延长佣金

佣金和关联功能由单个类 CommissionInfo 管理,该类 CommissionInfo 主要由调用 broker.setcommission 进行实例化。

有一些帖子讨论了这种行为。

-

佣金:股票与期货

-

提高佣金:股票与期货

这一概念仅限于有保证金和每份合同固定佣金的期货和基于价格/规模百分比佣金的股票。即使达到了目的,也不是最灵活的计划。

关于我自己的实现,我唯一不喜欢的是CommissionInfo采用绝对值(0.xx%)而不是相对值(xx%)

对 GitHub29的增强请求导致了一些返工,以便:

-

保持

CommissionInfo和broker.setcommission与原始行为兼容 -

对代码进行一些清理

-

使佣金计划灵活,以支持增强请求和进一步的可能性

到达样品前的实际工作:

class CommInfoBase(with_metaclass(MetaParams)):

COMM_PERC, COMM_FIXED = range(2)

params = (

('commission', 0.0), ('mult', 1.0), ('margin', None),

('commtype', None),

('stocklike', False),

('percabs', False),

)

引入了CommissionInfo的基类,该基类为混合添加了新参数:

-

commtype(默认为无)这是兼容性的关键。如果值为

None,则CommissionInfo对象和broker.setcommission的行为将与之前一样工作。即:-

如果设置了

margin,则佣金方案适用于每个合同都有固定佣金的期货 -

如果未设置

margin,则佣金方案针对股票,采用百分比法

如果该值为

COMM_PERC或COMM_FIXED(或任何其他派生类),这显然决定了佣金是固定的还是基于百分比的 -

-

stocklike(默认为 False)如上所述,旧的

CommissionInfo对象中的实际行为由参数margin确定如上所述,如果

commtype设置为None以外的其他值,则该值表示该资产是否为期货类资产(将使用保证金并执行基于条形图的现金调整 9,否则为股票类资产) -

percabs(默认为 False)如果

False,则百分比必须以相对值(xx%)通过如果

True百分比必须作为绝对值传递(0.xx)CommissionInfo是CommInfoBase的子类,将该参数的默认值更改为True以保持兼容行为

所有这些参数也可以在broker.setcommission中使用,现在看起来如下:

def setcommission(self,

commission=0.0, margin=None, mult=1.0,

commtype=None, percabs=True, stocklike=False,

name=None):

请注意以下事项:

percabs是True保持行为与CommissionInfo对象的上述旧调用兼容

要测试的旧样本commissions-schemes已经过修改,以支持命令行参数和新行为。用法帮助:

$ ./commission-schemes.py --help

usage: commission-schemes.py [-h] [--data DATA] [--fromdate FROMDATE]

[--todate TODATE] [--stake STAKE]

[--period PERIOD] [--cash CASH] [--comm COMM]

[--mult MULT] [--margin MARGIN]

[--commtype {none,perc,fixed}] [--stocklike]

[--percrel] [--plot] [--numfigs NUMFIGS]

Commission schemes

optional arguments:

-h, --help show this help message and exit

--data DATA, -d DATA data to add to the system (default:

../../datas/2006-day-001.txt)

--fromdate FROMDATE, -f FROMDATE

Starting date in YYYY-MM-DD format (default:

2006-01-01)

--todate TODATE, -t TODATE

Starting date in YYYY-MM-DD format (default:

2006-12-31)

--stake STAKE Stake to apply in each operation (default: 1)

--period PERIOD Period to apply to the Simple Moving Average (default:

30)

--cash CASH Starting Cash (default: 10000.0)

--comm COMM Commission factor for operation, either apercentage or

a per stake unit absolute value (default: 2.0)

--mult MULT Multiplier for operations calculation (default: 10)

--margin MARGIN Margin for futures-like operations (default: 2000.0)

--commtype {none,perc,fixed}

Commission - choose none for the old CommissionInfo

behavior (default: none)

