直观图表实时数据/交易

原文: https://www.backtrader.com/blog/posts/2016-07-12-visualchart-feed/visualchart-feed/

从发行版1.5.1.93开始,backtrader 支持可视化图表实时提要和实时交易。

需要的东西:

-

视觉图表 6(此图表在 Windows 上运行)

-

comtypes,特别是这个叉子:https://github.com/mementum/comtypes安装时使用:

pip install https://github.com/mementum/comtypes/archive/master.zip可视化图表API 基于COM,当前

comtypes主分支不支持VT_RECORD的VT_ARRAYS解包。这是视觉图表使用的拉取请求已提交但尚未集成。一旦集成,就可以使用主分支。

-

pytz(可选,但强烈推荐)在许多情况下,数据馈送提供的内部

SymbolInfo.TimeOffset足以在市场时间返回数据馈送(即使默认配置为视觉图表中的LocalTime)

如果您不知道什么是视觉图表和/或其当前的关联经纪人Esfera Capital,请访问以下网站:

初始声明:

-

和往常一样,在冒险之前,测试、测试、测试和再测试一千次。

从本软件中的错误到您自己的软件中的错误以及意外情况的管理:任何事情都可能出错

关于这一点,请注意:

-

数据馈送相当好,支持内置重采样。很好,因为不需要重新采样。

-

数据馈送不支持秒分辨率。不好,但可通过backtrader的内置重采样解决

-

回填是内置的

-

International Indices(交换096)市场上的一些产品具有奇数时区和市场补偿。一些工作已经进入这一阶段,例如在预期的

US/Eastern时区交付096.DJI -

数据提要提供了连续期货,这对于拥有大量历史非常方便。

因此,可以将第二个参数传递给数据,以指示哪一个是实际交易资产。

-

有效截止日期订单的日期时间只能指定为日期。忽略时间分量。

-

没有直接的方法可以找到从本地设备到数据服务器的偏移量,需要一种启发式方法来从会话开始时的实时信号中找到这一点。

-

传递带有时间组件的日期时间(而不是默认的00:00:00)似乎在COMAPI 中创建了一个时间过滤器。例如,如果你说你想要分钟数据,从 3 天前14:30开始,你可以:

```py dt = datetime.now() - timedelta(days=3) dt.replace(hour=14, minute=30)

vcstore.getdata(dataname='001ES', fromdate=dt) ```

然后,数据被跳过,直到14:30,不仅在之前,而且在之后的每一天

因此,请仅传递完整日期,因为默认时间组件未被触及。

-

经纪人支持头寸的概念,但仅当它们未平仓时。关于位置(即大小为 0的位置)的最后一个事件未发送。

因此,头寸的核算完全由反向交易者完成

-

经纪人不报告佣金。

解决方法是在实例化代理时提供您自己的

CommissionInfo派生类。请参阅backtader文档以创建您自己的类。这相当容易。 -

CancelledvsExpired订单。这种区别是不存在的,需要一种启发式方法来消除这种区别。因此,仅报告

Cancelled

一些补充说明:

-

实时滴答声大多不使用。他们产生大量不必要的信息用于反向交易者目的。在被反向交易者完全断开之前,它们有两个主要用途

-

查找符号是否存在。

-

计算到数据服务器的偏移量

当然,这些信息是实时收集的价格信息,但来自于同时提供历史数据的数据源对象。

-

已尽可能多地记录在案,并可通过通常的文档链接获得:

从样本vctest.pye到视觉图表和演示代理的几次运行

第一个:015ES(EuroStoxx50连续),重采样至 1 分钟,具有断开和重新连接功能:

$ ./vctest.py --data0 015ES --timeframe Minutes --compression 1 --fromdate 2016-07-12

输出:

--------------------------------------------------

Strategy Created

--------------------------------------------------

Datetime, Open, High, Low, Close, Volume, OpenInterest, SMA

***** DATA NOTIF: CONNECTED

***** DATA NOTIF: DELAYED

0001, 2016-07-12T08:01:00.000000, 2871.0, 2872.0, 2869.0, 2872.0, 1915.0, 0.0, nan

0002, 2016-07-12T08:02:00.000000, 2872.0, 2872.0, 2870.0, 2871.0, 479.0, 0.0, nan

0003, 2016-07-12T08:03:00.000000, 2871.0, 2871.0, 2869.0, 2870.0, 518.0, 0.0, nan

0004, 2016-07-12T08:04:00.000000, 2870.0, 2871.0, 2870.0, 2871.0, 248.0, 0.0, nan

0005, 2016-07-12T08:05:00.000000, 2870.0, 2871.0, 2870.0, 2871.0, 234.0, 0.0, 2871.0

...

...

0639, 2016-07-12T18:39:00.000000, 2932.0, 2933.0, 2932.0, 2932.0, 1108.0, 0.0, 2932.8

0640, 2016-07-12T18:40:00.000000, 2931.0, 2932.0, 2931.0, 2931.0, 65.0, 0.0, 2932.6

***** DATA NOTIF: LIVE

0641, 2016-07-12T18:41:00.000000, 2932.0, 2932.0, 2930.0, 2930.0, 2093.0, 0.0, 2931.8

***** STORE NOTIF: (u'VisualChart is Disconnected', -65520)

***** DATA NOTIF: CONNBROKEN

***** STORE NOTIF: (u'VisualChart is Connected', -65521)

***** DATA NOTIF: CONNECTED

***** DATA NOTIF: DELAYED

0642, 2016-07-12T18:42:00.000000, 2931.0, 2931.0, 2931.0, 2931.0, 137.0, 0.0, 2931.2

0643, 2016-07-12T18:43:00.000000, 2931.0, 2931.0, 2931.0, 2931.0, 432.0, 0.0, 2931.0

...

0658, 2016-07-12T18:58:00.000000, 2929.0, 2929.0, 2929.0, 2929.0, 4.0, 0.0, 2930.0

0659, 2016-07-12T18:59:00.000000, 2929.0, 2930.0, 2929.0, 2930.0, 353.0, 0.0, 2930.0

***** DATA NOTIF: LIVE

0660, 2016-07-12T19:00:00.000000, 2930.0, 2930.0, 2930.0, 2930.0, 376.0, 0.0, 2930.0

