多等级

原文: https://www.backtrader.com/blog/posts/2015-10-05-multitrades/multitrades/

现在可以为每笔交易添加一个唯一的标识符,即使是在相同的数据上运行。

根据勾选数据和backtrader第 1.1.12.88 版重采样请求,支持“多交易”,即:向订单分配tradeid的能力。此 id 被传递到Trades,这样就可以有不同类别的交易并同时开放。

tradeid可在以下情况下指定:

-

呼叫策略。买入/卖出/与 kwarg 成交

tradeid -

呼叫经纪人。与 kwarg 进行买卖

tradeid -

使用 kwarg

tradeid创建订单实例

如果未指定,则默认值为:

tradeid = 0

为了测试已实现的小脚本,使用自定义MTradeObserver实现结果可视化,该自定义MTradeObserver根据tradeid在绘图上指定不同的标记(对于测试值,使用 0、1 和 2)

脚本支持使用三个 ID(0、1、2)或仅使用 0(默认值)

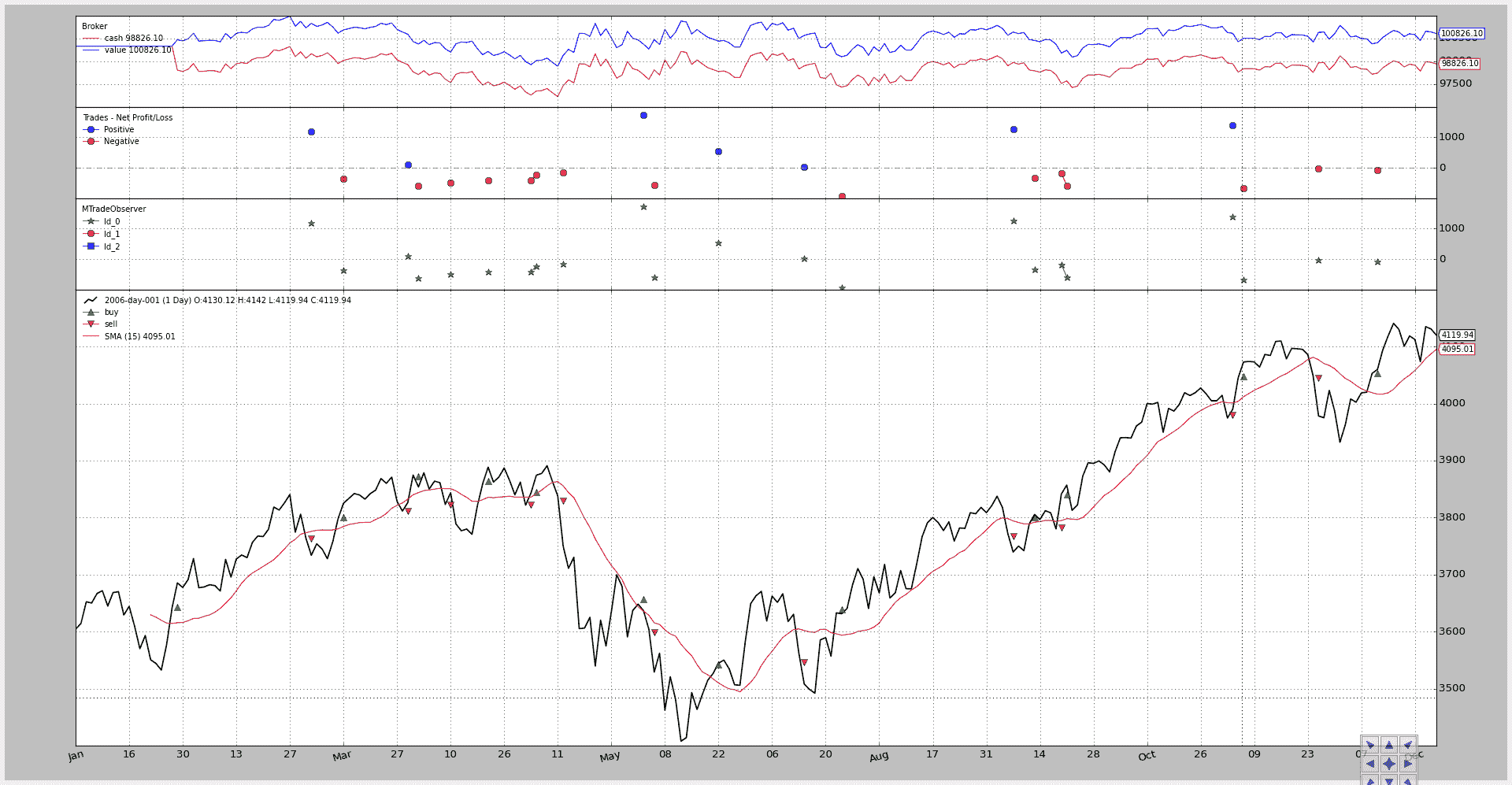

不启用多个 ID 的执行:

