

# Adjust times

dt = datetime.datetime.combine(datadt, data.p.sessionstart)

ohlbar[data.DateTime] = data.date2num(dt)

# Adjust closebar to generate a single tick -> close price

closebar[data.Open] = cprice = closebar[data.Close]

closebar[data.High] = cprice

closebar[data.Low] = cprice

closebar[data.Volume] = vol - vohl

ohlbar[data.OpenInterest] = oi

# Adjust times

dt = datetime.datetime.combine(datadt, data.p.sessionend)

closebar[data.DateTime] = data.date2num(dt)

# Update stream

data.backwards(force=True) # remove the copied bar from stream

data._add2stack(ohlbar) # add ohlbar to stack

# Add 2nd part to stash to delay processing to next round

data._add2stack(closebar, stash=True)

return False # the length of the stream was not changed

class St(bt.Strategy): params = ( ('highperiod', 20), ('sellafter', 2), ('market', False), )

def __init__(self):

pass

def start(self):

self.callcounter = 0

txtfields = list()

txtfields.append('Calls')

txtfields.append('Len Strat')

txtfields.append('Len Data')

txtfields.append('Datetime')

txtfields.append('Open')

txtfields.append('High')

txtfields.append('Low')

txtfields.append('Close')

txtfields.append('Volume')

txtfields.append('OpenInterest')

print(','.join(txtfields))

self.lcontrol = 0 # control if 1st or 2nd call

self.inmarket = 0

# Get the highest but delayed 1 ... to avoid "today"

self.highest = btind.Highest(self.data.high,

period=self.p.highperiod,

subplot=False)

def notify_order(self, order):

if order.isbuy() and order.status == order.Completed:

print('-- BUY Completed on:',

self.data.num2date(order.executed.dt).strftime('%Y-%m-%d'))

print('-- BUY Price:', order.executed.price)

def next(self):

self.callcounter += 1

txtfields = list()

txtfields.append('%04d' % self.callcounter)

txtfields.append('%04d' % len(self))

txtfields.append('%04d' % len(self.data0))

txtfields.append(self.data.datetime.datetime(0).isoformat())

txtfields.append('%.2f' % self.data0.open[0])

txtfields.append('%.2f' % self.data0.high[0])

txtfields.append('%.2f' % self.data0.low[0])

txtfields.append('%.2f' % self.data0.close[0])

txtfields.append('%.2f' % self.data0.volume[0])

txtfields.append('%.2f' % self.data0.openinterest[0])

print(','.join(txtfields))

if not self.position:

if len(self.data) > self.lcontrol:

if self.data.high == self.highest: # today is highest!!!

print('High %.2f > Highest %.2f' %

(self.data.high[0], self.highest[0]))

print('LAST 19 highs:',

self.data.high.get(size=19, ago=-1))

print('-- BUY on date:',

self.data.datetime.date().strftime('%Y-%m-%d'))

ex = bt.Order.Market if self.p.market else bt.Order.Close

self.buy(exectype=ex)

self.inmarket = len(self) # reset period in market

else: # in the market

if (len(self) - self.inmarket) >= self.p.sellafter:

self.sell()

self.lcontrol = len(self.data)

def runstrat(): args = parse_args()

cerebro = bt.Cerebro()

cerebro.broker.set_cash(args.cash)

cerebro.broker.set_eosbar(True)

dkwargs = dict()

if args.fromdate:

fromdate = datetime.datetime.strptime(args.fromdate, '%Y-%m-%d')

dkwargs['fromdate'] = fromdate

if args.todate:

todate = datetime.datetime.strptime(args.todate, '%Y-%m-%d')

dkwargs['todate'] = todate

if args.no_replay:

data = bt.feeds.YahooFinanceCSVData(dataname=args.data,

timeframe=bt.TimeFrame.Days,

compression=1,

**dkwargs)

data.addfilter(DayStepsCloseFilter)

cerebro.adddata(data)

else:

data = bt.feeds.YahooFinanceCSVData(dataname=args.data,

timeframe=bt.TimeFrame.Minutes,

compression=1,

**dkwargs)

data.addfilter(DayStepsReplayFilter)

cerebro.replaydata(data, timeframe=bt.TimeFrame.Days, compression=1)

cerebro.addstrategy(St,

sellafter=args.sellafter,

highperiod=args.highperiod,

market=args.market)

cerebro.run(runonce=False, preload=False, oldbuysell=args.oldbuysell)

if args.plot:

pkwargs = dict(style='bar')

if args.plot is not True: # evals to True but is not True

npkwargs = eval('dict(' + args.plot + ')') # args were passed

pkwargs.update(npkwargs)

cerebro.plot(**pkwargs)

def parse_args(pargs=None):

parser = argparse.ArgumentParser(

formatter_class=argparse.ArgumentDefaultsHelpFormatter,

description='Sample for pinkfish challenge')

parser.add_argument('--data', required=False,

default='../../datas/yhoo-1996-2015.txt',

help='Data to be read in')

parser.add_argument('--fromdate', required=False,

default='2005-01-01',

help='Starting date in YYYY-MM-DD format')

parser.add_argument('--todate', required=False,

default='2006-12-31',

help='Ending date in YYYY-MM-DD format')

parser.add_argument('--cash', required=False, action='store',

type=float, default=50000,

help=('Cash to start with'))

parser.add_argument('--sellafter', required=False, action='store',

type=int, default=2,

help=('Sell after so many bars in market'))

parser.add_argument('--highperiod', required=False, action='store',

type=int, default=20,

help=('Period to look for the highest'))

parser.add_argument('--no-replay', required=False, action='store_true',

help=('Use Replay + replay filter'))

parser.add_argument('--market', required=False, action='store_true',

help=('Use Market exec instead of Close'))

parser.add_argument('--oldbuysell', required=False, action='store_true',

help=('Old buysell plot behavior - ON THE PRICE'))

# Plot options

parser.add_argument('--plot', '-p', nargs='?', required=False,

metavar='kwargs', const=True,

help=('Plot the read data applying any kwargs passed\n'

'\n'

'For example (escape the quotes if needed):\n'

'\n'

' --plot style="candle" (to plot candles)\n'))

if pargs is not None:

return parser.parse_args(pargs)

return parser.parse_args()

if name == 'main': runstrat() ```*