实际使用

原文: https://www.backtrader.com/blog/posts/2015-08-27-real-world-usage/real-world-usage/

最后,它似乎得到了回报,已经着手发展 backtrader。

在过去几周观察欧洲市场时,我的一位朋友问我是否可以看看我们图表包中的数据,看看下跌幅度与之前类似事件相比如何。

当然可以,但我说我可以做的不仅仅是查看图表,因为我可以很快:

-

创建一个快速

LegDown指示器,测量坠落范围。它也可能被命名为HighLowRange或HiLoRange。幸运的是,如果认为需要,可以通过alias解决 -

创建一个

LegDownAnalyzer来收集结果并对其进行排序

这导致了一个额外的请求:

-

在接下来的 5、10、15、20 天(交易日…)下跌后恢复

通过

LegUp指示器解决,该指示器将值写回,以便与相应的“LegDown”对齐``

工作很快就完成了(在我空闲时间的允许范围内),结果与请求者共享。但是…这是我看到的唯一潜在问题:

-

自动化方面的改进

bt-run.py-

具有分离 KWARG 的多策略/观察者/分析器

-

将指标直接注入战略,每个指标使用 KWARG

-

单点绘图参数也接受 kwargs

-

-

对

AnalyzerAPI 进行改进,使其具有自动打印结果的功能(作为类似dict的实例返回),并具有直接data访问别名

尽管:

-

由于我编写的实现组合通过混合声明和额外使用

next来对齐LegDown和LegUp值,出现了一个模糊的 bug引入该缺陷是为了简化单个数据与多个

Lines的传递,因此Indicators可以作为单独的数据在每一行上进行操作

后者迫使我:

-

添加一个与

LineDelay相对的背景对象来“展望”未来这实际上意味着实际值被写入过去的数组位置

一旦上述所有内容都落实到位,就应该重新测试上述请求所带来的(小的?)挑战是否能够更容易、更快地(在实施时间内)得到解决。

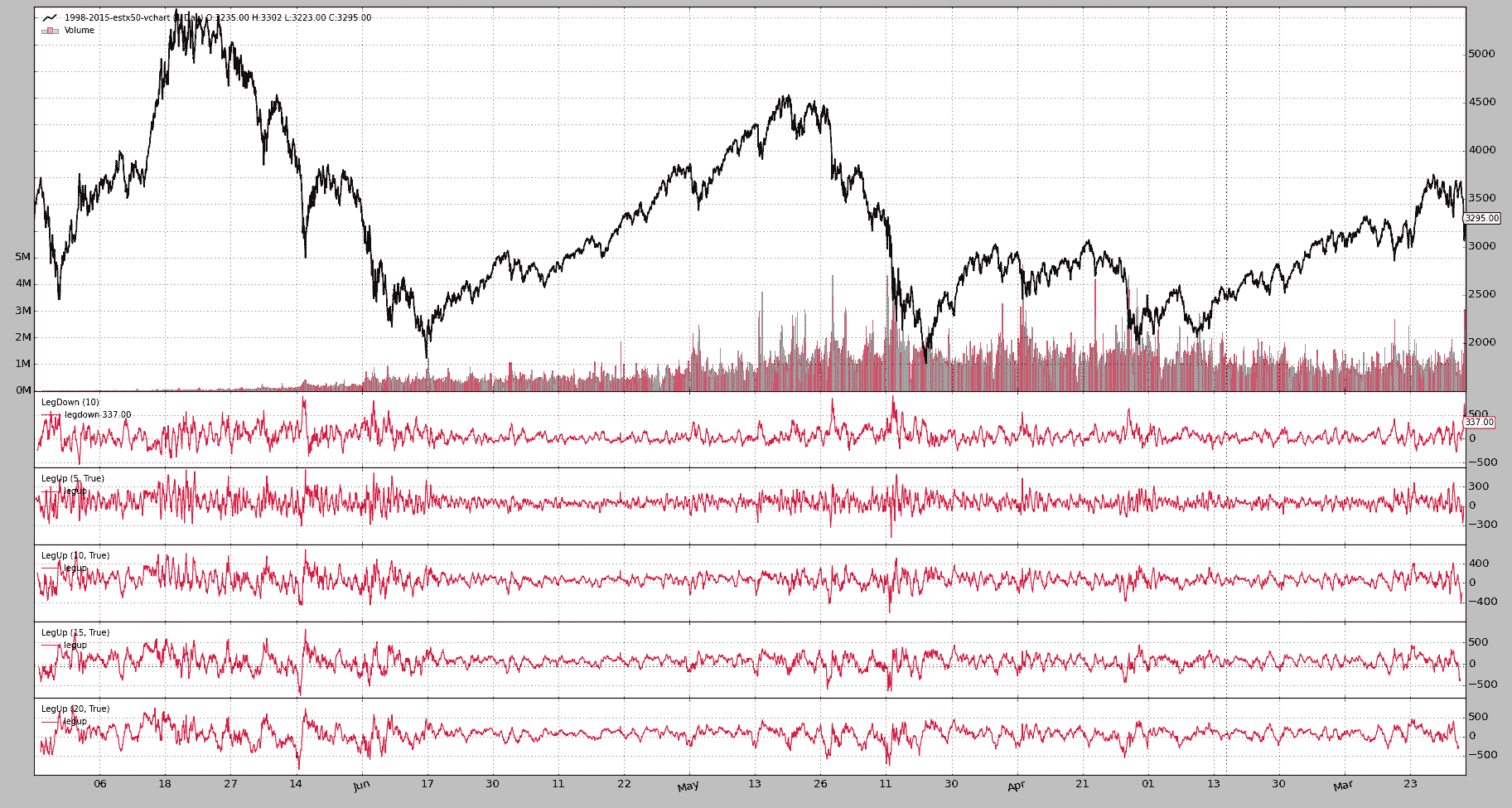

最后,从 1998 年到今天,Eurostoxx 50 未来的执行情况和结果:

bt-run.py \

--csvformat vchartcsv \

--data ../datas/sample/1998-2015-estx50-vchart.txt \

--analyzer legdownup \

--pranalyzer \

--nostdstats \

--plot

====================

== Analyzers

====================

##########

legdownupanalyzer

##########

Date,LegDown,LegUp_5,LegUp_10,LegUp_15,LegUp_20

2008-10-10,901.0,331.0,69.0,336.0,335.0

2001-09-11,889.0,145.0,111.0,239.0,376.0

2008-01-22,844.0,328.0,360.0,302.0,344.0

2001-09-21,813.0,572.0,696.0,816.0,731.0

2002-07-24,799.0,515.0,384.0,373.0,572.0

2008-01-23,789.0,345.0,256.0,319.0,290.0

2001-09-17,769.0,116.0,339.0,405.0,522.0

2008-10-09,768.0,102.0,0.0,120.0,208.0

2001-09-12,764.0,137.0,126.0,169.0,400.0

2002-07-23,759.0,331.0,183.0,285.0,421.0

2008-10-16,758.0,102.0,222.0,310.0,201.0

2008-10-17,740.0,-48.0,219.0,218.0,116.0

2015-08-24,731.0,nan,nan,nan,nan

2002-07-22,729.0,292.0,62.0,262.0,368.0

...

...

...

2001-10-05,-364.0,228.0,143.0,286.0,230.0

1999-01-04,-370.0,219.0,99.0,-7.0,191.0

2000-03-06,-382.0,-60.0,-127.0,-39.0,-161.0

2000-02-14,-393.0,-92.0,90.0,340.0,230.0

2000-02-09,-400.0,-22.0,-46.0,96.0,270.0

1999-01-05,-438.0,3.0,5.0,-107.0,5.0

1999-01-07,-446.0,-196.0,-6.0,-82.0,-50.0

1999-01-06,-536.0,-231.0,-42.0,-174.0,-129.0

2015 年 8 月的降程出现在第 13 位th。很明显,发生了一种非常见的疾病,尽管更严重。

对于静态学家和聪明的数学头脑来说,从指向上的后续腿中做什么比我更重要。

LegUpDownAnalyzer的实现细节(见末尾的整个模块代码):

-

与其他对象一样,它在

__init__中创建指示器:Strategies,Indicators通常是常见的可疑对象这些指示器将自动注册到分析仪所连接的策略

-

就像策略一样,

Analyzer有self.datas(一个数据数组)和别名:self.data、self.data0、self.data1… -

同样类似于策略:

nexstart和stop挂钩(这些在指标中不存在)在这种情况下,用于:

-

nextstart:记录策略的初始起点 -

stop:做最后的计算,因为事情已经完成了

-

-

注:本例不需要

start、prenext、next等其他方式 -

LegDownUpAnalyzer方法print已被重写,不再调用pprint方法,而是创建计算的 CSV 打印输出

经过多次讨论,由于我们将--plot添加到组合中……图表。

最后是bt-run加载的legupdown模块。

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import itertools

import operator

import six

from six.moves import map, xrange, zip

import backtrader as bt

import backtrader.indicators as btind

from backtrader.utils import OrderedDict

class LegDown(bt.Indicator):

'''

Calculates what the current legdown has been using:

- Current low

- High from ``period`` bars ago

'''

lines = ('legdown',)

params = (('period', 10),)

def __init__(self):

self.lines.legdown = self.data.high(-self.p.period) - self.data.low

class LegUp(bt.Indicator):

'''

Calculates what the current legup has been using:

- Current high

- Low from ``period`` bars ago

If param ``writeback`` is True the value will be written

backwards ``period`` bars ago

'''

lines = ('legup',)

params = (('period', 10), ('writeback', True),)

def __init__(self):

self.lu = self.data.high - self.data.low(-self.p.period)

self.lines.legup = self.lu(self.p.period * self.p.writeback)

class LegDownUpAnalyzer(bt.Analyzer):

params = (

# If created indicators have to be plotteda along the data

('plotind', True),

# period to consider for a legdown

('ldown', 10),

# periods for the following legups after a legdown

('lups', [5, 10, 15, 20]),

# How to sort: date-asc, date-desc, legdown-asc, legdown-desc

('sort', 'legdown-desc'),

)

sort_options = ['date-asc', 'date-des', 'legdown-desc', 'legdown-asc']

def __init__(self):

# Create the legdown indicator

self.ldown = LegDown(self.data, period=self.p.ldown)

self.ldown.plotinfo.plot = self.p.plotind

# Create the legup indicators indicator - writeback is not touched

# so the values will be written back the selected period and therefore

# be aligned with the end of the legdown

self.lups = list()

for lup in self.p.lups:

legup = LegUp(self.data, period=lup)

legup.plotinfo.plot = self.p.plotind

self.lups.append(legup)

def nextstart(self):

self.start = len(self.data) - 1

def stop(self):

# Calculate start and ending points with values

start = self.start

end = len(self.data)

size = end - start

# Prepare dates (key in the returned dictionary)

dtnumslice = self.strategy.data.datetime.getzero(start, size)

dtslice = map(lambda x: bt.num2date(x).date(), dtnumslice)

keys = dtslice

# Prepare the values, a list for each key item

# leg down

ldown = self.ldown.legdown.getzero(start, size)

# as many legs up as requested

lups = [up.legup.getzero(start, size) for up in self.lups]

# put legs down/up together and interleave (zip)

vals = [ldown] + lups

zvals = zip(*vals)

# Prepare sorting options

if self.p.sort == 'date-asc':

reverse, item = False, 0

elif self.p.sort == 'date-desc':

reverse, item = True, 0

elif self.p.sort == 'legdown-asc':

reverse, item = False, 1

elif self.p.sort == 'legdown-desc':

reverse, item = True, 1

else:

# Default ordering - date-asc

reverse, item = False, 0

# Prepare a sorted array of 2-tuples

keyvals_sorted = sorted(zip(keys, zvals),

reverse=reverse,

key=operator.itemgetter(item))

# Use it to build an ordereddict

self.ret = OrderedDict(keyvals_sorted)

def get_analysis(self):

return self.ret

def print(self, *args, **kwargs):

# Overriden to change default behavior (call pprint)

# provides a CSV printout of the legs down/up

header_items = ['Date', 'LegDown']

header_items.extend(['LegUp_%d' % x for x in self.p.lups])

header_txt = ','.join(header_items)

print(header_txt)

for key, vals in six.iteritems(self.ret):

keytxt = key.strftime('%Y-%m-%d')

txt = ','.join(itertools.chain([keytxt], map(str, vals)))

print(txt)