订单管理和执行

原文: https://www.backtrader.com/blog/posts/2015-08-08-order-creation-execution/order-creation-execution/

如果不能模拟订单,回溯测试和回溯交易者将无法完成。为此,平台中提供了以下内容。

对于订单管理 3 原语:

-

buy -

sell -

cancel

笔记

update原语显然是合乎逻辑的东西,但常识表明,这种方法主要由手动操作人员使用,他们使用的是判断性交易方法。

对于订单执行逻辑,以下执行类型:

-

Market -

Close -

Limit -

Stop -

StopLimit

订单管理

其主要目标是易于使用,因此,订单管理的最直接(也是最简单)的方法来自于策略本身。

buy和self原语作为Strategy方法具有以下签名:

-

def buy(self,data=None,size=None,price=None,plimit=None,exectype=None,valid=None):

-

def 购买(自身、数据=无、大小=无、价格=无、exectype=无、有效=无)

data->数据馈送参考,支持购买

如果

None通过,则以策略的主要数据为目标size->int/long 确定要应用的桩号

如果

None通过,则策略中可用的Sizer将用于自动确定赌注。默认Sizer使用1的固定状态-

price->对于Market将被忽略,可以保留为None订单,但对于其他订单类型,必须为浮动。如果保留为None,将使用当前收盘价 -

plimit->在StopLimit订单中的限价,其中price将作为触发价

如果保留为

None,则price将用作限制(触发器和限制相同)exectype->订单执行类型之一。如果None通过,则假定Market

执行类型在

Order中列举。示例:Order.Limitvalid->来自 date2num(或数据源)或 datetime.datetime Python 对象的浮点值

注:无论

valid参数如何,都会执行Market指令返回值:一个

Order实例 -

def 销售(self,data=None,size=None,price=None,exectype=None,valid=None)

因为取消订单只需要buy或self返回的order引用,所以可以使用经纪人的原语(见下文)

一些例子:

# buy the main date, with sizer default stake, Market order

order = self.buy()

# Market order - valid will be "IGNORED"

order = self.buy(valid=datetime.datetime.now() + datetime.timedelta(days=3))

# Market order - price will be IGNORED

order = self.buy(price=self.data.close[0] * 1.02)

# Market order - manual stake

order = self.buy(size=25)

# Limit order - want to set the price and can set a validity

order = self.buy(exectype=Order.Limit,

price=self.data.close[0] * 1.02,

valid=datetime.datetime.now() + datetime.timedelta(days=3)))

# StopLimit order - want to set the price, price limit

order = self.buy(exectype=Order.StopLimit,

price=self.data.close[0] * 1.02,

plimit=self.data.close[0] * 1.07)

# Canceling an existing order

self.broker.cancel(order)

笔记

所有订单类型都可以通过创建Order实例(或其子类之一)创建,然后通过以下方式传递给代理:

order = self.broker.submit(order)