$ ./multitrades.py --plot

结果图表显示了所有交易的结转 id0,因此无法区分。

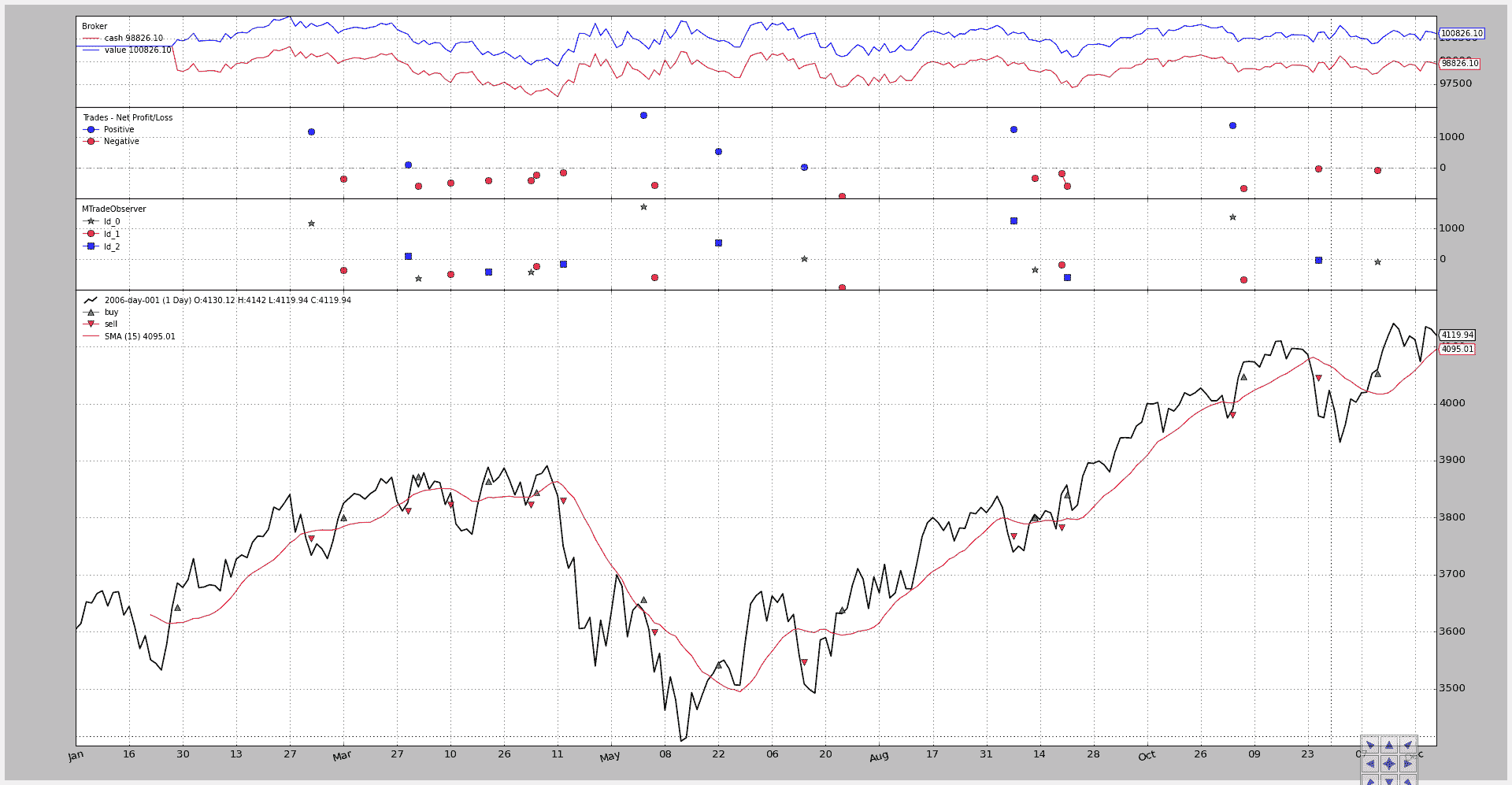

第二次执行通过在 0、1 和 2 之间循环来启用多交易:

$ ./multitrades.py --plot --mtrade

现在,3 个不同的标记交替显示每种交易可以使用tradeid成员进行区分。

笔记

backtrader尝试使用模拟现实的模型。因此,Broker实例不计算“交易”,它只处理订单。

交易按策略计算。

因此,现实生活中的代理可能不支持tradeid(或类似内容),在这种情况下,需要手动跟踪代理分配的唯一 orde id。

现在,自定义观察者的代码

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import math

import backtrader as bt

class MTradeObserver(bt.observer.Observer):

lines = ('Id_0', 'Id_1', 'Id_2')

plotinfo = dict(plot=True, subplot=True, plotlinelabels=True)

plotlines = dict(

Id_0=dict(marker='*', markersize=8.0, color='lime', fillstyle='full'),

Id_1=dict(marker='o', markersize=8.0, color='red', fillstyle='full'),

Id_2=dict(marker='s', markersize=8.0, color='blue', fillstyle='full')

)

def next(self):

for trade in self._owner._tradespending:

if trade.data is not self.data:

continue

if not trade.isclosed:

continue

self.lines[trade.tradeid][0] = trade.pnlcomm

主要脚本用法:

$ ./multitrades.py --help

usage: multitrades.py [-h] [--data DATA] [--fromdate FROMDATE]

[--todate TODATE] [--mtrade] [--period PERIOD]

[--onlylong] [--cash CASH] [--comm COMM] [--mult MULT]

[--margin MARGIN] [--stake STAKE] [--plot]

[--numfigs NUMFIGS]

MultiTrades

optional arguments:

-h, --help show this help message and exit

--data DATA, -d DATA data to add to the system

--fromdate FROMDATE, -f FROMDATE

Starting date in YYYY-MM-DD format

--todate TODATE, -t TODATE