--stocklike If the operation is for stock-like assets orfuture-

like assets (default: False)

--percrel If perc is expressed in relative xx{'const': True,

'help': u'If perc is expressed in relative xx%

ratherthan absolute value 0.xx', 'option_strings': [u'

--percrel'], 'dest': u'percrel', 'required': False,

'nargs': 0, 'choices': None, 'default': False, 'prog':

'commission-schemes.py', 'container':

<argparse._ArgumentGroup object at

0x0000000007EC9828>, 'type': None, 'metavar':

None}atherthan absolute value 0.xx (default: False)

--plot, -p Plot the read data (default: False)

--numfigs NUMFIGS, -n NUMFIGS

Plot using numfigs figures (default: 1)

让我们进行一些运行,以重新创建原始佣金方案帖子的原始行为。

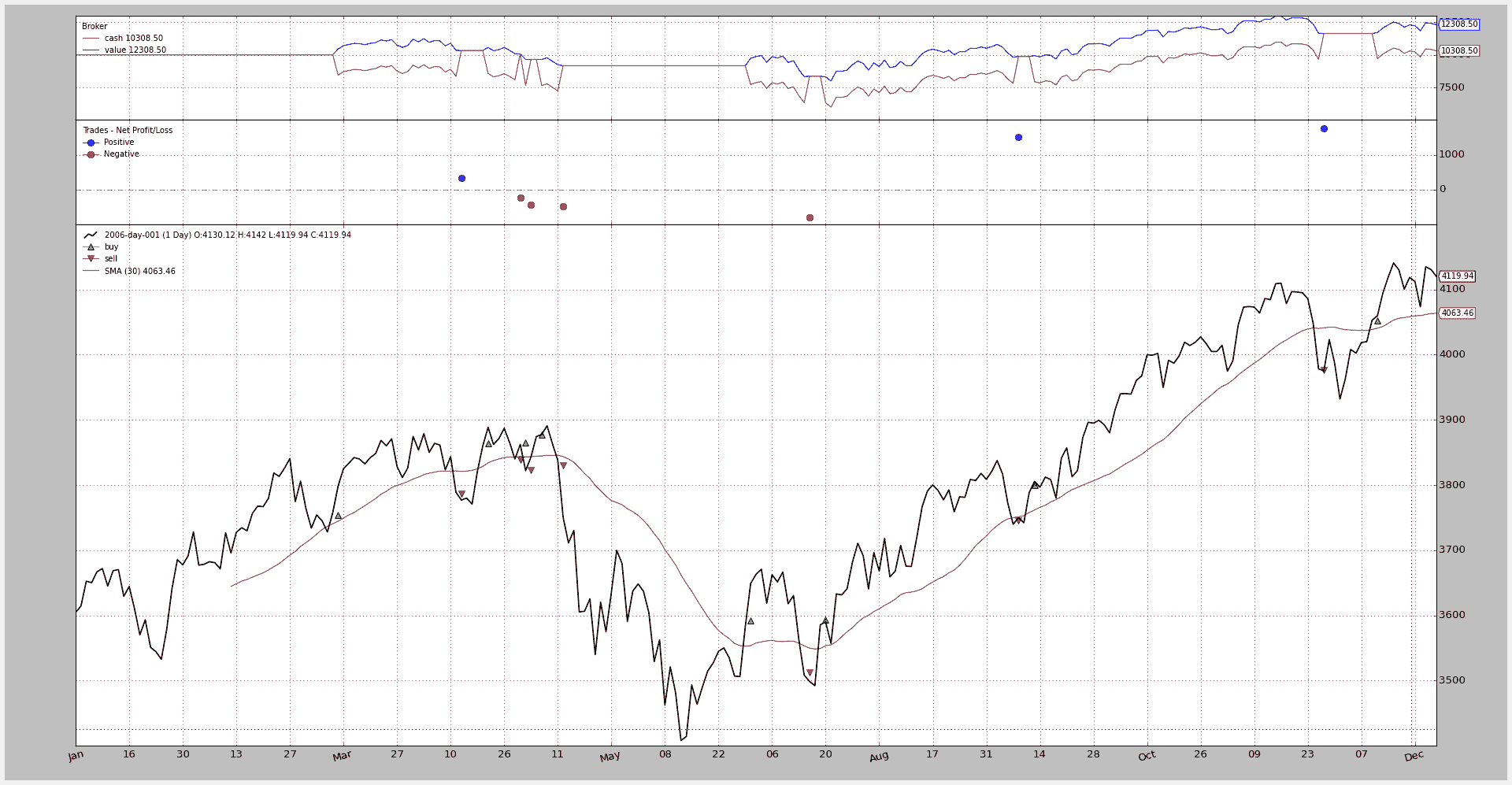

期货佣金(固定和有保证金)

执行和图表:

$ ./commission-schemes.py --comm 2.0 --margin 2000.0 --mult 10 --plot

输出显示固定佣金为 2.0 货币单位(默认股份为 1):

2006-03-09, BUY CREATE, 3757.59

2006-03-10, BUY EXECUTED, Price: 3754.13, Cost: 2000.00, Comm 2.00

2006-04-11, SELL CREATE, 3788.81

2006-04-12, SELL EXECUTED, Price: 3786.93, Cost: 2000.00, Comm 2.00

2006-04-12, TRADE PROFIT, GROSS 328.00, NET 324.00

...

股票佣金(perc 和无保证金)

执行和图表:

$ ./commission-schemes.py --comm 0.005 --margin 0 --mult 1 --plot

为了提高可读性,可以使用相对%值:

$ ./commission-schemes.py --percrel --comm 0.5 --margin 0 --mult 1 --plot

现在0.5直接表示0.5%

在两种情况下都是输出:

2006-03-09, BUY CREATE, 3757.59

2006-03-10, BUY EXECUTED, Price: 3754.13, Cost: 3754.13, Comm 18.77

2006-04-11, SELL CREATE, 3788.81

2006-04-12, SELL EXECUTED, Price: 3786.93, Cost: 3754.13, Comm 18.93

2006-04-12, TRADE PROFIT, GROSS 32.80, NET -4.91

...