笔记

在broker本身中有buy和sell原语,但它们对默认参数的宽容程度较低。

订单执行逻辑

broker使用两个主要准则(假设?)执行订单。

-

当前数据已发生,无法用于执行订单。

如果策略中的逻辑类似于:

```py if self.data.close > self.sma: # where sma is a Simple Moving Average self.buy()

The expectation CANNOT be that the order will be executed with the

closeprice which is being examined in the logic BECAUSE it has already happened.The order CAN BE 1st EXECUTED withing the bounds of the next set of Open/High/Low/Close price points (and the conditions set forth herein by the order) ```

-

音量不起作用

如果交易者选择非流动资产,或者恰好达到价格条的极端值(高/低),那么在实际交易中确实如此。

但触及高点/低点是很少发生的(如果你这样做了……你不需要

backtrader),所选资产将有足够的流动性来吸收任何常规交易的订单

集市

执行:

下一套开盘/高/低/收盘价开盘价(俗称条)

理论基础:

如果逻辑在时间点 X 执行并发出Market订单,则下一个将发生的价格点是即将到来的open价格

笔记

此命令始终执行,并忽略用于创建它的任何price和valid参数

关

执行:

当下一个酒吧实际关闭时,使用下一个酒吧的close价格

理论基础:

大多数回溯测试馈送包含已经关闭的条,订单将立即执行,下一条的close价格。每日数据馈送是最常见的示例。

但是系统可以输入“滴答”价格,并且实际的酒吧(时间/日期方面)会不断地使用新的滴答进行预测,而不会实际移动到下一个酒吧(因为时间和/或日期没有改变)

只有当时间或日期发生变化时,酒吧才真正关闭,订单才会执行

限度

执行:

如果data触及price,则在订单创建时设置price,从下一个价格栏开始。

如果设置了valid且到达时间点,订单将被取消

价格匹配:

backtrader尝试为Limit订单提供最现实的执行价格。

使用 4 个价格点(开盘/高位/低位/收盘),可以部分推断请求的price是否可以改善。

Buy订单

- Case 1:

If the `open` price of the bar is below the limit price the order

executes immediately with the `open` price. The order has been swept

during the opening phase of the session

- Case 2:

If the `open` price has not penetrated below the limit price but the

`low` price is below the limit price, then the limit price has been

seen during the session and the order can be executed

Sell顺序的逻辑显然是颠倒的。

停止

执行:

如果data触到触发器price,则在订单创建时设置触发器price,从下一个价格栏开始。

如果设置了valid且到达时间点,订单将被取消

价格匹配:

backtrader尝试为Stop订单提供最现实的触发价格。

使用 4 个价格点(开盘/高位/低位/收盘),可以部分推断请求的price是否可以改善。

对于\停止orders which购买`

- Case 1:

If the `open` price of the bar is above the stop price the order is

executed immediately with the `open` price.

Intended to stop a loss if the price is moving upwards against an

existing short position

- Case 2:

If the `open` price has not penetrated above the stop price but the

`high` price is above the stop price, then the stop price has been

seen during the session and the order can be executed

对于Sell的Stop顺序,逻辑明显颠倒。

止损

执行:

触发器price设置从下一个价格条开始的移动订单。

价格匹配:

-

触发:使用

Stop匹配逻辑(但仅触发并将订单转换为Limit订单) -

限额:使用

Limit价格匹配逻辑

一些样品

像往常一样,图片(带代码)价值数百万条长长的解释。请注意,这些片段集中在订单创建部分。完整的代码在底部。

价格高于/低于一个简单的移动平均线策略将用于生成买入/卖出信号

信号显示在图表底部:使用交叉指示器的CrossOver。

将保留对生成的“购买”订单的引用,以便在系统中最多只允许一个同时订单。

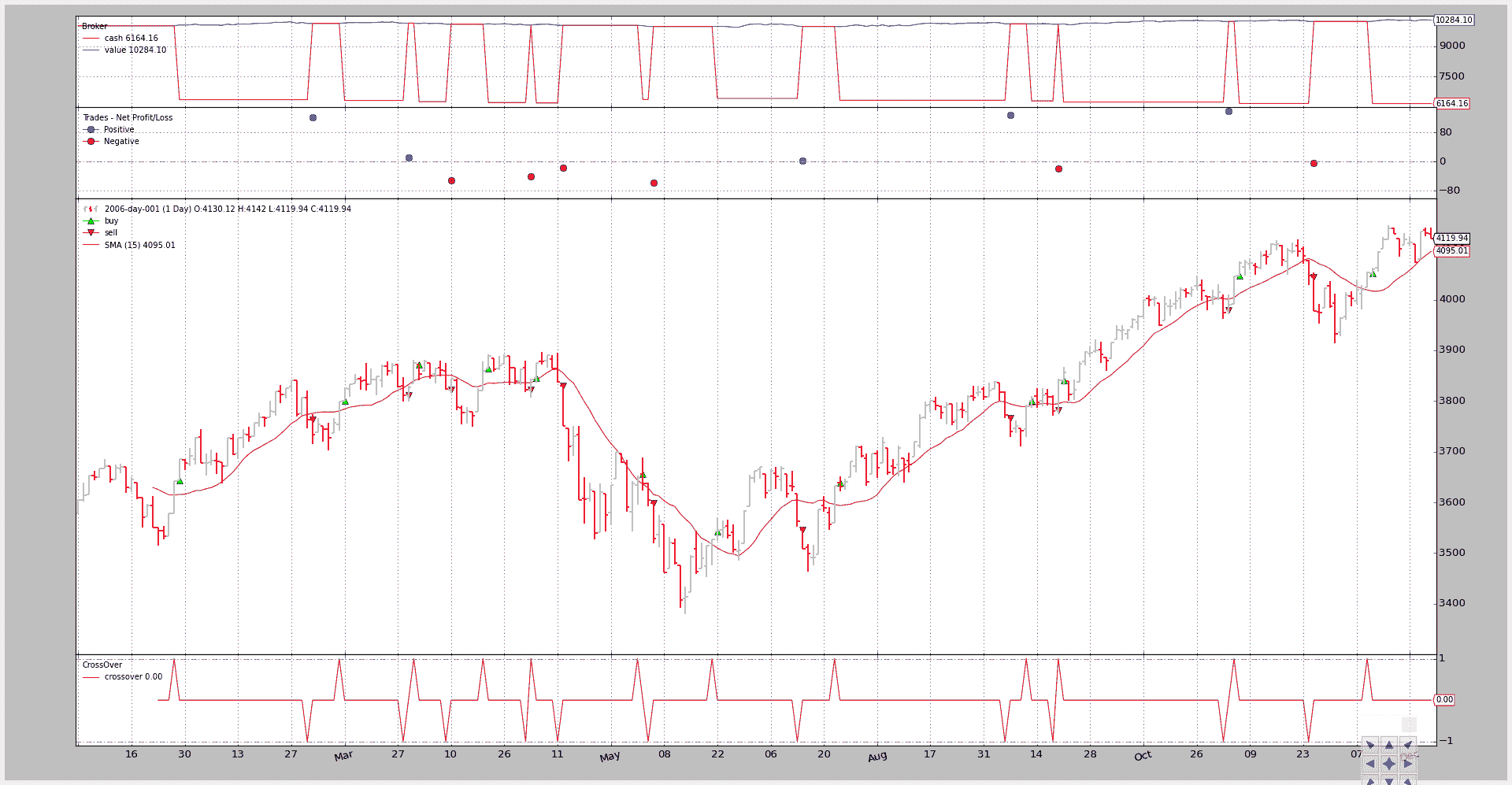

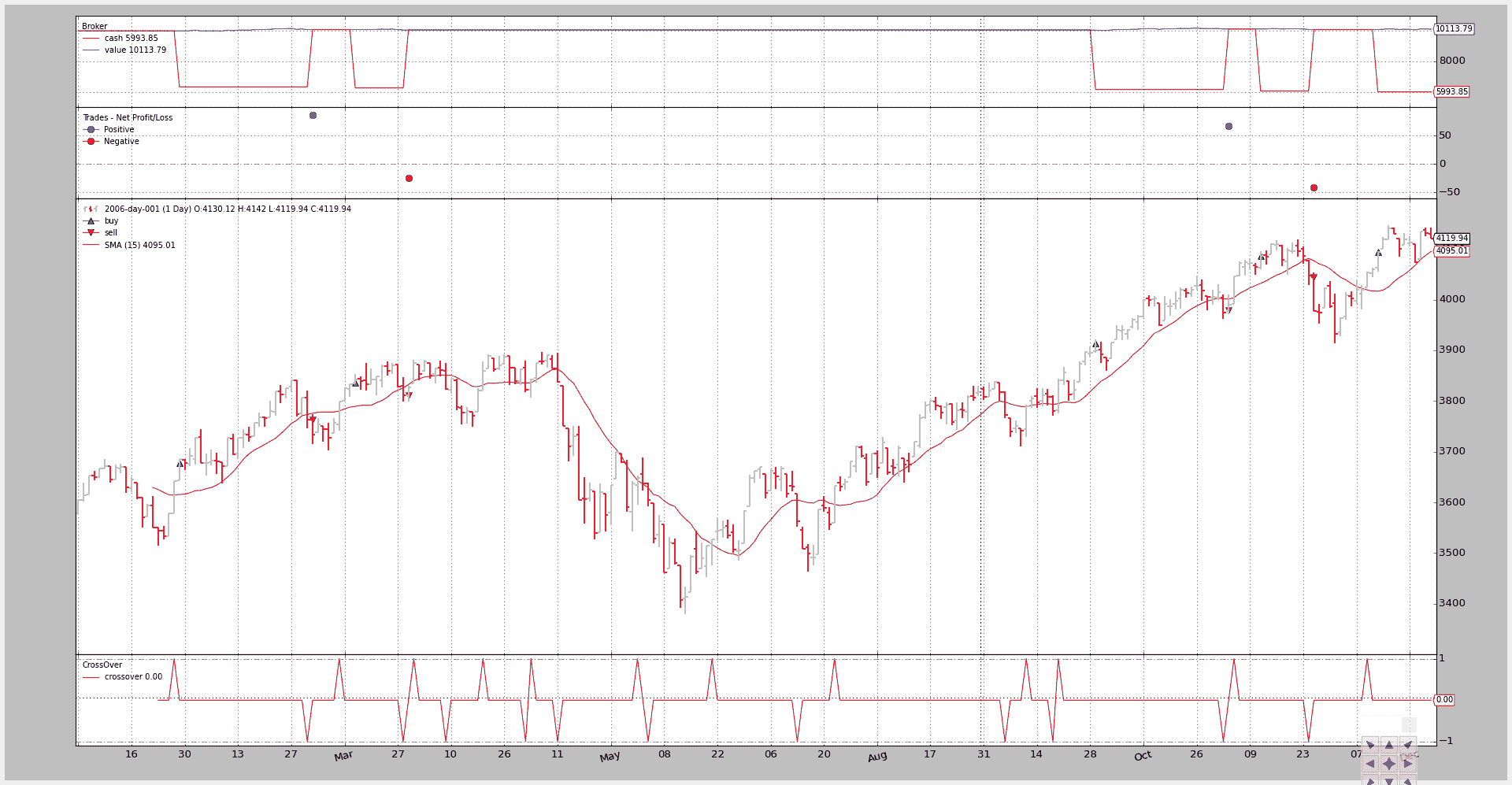

执行类型:市场

请参见图表中的订单如何在开盘价产生信号后一个小节执行。

if self.p.exectype == 'Market':

self.buy(exectype=bt.Order.Market) # default if not given

self.log('BUY CREATE, exectype Market, price %.2f' %

self.data.close[0])

输出图表。

命令行和输出:

$ ./order-execution-samples.py --exectype Market

2006-01-26T23:59:59+00:00, BUY CREATE, exectype Market, price 3641.42

2006-01-26T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-01-27T23:59:59+00:00, BUY EXECUTED, Price: 3643.35, Cost: 3643.35, Comm 0.00

2006-03-02T23:59:59+00:00, SELL CREATE, 3763.73