Starting date in YYYY-MM-DD format

--mtrade Activate MultiTrade Ids

--period PERIOD Period to apply to the Simple Moving Average

--onlylong, -ol Do only long operations

--cash CASH Starting Cash

--comm COMM Commission for operation

--mult MULT Multiplier for futures

--margin MARGIN Margin for each future

--stake STAKE Stake to apply in each operation

--plot, -p Plot the read data

--numfigs NUMFIGS, -n NUMFIGS

Plot using numfigs figures

脚本的代码。

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import argparse

import datetime

import itertools

# The above could be sent to an independent module

import backtrader as bt

import backtrader.feeds as btfeeds

import backtrader.indicators as btind

import mtradeobserver

class MultiTradeStrategy(bt.Strategy):

'''This strategy buys/sells upong the close price crossing

upwards/downwards a Simple Moving Average.

It can be a long-only strategy by setting the param "onlylong" to True

'''

params = dict(

period=15,

stake=1,

printout=False,

onlylong=False,

mtrade=False,

)

def log(self, txt, dt=None):

if self.p.printout:

dt = dt or self.data.datetime[0]

dt = bt.num2date(dt)

print('%s, %s' % (dt.isoformat(), txt))

def __init__(self):

# To control operation entries

self.order = None

# Create SMA on 2nd data

sma = btind.MovAv.SMA(self.data, period=self.p.period)

# Create a CrossOver Signal from close an moving average

self.signal = btind.CrossOver(self.data.close, sma)