0661, 2016-07-12T19:01:00.000000, 2929.0, 2930.0, 2929.0, 2930.0, 35.0, 0.0, 2929.8

笔记

已安装执行环境pytz

笔记

请注意缺少--resample:对于Minutes而言,重采样是内置的视觉图表

最后是一些交易,用单个Market订单购买015ES的2合同,然后分别以1合同的两个订单出售。

执行:

$ ./vctest.py --data0 015ES --timeframe Minutes --compression 1 --fromdate 2016-07-12 2>&1 --broker --account accname --trade --stake 2

输出相当详细,显示了订单执行的所有部分。总结一下:

--------------------------------------------------

Strategy Created

--------------------------------------------------

Datetime, Open, High, Low, Close, Volume, OpenInterest, SMA

***** DATA NOTIF: CONNECTED

***** DATA NOTIF: DELAYED

0001, 2016-07-12T08:01:00.000000, 2871.0, 2872.0, 2869.0, 2872.0, 1915.0, 0.0, nan

...

0709, 2016-07-12T19:50:00.000000, 2929.0, 2930.0, 2929.0, 2930.0, 11.0, 0.0, 2930.4

***** DATA NOTIF: LIVE

0710, 2016-07-12T19:51:00.000000, 2930.0, 2930.0, 2929.0, 2929.0, 134.0, 0.0, 2930.0

-------------------------------------------------- ORDER BEGIN 2016-07-12 19:52:01.629000

Ref: 1

OrdType: 0

OrdType: Buy

Status: 1

Status: Submitted

Size: 2

Price: None

Price Limit: None

ExecType: 0

ExecType: Market

CommInfo: <backtrader.brokers.vcbroker.VCCommInfo object at 0x000000001100CE10>

End of Session: 736157.916655

Info: AutoOrderedDict()

Broker: <backtrader.brokers.vcbroker.VCBroker object at 0x000000000475D400>

Alive: True

-------------------------------------------------- ORDER END

-------------------------------------------------- ORDER BEGIN 2016-07-12 19:52:01.629000

Ref: 1

OrdType: 0

OrdType: Buy

Status: 2

Status: Accepted

Size: 2

Price: None

Price Limit: None

ExecType: 0

ExecType: Market

CommInfo: <backtrader.brokers.vcbroker.VCCommInfo object at 0x000000001100CE10>

End of Session: 736157.916655

Info: AutoOrderedDict()

Broker: None

Alive: True

-------------------------------------------------- ORDER END

-------------------------------------------------- ORDER BEGIN 2016-07-12 19:52:01.629000

Ref: 1

OrdType: 0

OrdType: Buy

Status: 4

Status: Completed

Size: 2

Price: None

Price Limit: None

ExecType: 0

ExecType: Market

CommInfo: <backtrader.brokers.vcbroker.VCCommInfo object at 0x000000001100CE10>

End of Session: 736157.916655

Info: AutoOrderedDict()

Broker: None

Alive: False

-------------------------------------------------- ORDER END

-------------------------------------------------- TRADE BEGIN 2016-07-12 19:52:01.629000

ref:1

data:<backtrader.feeds.vcdata.VCData object at 0x000000000475D9E8>

tradeid:0

size:2.0

price:2930.0

value:5860.0

commission:0.0

pnl:0.0

pnlcomm:0.0

justopened:True

isopen:True

isclosed:0

baropen:710

dtopen:736157.74375

barclose:0

dtclose:0.0

barlen:0

historyon:False

history:[]

status:1

-------------------------------------------------- TRADE END

...

发生以下情况:

-

数据正常接收

-

针对执行类型为

Market的2发出BUY-

收到

Submitted和Accepted通知(以上仅显示Submitted) -

连续执行

Partial次(仅显示 1 次),直到收到Completed。

未显示实际执行情况,但在

order.executed下接收的order实例中可用 -

-

虽然未显示,但会发出 2 个

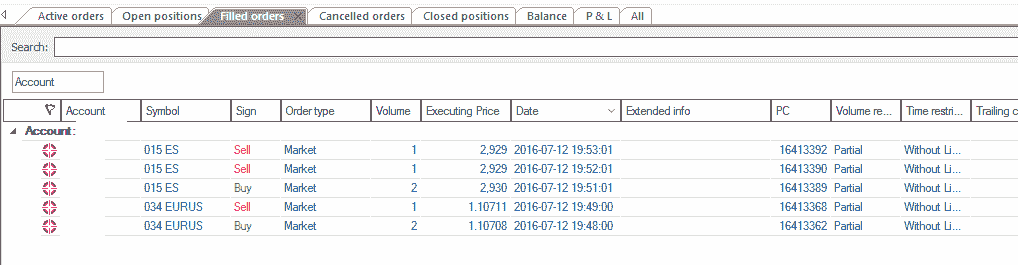

Market``SELL命令来撤消该操作屏幕截图显示了在

015ES(EuroStoxx 50)和034EURUS(欧元兑美元外汇对两次不同的运行后视觉图表中的日志

该样品可以做更多的工作,旨在对设施进行彻底测试,如果可能的话,可以发现任何粗糙的边缘。

用法:

$ ./vctest.py --help

usage: vctest.py [-h] [--exactbars EXACTBARS] [--plot] [--stopafter STOPAFTER]

[--nostore] [--qcheck QCHECK] [--no-timeoffset] --data0 DATA0

[--tradename TRADENAME] [--data1 DATA1] [--timezone TIMEZONE]