2006-03-02T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-03-03T23:59:59+00:00, SELL EXECUTED, Price: 3763.95, Cost: 3763.95, Comm 0.00

...

...

2006-12-11T23:59:59+00:00, BUY CREATE, exectype Market, price 4052.89

2006-12-11T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-12-12T23:59:59+00:00, BUY EXECUTED, Price: 4052.55, Cost: 4052.55, Comm 0.00

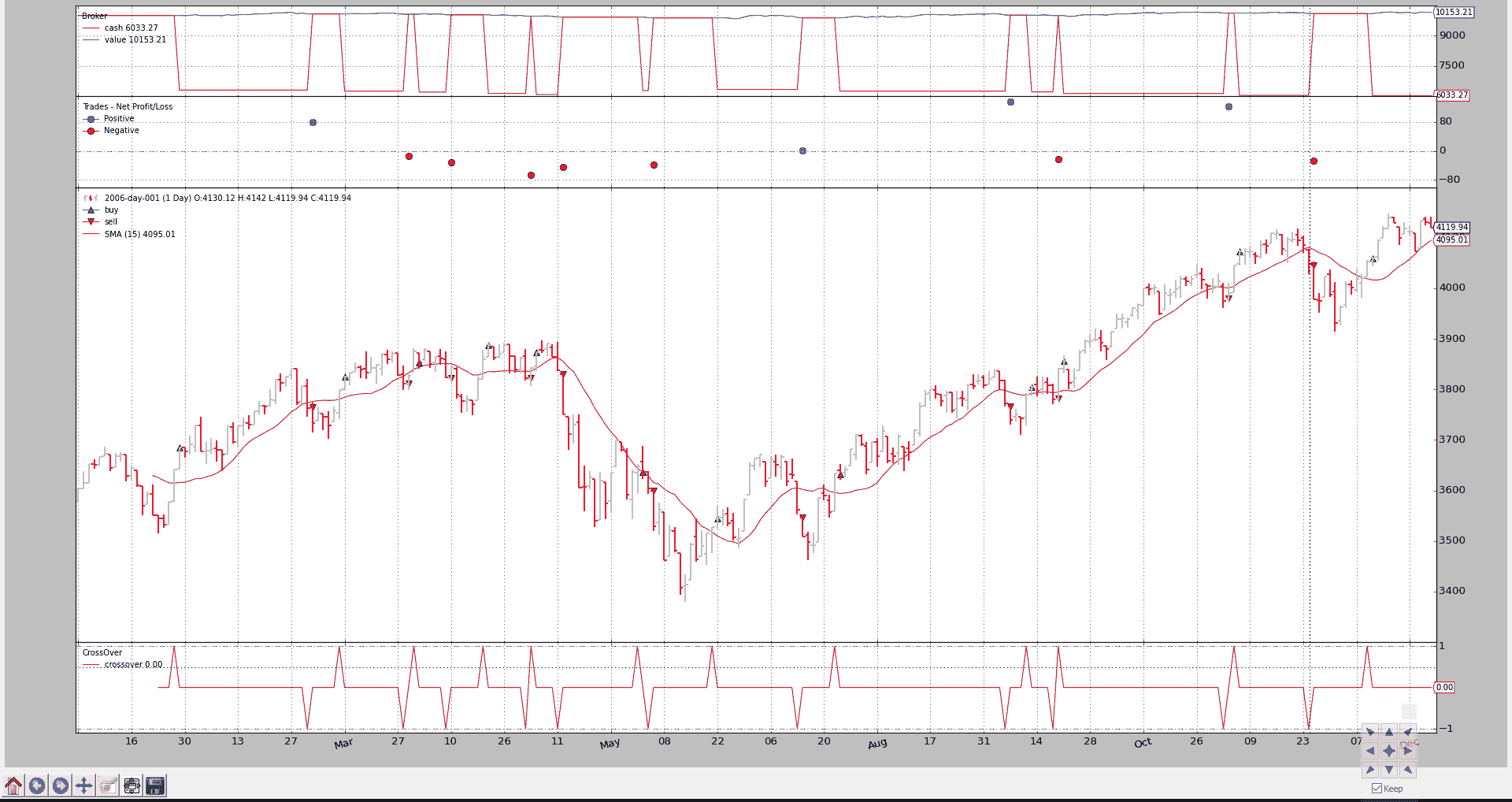

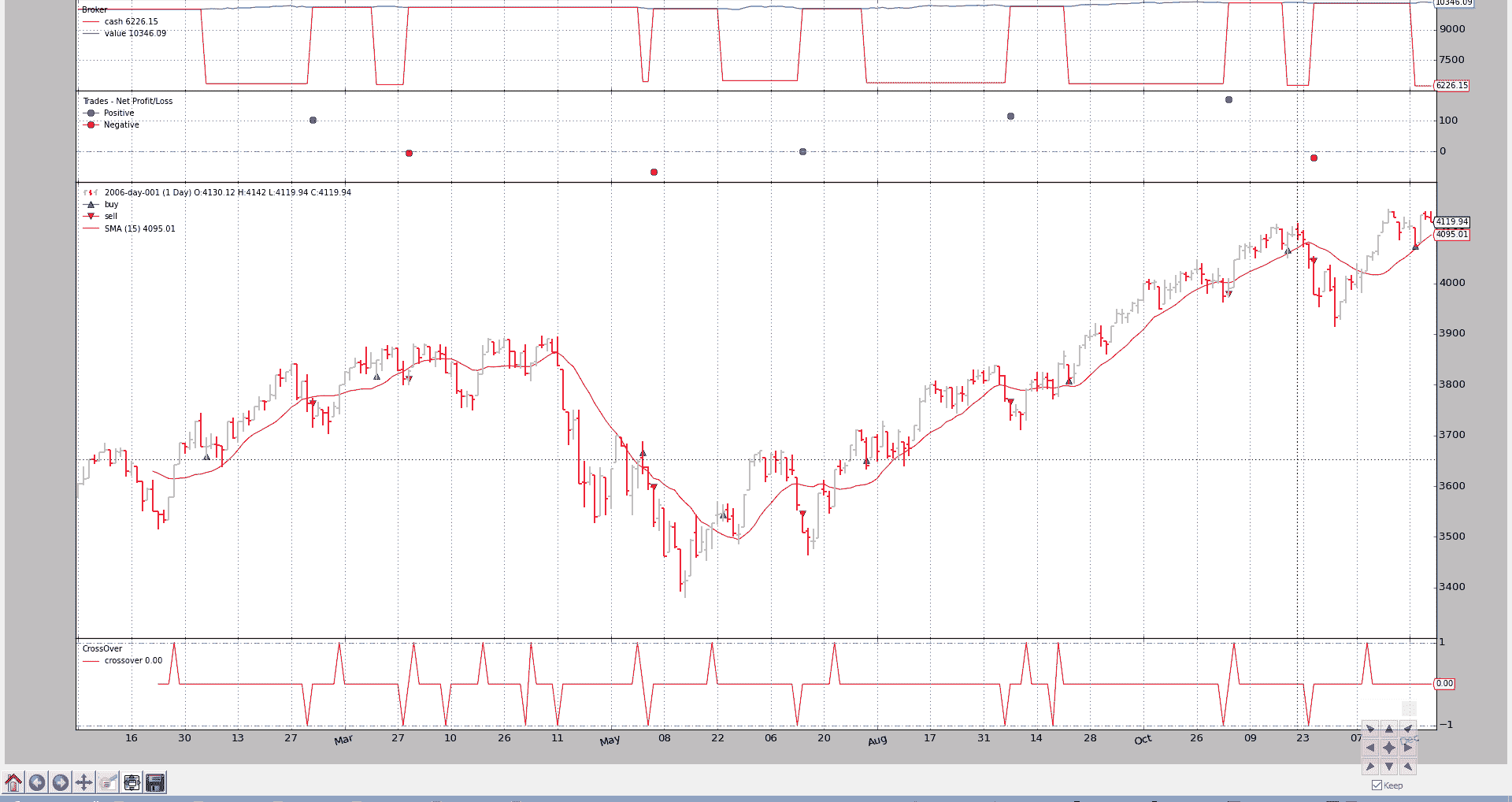

执行类型:关闭

笔记

在第 11 期之后,创建了开发分支机构,更新图表和输出。使用了错误的收盘价。

现在,指令也在信号发出后一个小节执行,但以收盘价执行。

elif self.p.exectype == 'Close':

self.buy(exectype=bt.Order.Close)

self.log('BUY CREATE, exectype Close, price %.2f' %

self.data.close[0])

输出图表。

命令行和输出:

$ ./order-execution-samples.py --exectype Close

2006-01-26T23:59:59+00:00, BUY CREATE, exectype Close, price 3641.42

2006-01-26T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-01-27T23:59:59+00:00, BUY EXECUTED, Price: 3685.48, Cost: 3685.48, Comm 0.00

2006-03-02T23:59:59+00:00, SELL CREATE, 3763.73

2006-03-02T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-03-03T23:59:59+00:00, SELL EXECUTED, Price: 3763.95, Cost: 3763.95, Comm 0.00

...

...

2006-11-06T23:59:59+00:00, BUY CREATE, exectype Close, price 4045.22

2006-11-06T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-11-07T23:59:59+00:00, BUY EXECUTED, Price: 4072.86, Cost: 4072.86, Comm 0.00

2006-11-24T23:59:59+00:00, SELL CREATE, 4048.16

2006-11-24T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-11-27T23:59:59+00:00, SELL EXECUTED, Price: 4045.05, Cost: 4045.05, Comm 0.00

2006-12-11T23:59:59+00:00, BUY CREATE, exectype Close, price 4052.89