# To alternate amongst different tradeids

if self.p.mtrade:

self.tradeid = itertools.cycle([0, 1, 2])

else:

self.tradeid = itertools.cycle([0])

def next(self):

if self.order:

return # if an order is active, no new orders are allowed

if self.signal > 0.0: # cross upwards

if self.position:

self.log('CLOSE SHORT , %.2f' % self.data.close[0])

self.close(tradeid=self.curtradeid)

self.log('BUY CREATE , %.2f' % self.data.close[0])

self.curtradeid = next(self.tradeid)

self.buy(size=self.p.stake, tradeid=self.curtradeid)

elif self.signal < 0.0:

if self.position:

self.log('CLOSE LONG , %.2f' % self.data.close[0])

self.close(tradeid=self.curtradeid)

if not self.p.onlylong:

self.log('SELL CREATE , %.2f' % self.data.close[0])

self.curtradeid = next(self.tradeid)

self.sell(size=self.p.stake, tradeid=self.curtradeid)

def notify_order(self, order):

if order.status in [bt.Order.Submitted, bt.Order.Accepted]:

return # Await further notifications

if order.status == order.Completed:

if order.isbuy():

buytxt = 'BUY COMPLETE, %.2f' % order.executed.price

self.log(buytxt, order.executed.dt)

else:

selltxt = 'SELL COMPLETE, %.2f' % order.executed.price

self.log(selltxt, order.executed.dt)

elif order.status in [order.Expired, order.Canceled, order.Margin]:

self.log('%s ,' % order.Status[order.status])

pass # Simply log

# Allow new orders

self.order = None

def notify_trade(self, trade):

if trade.isclosed:

self.log('TRADE PROFIT, GROSS %.2f, NET %.2f' %

(trade.pnl, trade.pnlcomm))

elif trade.justopened:

self.log('TRADE OPENED, SIZE %2d' % trade.size)

def runstrategy():

args = parse_args()

# Create a cerebro

cerebro = bt.Cerebro()

# Get the dates from the args

fromdate = datetime.datetime.strptime(args.fromdate, '%Y-%m-%d')

todate = datetime.datetime.strptime(args.todate, '%Y-%m-%d')

# Create the 1st data

data = btfeeds.BacktraderCSVData(

dataname=args.data,

fromdate=fromdate,

todate=todate)

# Add the 1st data to cerebro

cerebro.adddata(data)

# Add the strategy

cerebro.addstrategy(MultiTradeStrategy,

period=args.period,

onlylong=args.onlylong,

stake=args.stake,

mtrade=args.mtrade)

# Add the commission - only stocks like a for each operation

cerebro.broker.setcash(args.cash)

# Add the commission - only stocks like a for each operation

cerebro.broker.setcommission(commission=args.comm,

mult=args.mult,

margin=args.margin)

# Add the MultiTradeObserver

cerebro.addobserver(mtradeobserver.MTradeObserver)

# And run it

cerebro.run()

# Plot if requested

if args.plot:

cerebro.plot(numfigs=args.numfigs, volume=False, zdown=False)

def parse_args():

parser = argparse.ArgumentParser(description='MultiTrades')

parser.add_argument('--data', '-d',

default='../../datas/2006-day-001.txt',

help='data to add to the system')

parser.add_argument('--fromdate', '-f',

default='2006-01-01',

help='Starting date in YYYY-MM-DD format')

parser.add_argument('--todate', '-t',

default='2006-12-31',

help='Starting date in YYYY-MM-DD format')

parser.add_argument('--mtrade', action='store_true',

help='Activate MultiTrade Ids')

parser.add_argument('--period', default=15, type=int,

help='Period to apply to the Simple Moving Average')

parser.add_argument('--onlylong', '-ol', action='store_true',

help='Do only long operations')

parser.add_argument('--cash', default=100000, type=int,

help='Starting Cash')

parser.add_argument('--comm', default=2, type=float,

help='Commission for operation')

parser.add_argument('--mult', default=10, type=int,

help='Multiplier for futures')

parser.add_argument('--margin', default=2000.0, type=float,

help='Margin for each future')

parser.add_argument('--stake', default=1, type=int,

help='Stake to apply in each operation')

parser.add_argument('--plot', '-p', action='store_true',

help='Plot the read data')

parser.add_argument('--numfigs', '-n', default=1,

help='Plot using numfigs figures')

return parser.parse_args()

if __name__ == '__main__':

runstrategy()