[--no-backfill_start] [--latethrough] [--historical]

[--fromdate FROMDATE] [--todate TODATE]

[--smaperiod SMAPERIOD] [--replay | --resample]

[--timeframe {Ticks,MicroSeconds,Seconds,Minutes,Days,Weeks,Months,Years}]

[--compression COMPRESSION] [--no-bar2edge] [--no-adjbartime]

[--no-rightedge] [--broker] [--account ACCOUNT] [--trade]

[--donotsell]

[--exectype {Market,Close,Limit,Stop,StopLimit}]

[--price PRICE] [--pstoplimit PSTOPLIMIT] [--stake STAKE]

[--valid VALID] [--cancel CANCEL]

Test Visual Chart 6 integration

optional arguments:

-h, --help show this help message and exit

--exactbars EXACTBARS

exactbars level, use 0/-1/-2 to enable plotting

(default: 1)

--plot Plot if possible (default: False)

--stopafter STOPAFTER

Stop after x lines of LIVE data (default: 0)

--nostore Do not Use the store pattern (default: False)

--qcheck QCHECK Timeout for periodic notification/resampling/replaying

check (default: 0.5)

--no-timeoffset Do not Use TWS/System time offset for non timestamped

prices and to align resampling (default: False)

--data0 DATA0 data 0 into the system (default: None)

--tradename TRADENAME

Actual Trading Name of the asset (default: None)

--data1 DATA1 data 1 into the system (default: None)

--timezone TIMEZONE timezone to get time output into (pytz names)

(default: None)

--historical do only historical download (default: False)

--fromdate FROMDATE Starting date for historical download with format:

YYYY-MM-DD[THH:MM:SS] (default: None)

--todate TODATE End date for historical download with format: YYYY-MM-

DD[THH:MM:SS] (default: None)

--smaperiod SMAPERIOD

Period to apply to the Simple Moving Average (default:

5)

--replay replay to chosen timeframe (default: False)

--resample resample to chosen timeframe (default: False)

--timeframe {Ticks,MicroSeconds,Seconds,Minutes,Days,Weeks,Months,Years}

TimeFrame for Resample/Replay (default: Ticks)

--compression COMPRESSION

Compression for Resample/Replay (default: 1)

--no-bar2edge no bar2edge for resample/replay (default: False)

--no-adjbartime no adjbartime for resample/replay (default: False)

--no-rightedge no rightedge for resample/replay (default: False)

--broker Use VisualChart as broker (default: False)

--account ACCOUNT Choose broker account (else first) (default: None)

--trade Do Sample Buy/Sell operations (default: False)

--donotsell Do not sell after a buy (default: False)

--exectype {Market,Close,Limit,Stop,StopLimit}

Execution to Use when opening position (default:

Market)

--price PRICE Price in Limit orders or Stop Trigger Price (default:

None)

--pstoplimit PSTOPLIMIT

Price for the limit in StopLimit (default: None)

--stake STAKE Stake to use in buy operations (default: 10)

--valid VALID Seconds or YYYY-MM-DD (default: None)

--cancel CANCEL Cancel a buy order after n bars in operation, to be

combined with orders like Limit (default: 0)

守则:

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import argparse

import datetime

# The above could be sent to an independent module

import backtrader as bt

from backtrader.utils import flushfile # win32 quick stdout flushing

from backtrader.utils.py3 import string_types

class TestStrategy(bt.Strategy):

params = dict(

smaperiod=5,

trade=False,

stake=10,

exectype=bt.Order.Market,

stopafter=0,

valid=None,

cancel=0,

donotsell=False,