2006-12-11T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-12-12T23:59:59+00:00, BUY EXECUTED, Price: 4059.74, Cost: 4059.74, Comm 0.00

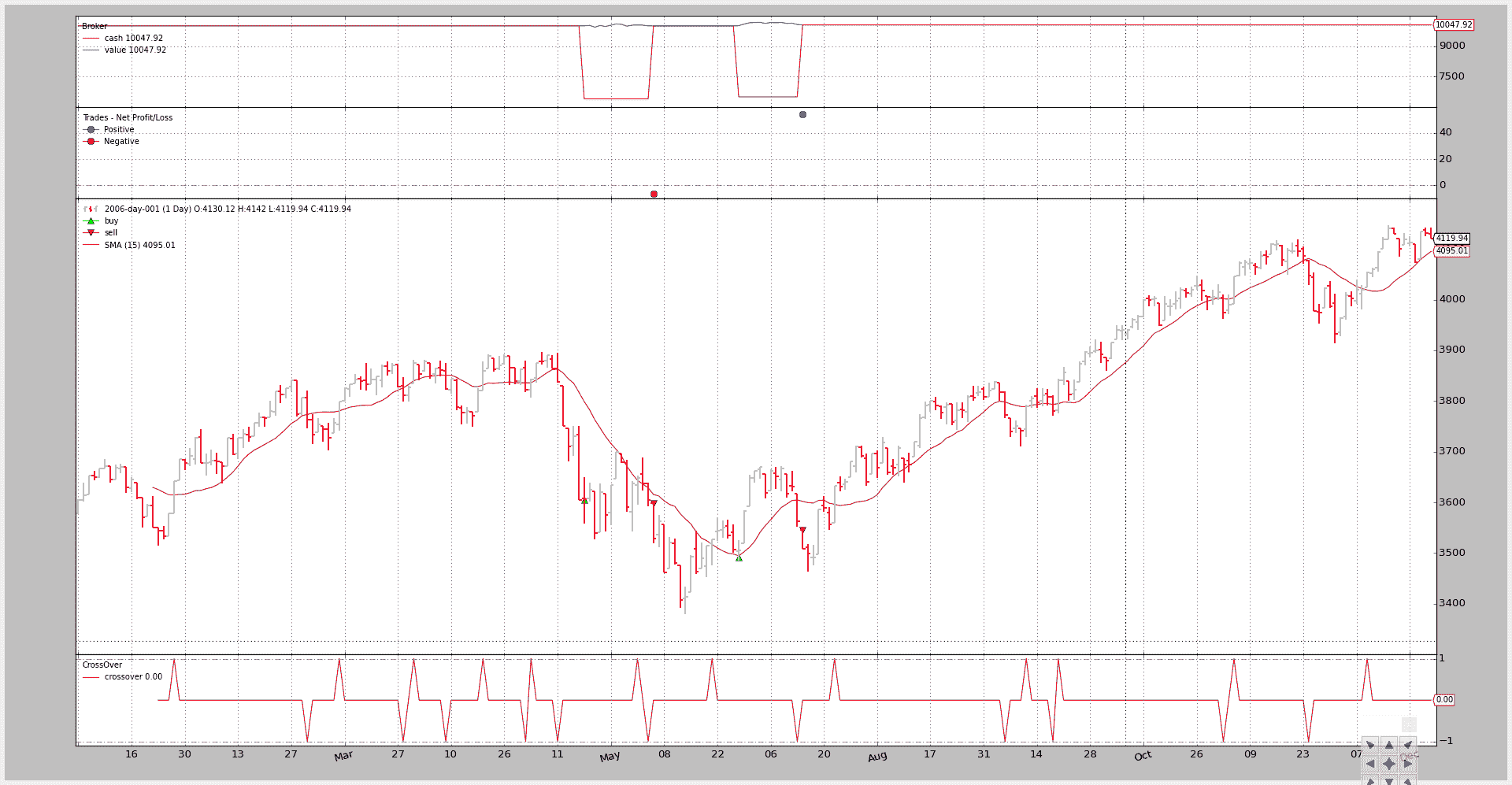

执行类型:限制

有效性在前几行计算,以防它作为参数传递。

if self.p.valid:

valid = self.data.datetime.date(0) + \

datetime.timedelta(days=self.p.valid)

else:

valid = None

设定了低于信号生成价格(信号条收盘价)1%的限价。请注意,这是如何阻止执行上述许多命令的。

elif self.p.exectype == 'Limit':

price = self.data.close * (1.0 - self.p.perc1 / 100.0)

self.buy(exectype=bt.Order.Limit, price=price, valid=valid)

if self.p.valid:

txt = 'BUY CREATE, exectype Limit, price %.2f, valid: %s'

self.log(txt % (price, valid.strftime('%Y-%m-%d')))

else:

txt = 'BUY CREATE, exectype Limit, price %.2f'

self.log(txt % price)

输出图表。

仅发出了 4 份订单。限制价格以赶上小幅下跌,已经完全改变了产量。

命令行和输出:

$ ./order-execution-samples.py --exectype Limit --perc1 1

2006-01-26T23:59:59+00:00, BUY CREATE, exectype Limit, price 3605.01

2006-01-26T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-05-18T23:59:59+00:00, BUY EXECUTED, Price: 3605.01, Cost: 3605.01, Comm 0.00

2006-06-05T23:59:59+00:00, SELL CREATE, 3604.33

2006-06-05T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-06-06T23:59:59+00:00, SELL EXECUTED, Price: 3598.58, Cost: 3598.58, Comm 0.00

2006-06-21T23:59:59+00:00, BUY CREATE, exectype Limit, price 3491.57

2006-06-21T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-06-28T23:59:59+00:00, BUY EXECUTED, Price: 3491.57, Cost: 3491.57, Comm 0.00

2006-07-13T23:59:59+00:00, SELL CREATE, 3562.56