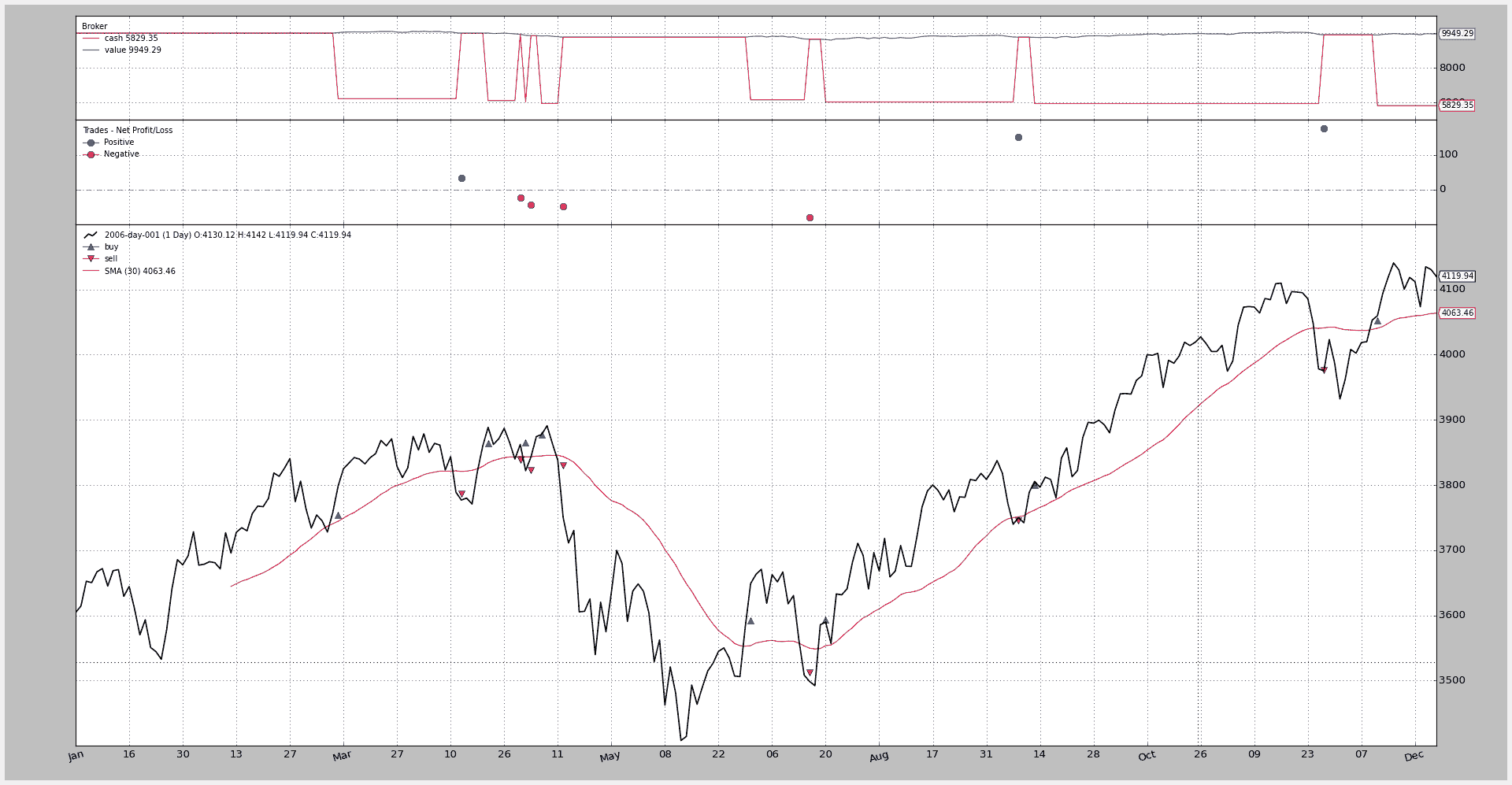

期货佣金(perc 和保证金)

使用新参数,基于 perc 方案的期货:

$ ./commission-schemes.py --commtype perc --percrel --comm 0.5 --margin 2000 --mult 10 --plot

毫无疑问,通过改变委员会……最终结果发生了变化

结果表明,佣金现在是可变的:

2006-03-09, BUY CREATE, 3757.59

2006-03-10, BUY EXECUTED, Price: 3754.13, Cost: 2000.00, Comm 18.77

2006-04-11, SELL CREATE, 3788.81

2006-04-12, SELL EXECUTED, Price: 3786.93, Cost: 2000.00, Comm 18.93

2006-04-12, TRADE PROFIT, GROSS 328.00, NET 290.29

...

在上一次运行中,设置 2.0 货币单位(默认值为 1)

另一篇文章将详细介绍新课程和 homme 熟食佣金计划的实施情况。

示例的代码

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import argparse

import datetime

import backtrader as bt

import backtrader.feeds as btfeeds

import backtrader.indicators as btind

class SMACrossOver(bt.Strategy):

params = (

('stake', 1),

('period', 30),

)

def log(self, txt, dt=None):

''' Logging function fot this strategy'''

dt = dt or self.datas[0].datetime.date(0)

print('%s, %s' % (dt.isoformat(), txt))

def notify_order(self, order):

if order.status in [order.Submitted, order.Accepted]:

# Buy/Sell order submitted/accepted to/by broker - Nothing to do

return

# Check if an order has been completed

# Attention: broker could reject order if not enougth cash

if order.status in [order.Completed, order.Canceled, order.Margin]:

if order.isbuy():

self.log(

'BUY EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

else: # Sell

self.log('SELL EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

def notify_trade(self, trade):

if trade.isclosed:

self.log('TRADE PROFIT, GROSS %.2f, NET %.2f' %

(trade.pnl, trade.pnlcomm))

def __init__(self):

sma = btind.SMA(self.data, period=self.p.period)

# > 0 crossing up / < 0 crossing down

self.buysell_sig = btind.CrossOver(self.data, sma)

def next(self):

if self.buysell_sig > 0:

self.log('BUY CREATE, %.2f' % self.data.close[0])

self.buy(size=self.p.stake) # keep order ref to avoid 2nd orders

elif self.position and self.buysell_sig < 0:

self.log('SELL CREATE, %.2f' % self.data.close[0])

self.sell(size=self.p.stake)

def runstrategy():

args = parse_args()

# Create a cerebro

cerebro = bt.Cerebro()

# Get the dates from the args

fromdate = datetime.datetime.strptime(args.fromdate, '%Y-%m-%d')

todate = datetime.datetime.strptime(args.todate, '%Y-%m-%d')

# Create the 1st data

data = btfeeds.BacktraderCSVData(

dataname=args.data,

fromdate=fromdate,

todate=todate)

# Add the 1st data to cerebro

cerebro.adddata(data)

# Add a strategy

cerebro.addstrategy(SMACrossOver, period=args.period, stake=args.stake)

# Add the commission - only stocks like a for each operation

cerebro.broker.setcash(args.cash)

commtypes = dict(

none=None,

perc=bt.CommInfoBase.COMM_PERC,

fixed=bt.CommInfoBase.COMM_FIXED)

# Add the commission - only stocks like a for each operation

cerebro.broker.setcommission(commission=args.comm,

mult=args.mult,

margin=args.margin,

percabs=not args.percrel,

commtype=commtypes[args.commtype],

stocklike=args.stocklike)

# And run it

cerebro.run()

# Plot if requested

if args.plot:

cerebro.plot(numfigs=args.numfigs, volume=False)

def parse_args():

parser = argparse.ArgumentParser(

description='Commission schemes',

formatter_class=argparse.ArgumentDefaultsHelpFormatter,)

parser.add_argument('--data', '-d',

default='../../datas/2006-day-001.txt',

help='data to add to the system')

parser.add_argument('--fromdate', '-f',

default='2006-01-01',

help='Starting date in YYYY-MM-DD format')

parser.add_argument('--todate', '-t',

default='2006-12-31',

help='Starting date in YYYY-MM-DD format')

parser.add_argument('--stake', default=1, type=int,

help='Stake to apply in each operation')

parser.add_argument('--period', default=30, type=int,

help='Period to apply to the Simple Moving Average')

parser.add_argument('--cash', default=10000.0, type=float,

help='Starting Cash')

parser.add_argument('--comm', default=2.0, type=float,

help=('Commission factor for operation, either a'

'percentage or a per stake unit absolute value'))

parser.add_argument('--mult', default=10, type=int,

help='Multiplier for operations calculation')

parser.add_argument('--margin', default=2000.0, type=float,

help='Margin for futures-like operations')

parser.add_argument('--commtype', required=False, default='none',

choices=['none', 'perc', 'fixed'],

help=('Commission - choose none for the old'

' CommissionInfo behavior'))

parser.add_argument('--stocklike', required=False, action='store_true',

help=('If the operation is for stock-like assets or'

'future-like assets'))

parser.add_argument('--percrel', required=False, action='store_true',

help=('If perc is expressed in relative xx% rather'

'than absolute value 0.xx'))

parser.add_argument('--plot', '-p', action='store_true',

help='Plot the read data')

parser.add_argument('--numfigs', '-n', default=1,

help='Plot using numfigs figures')

return parser.parse_args()

if __name__ == '__main__':

runstrategy()