price=None,

pstoplimit=None,

)

def __init__(self):

# To control operation entries

self.orderid = list()

self.order = None

self.counttostop = 0

self.datastatus = 0

# Create SMA on 2nd data

self.sma = bt.indicators.MovAv.SMA(self.data, period=self.p.smaperiod)

print('--------------------------------------------------')

print('Strategy Created')

print('--------------------------------------------------')

def notify_data(self, data, status, *args, **kwargs):

print('*' * 5, 'DATA NOTIF:', data._getstatusname(status), *args)

if status == data.LIVE:

self.counttostop = self.p.stopafter

self.datastatus = 1

def notify_store(self, msg, *args, **kwargs):

print('*' * 5, 'STORE NOTIF:', msg)

def notify_order(self, order):

if order.status in [order.Completed, order.Cancelled, order.Rejected]:

self.order = None

print('-' * 50, 'ORDER BEGIN', datetime.datetime.now())

print(order)

print('-' * 50, 'ORDER END')

def notify_trade(self, trade):

print('-' * 50, 'TRADE BEGIN', datetime.datetime.now())

print(trade)

print('-' * 50, 'TRADE END')

def prenext(self):

self.next(frompre=True)

def next(self, frompre=False):

txt = list()

txt.append('%04d' % len(self))

dtfmt = '%Y-%m-%dT%H:%M:%S.%f'

txt.append('%s' % self.data.datetime.datetime(0).strftime(dtfmt))

txt.append('{}'.format(self.data.open[0]))

txt.append('{}'.format(self.data.high[0]))

txt.append('{}'.format(self.data.low[0]))

txt.append('{}'.format(self.data.close[0]))

txt.append('{}'.format(self.data.volume[0]))

txt.append('{}'.format(self.data.openinterest[0]))

txt.append('{}'.format(self.sma[0]))

print(', '.join(txt))

if len(self.datas) > 1:

txt = list()

txt.append('%04d' % len(self))

dtfmt = '%Y-%m-%dT%H:%M:%S.%f'

txt.append('%s' % self.data1.datetime.datetime(0).strftime(dtfmt))

txt.append('{}'.format(self.data1.open[0]))

txt.append('{}'.format(self.data1.high[0]))

txt.append('{}'.format(self.data1.low[0]))

txt.append('{}'.format(self.data1.close[0]))

txt.append('{}'.format(self.data1.volume[0]))

txt.append('{}'.format(self.data1.openinterest[0]))

txt.append('{}'.format(float('NaN')))

print(', '.join(txt))

if self.counttostop: # stop after x live lines

self.counttostop -= 1

if not self.counttostop:

self.env.runstop()

return

if not self.p.trade:

return

# if True and len(self.orderid) < 1:

if self.datastatus and not self.position and len(self.orderid) < 1:

self.order = self.buy(size=self.p.stake,

exectype=self.p.exectype,

price=self.p.price,

plimit=self.p.pstoplimit,

valid=self.p.valid)

self.orderid.append(self.order)

elif self.position.size > 0 and not self.p.donotsell:

if self.order is None:

size = self.p.stake // 2

if not size:

size = self.position.size # use the remaining

self.order = self.sell(size=size, exectype=bt.Order.Market)

elif self.order is not None and self.p.cancel:

if self.datastatus > self.p.cancel:

self.cancel(self.order)

if self.datastatus:

self.datastatus += 1

def start(self):

header = ['Datetime', 'Open', 'High', 'Low', 'Close', 'Volume',

'OpenInterest', 'SMA']

print(', '.join(header))

self.done = False

def runstrategy():

args = parse_args()

# Create a cerebro

cerebro = bt.Cerebro()

storekwargs = dict()

if not args.nostore:

vcstore = bt.stores.VCStore(**storekwargs)

if args.broker:

brokerargs = dict(account=args.account, **storekwargs)

if not args.nostore:

broker = vcstore.getbroker(**brokerargs)