2006-07-13T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-07-14T23:59:59+00:00, SELL EXECUTED, Price: 3545.92, Cost: 3545.92, Comm 0.00

2006-07-24T23:59:59+00:00, BUY CREATE, exectype Limit, price 3596.60

2006-07-24T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

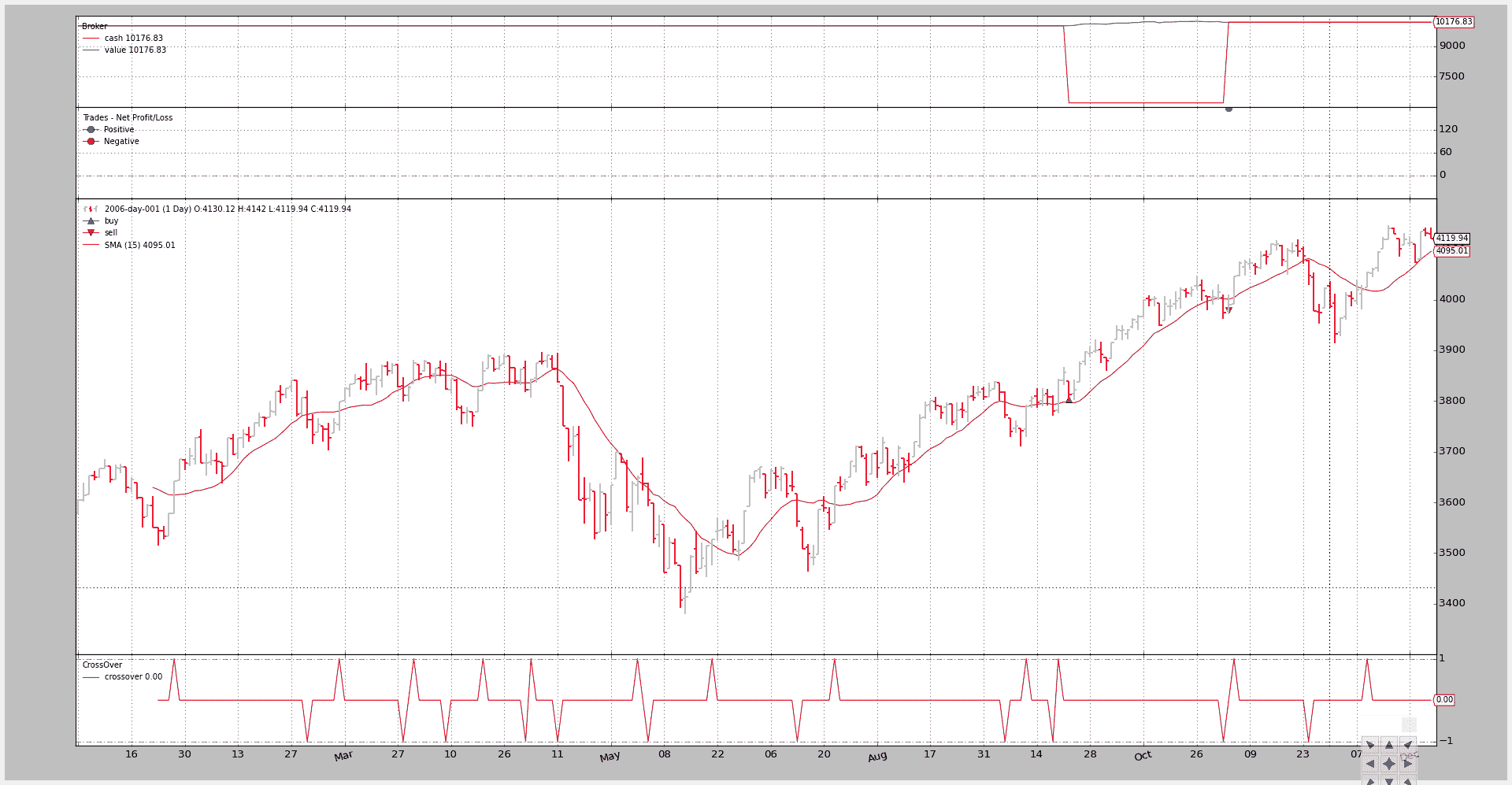

执行类型:具有有效性的限制

为了避免在限价单上永远等待,限价单只能在价格与“买入”订单相反时执行,该订单的有效期仅为 4(日历)天。

输出图表。

生成了更多订单,但除一个“购买”订单外,所有订单均已过期,进一步限制了操作量。

命令行和输出:

$ ./order-execution-samples.py --exectype Limit --perc1 1 --valid 4

2006-01-26T23:59:59+00:00, BUY CREATE, exectype Limit, price 3605.01, valid: 2006-01-30

2006-01-26T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-01-30T23:59:59+00:00, BUY EXPIRED

2006-03-10T23:59:59+00:00, BUY CREATE, exectype Limit, price 3760.48, valid: 2006-03-14

2006-03-10T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-03-14T23:59:59+00:00, BUY EXPIRED

2006-03-30T23:59:59+00:00, BUY CREATE, exectype Limit, price 3835.86, valid: 2006-04-03

2006-03-30T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-04-03T23:59:59+00:00, BUY EXPIRED

2006-04-20T23:59:59+00:00, BUY CREATE, exectype Limit, price 3821.40, valid: 2006-04-24

2006-04-20T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-04-24T23:59:59+00:00, BUY EXPIRED

2006-05-04T23:59:59+00:00, BUY CREATE, exectype Limit, price 3804.65, valid: 2006-05-08

2006-05-04T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-05-08T23:59:59+00:00, BUY EXPIRED

2006-06-01T23:59:59+00:00, BUY CREATE, exectype Limit, price 3611.85, valid: 2006-06-05