else:

broker = bt.brokers.VCBroker(**brokerargs)

cerebro.setbroker(broker)

timeframe = bt.TimeFrame.TFrame(args.timeframe)

if args.resample or args.replay:

datatf = bt.TimeFrame.Ticks

datacomp = 1

else:

datatf = timeframe

datacomp = args.compression

fromdate = None

if args.fromdate:

dtformat = '%Y-%m-%d' + ('T%H:%M:%S' * ('T' in args.fromdate))

fromdate = datetime.datetime.strptime(args.fromdate, dtformat)

todate = None

if args.todate:

dtformat = '%Y-%m-%d' + ('T%H:%M:%S' * ('T' in args.todate))

todate = datetime.datetime.strptime(args.todate, dtformat)

VCDataFactory = vcstore.getdata if not args.nostore else bt.feeds.VCData

datakwargs = dict(

timeframe=datatf, compression=datacomp,

fromdate=fromdate, todate=todate,

historical=args.historical,

qcheck=args.qcheck,

tz=args.timezone

)

if args.nostore and not args.broker: # neither store nor broker

datakwargs.update(storekwargs) # pass the store args over the data

data0 = VCDataFactory(dataname=args.data0, tradename=args.tradename,

**datakwargs)

data1 = None

if args.data1 is not None:

data1 = VCDataFactory(dataname=args.data1, **datakwargs)

rekwargs = dict(

timeframe=timeframe, compression=args.compression,

bar2edge=not args.no_bar2edge,

adjbartime=not args.no_adjbartime,

rightedge=not args.no_rightedge,

)

if args.replay:

cerebro.replaydata(dataname=data0, **rekwargs)

if data1 is not None:

cerebro.replaydata(dataname=data1, **rekwargs)

elif args.resample:

cerebro.resampledata(dataname=data0, **rekwargs)

if data1 is not None:

cerebro.resampledata(dataname=data1, **rekwargs)

else:

cerebro.adddata(data0)

if data1 is not None:

cerebro.adddata(data1)

if args.valid is None:

valid = None

else:

try:

valid = float(args.valid)

except:

dtformat = '%Y-%m-%d' + ('T%H:%M:%S' * ('T' in args.valid))

valid = datetime.datetime.strptime(args.valid, dtformat)

else:

valid = datetime.timedelta(seconds=args.valid)

# Add the strategy

cerebro.addstrategy(TestStrategy,

smaperiod=args.smaperiod,

trade=args.trade,

exectype=bt.Order.ExecType(args.exectype),

stake=args.stake,

stopafter=args.stopafter,

valid=valid,

cancel=args.cancel,

donotsell=args.donotsell,

price=args.price,

pstoplimit=args.pstoplimit)

# Live data ... avoid long data accumulation by switching to "exactbars"

cerebro.run(exactbars=args.exactbars)

if args.plot and args.exactbars < 1: # plot if possible

cerebro.plot()

def parse_args():

parser = argparse.ArgumentParser(

formatter_class=argparse.ArgumentDefaultsHelpFormatter,

description='Test Visual Chart 6 integration')

parser.add_argument('--exactbars', default=1, type=int,

required=False, action='store',

help='exactbars level, use 0/-1/-2 to enable plotting')

parser.add_argument('--plot',

required=False, action='store_true',

help='Plot if possible')

parser.add_argument('--stopafter', default=0, type=int,

required=False, action='store',

help='Stop after x lines of LIVE data')

parser.add_argument('--nostore',

required=False, action='store_true',

help='Do not Use the store pattern')

parser.add_argument('--qcheck', default=0.5, type=float,

required=False, action='store',

help=('Timeout for periodic '

'notification/resampling/replaying check'))

parser.add_argument('--no-timeoffset',

required=False, action='store_true',

help=('Do not Use TWS/System time offset for non '

'timestamped prices and to align resampling'))