2006-06-01T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-06-05T23:59:59+00:00, BUY EXPIRED

2006-06-21T23:59:59+00:00, BUY CREATE, exectype Limit, price 3491.57, valid: 2006-06-25

2006-06-21T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-06-26T23:59:59+00:00, BUY EXPIRED

2006-07-24T23:59:59+00:00, BUY CREATE, exectype Limit, price 3596.60, valid: 2006-07-28

2006-07-24T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-07-28T23:59:59+00:00, BUY EXPIRED

2006-09-12T23:59:59+00:00, BUY CREATE, exectype Limit, price 3751.07, valid: 2006-09-16

2006-09-12T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-09-18T23:59:59+00:00, BUY EXPIRED

2006-09-20T23:59:59+00:00, BUY CREATE, exectype Limit, price 3802.90, valid: 2006-09-24

2006-09-20T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-09-22T23:59:59+00:00, BUY EXECUTED, Price: 3802.90, Cost: 3802.90, Comm 0.00

2006-11-02T23:59:59+00:00, SELL CREATE, 3974.62

2006-11-02T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-11-03T23:59:59+00:00, SELL EXECUTED, Price: 3979.73, Cost: 3979.73, Comm 0.00

2006-11-06T23:59:59+00:00, BUY CREATE, exectype Limit, price 4004.77, valid: 2006-11-10

2006-11-06T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-11-10T23:59:59+00:00, BUY EXPIRED

2006-12-11T23:59:59+00:00, BUY CREATE, exectype Limit, price 4012.36, valid: 2006-12-15

2006-12-11T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-12-15T23:59:59+00:00, BUY EXPIRED

执行类型:停止

设定高于信号价 1%的止损价。这意味着,只有当信号产生且价格继续攀升时,该策略才会买入,这可能被视为实力的信号。

这完全改变了执行全景。

elif self.p.exectype == 'Stop':