parser.add_argument('--data0', default=None,

required=True, action='store',

help='data 0 into the system')

parser.add_argument('--tradename', default=None,

required=False, action='store',

help='Actual Trading Name of the asset')

parser.add_argument('--data1', default=None,

required=False, action='store',

help='data 1 into the system')

parser.add_argument('--timezone', default=None,

required=False, action='store',

help='timezone to get time output into (pytz names)')

parser.add_argument('--historical',

required=False, action='store_true',

help='do only historical download')

parser.add_argument('--fromdate',

required=False, action='store',

help=('Starting date for historical download '

'with format: YYYY-MM-DD[THH:MM:SS]'))

parser.add_argument('--todate',

required=False, action='store',

help=('End date for historical download '

'with format: YYYY-MM-DD[THH:MM:SS]'))

parser.add_argument('--smaperiod', default=5, type=int,

required=False, action='store',

help='Period to apply to the Simple Moving Average')

pgroup = parser.add_mutually_exclusive_group(required=False)

pgroup.add_argument('--replay',

required=False, action='store_true',

help='replay to chosen timeframe')

pgroup.add_argument('--resample',

required=False, action='store_true',

help='resample to chosen timeframe')

parser.add_argument('--timeframe', default=bt.TimeFrame.Names[0],

choices=bt.TimeFrame.Names,

required=False, action='store',

help='TimeFrame for Resample/Replay')

parser.add_argument('--compression', default=1, type=int,

required=False, action='store',

help='Compression for Resample/Replay')

parser.add_argument('--no-bar2edge',

required=False, action='store_true',

help='no bar2edge for resample/replay')

parser.add_argument('--no-adjbartime',

required=False, action='store_true',

help='no adjbartime for resample/replay')

parser.add_argument('--no-rightedge',

required=False, action='store_true',

help='no rightedge for resample/replay')

parser.add_argument('--broker',

required=False, action='store_true',

help='Use VisualChart as broker')

parser.add_argument('--account', default=None,

required=False, action='store',

help='Choose broker account (else first)')

parser.add_argument('--trade',

required=False, action='store_true',

help='Do Sample Buy/Sell operations')

parser.add_argument('--donotsell',

required=False, action='store_true',

help='Do not sell after a buy')

parser.add_argument('--exectype', default=bt.Order.ExecTypes[0],

choices=bt.Order.ExecTypes,

required=False, action='store',

help='Execution to Use when opening position')

parser.add_argument('--price', default=None, type=float,

required=False, action='store',

help='Price in Limit orders or Stop Trigger Price')

parser.add_argument('--pstoplimit', default=None, type=float,

required=False, action='store',

help='Price for the limit in StopLimit')

parser.add_argument('--stake', default=10, type=int,

required=False, action='store',

help='Stake to use in buy operations')

parser.add_argument('--valid', default=None,

required=False, action='store',

help='Seconds or YYYY-MM-DD')

parser.add_argument('--cancel', default=0, type=int,

required=False, action='store',

help=('Cancel a buy order after n bars in operation,'

' to be combined with orders like Limit'))

return parser.parse_args()

if __name__ == '__main__':

runstrategy()