price = self.data.close * (1.0 + self.p.perc1 / 100.0)

self.buy(exectype=bt.Order.Stop, price=price, valid=valid)

if self.p.valid:

txt = 'BUY CREATE, exectype Stop, price %.2f, valid: %s'

self.log(txt % (price, valid.strftime('%Y-%m-%d')))

else:

txt = 'BUY CREATE, exectype Stop, price %.2f'

self.log(txt % price)

输出图表。

命令行和输出:

$ ./order-execution-samples.py --exectype Stop --perc1 1

2006-01-26T23:59:59+00:00, BUY CREATE, exectype Stop, price 3677.83

2006-01-26T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-01-27T23:59:59+00:00, BUY EXECUTED, Price: 3677.83, Cost: 3677.83, Comm 0.00

2006-03-02T23:59:59+00:00, SELL CREATE, 3763.73

2006-03-02T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-03-03T23:59:59+00:00, SELL EXECUTED, Price: 3763.95, Cost: 3763.95, Comm 0.00

2006-03-10T23:59:59+00:00, BUY CREATE, exectype Stop, price 3836.44

2006-03-10T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-03-15T23:59:59+00:00, BUY EXECUTED, Price: 3836.44, Cost: 3836.44, Comm 0.00

2006-03-28T23:59:59+00:00, SELL CREATE, 3811.45

2006-03-28T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-03-29T23:59:59+00:00, SELL EXECUTED, Price: 3811.85, Cost: 3811.85, Comm 0.00

2006-03-30T23:59:59+00:00, BUY CREATE, exectype Stop, price 3913.36

2006-03-30T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-09-29T23:59:59+00:00, BUY EXECUTED, Price: 3913.36, Cost: 3913.36, Comm 0.00

2006-11-02T23:59:59+00:00, SELL CREATE, 3974.62

2006-11-02T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-11-03T23:59:59+00:00, SELL EXECUTED, Price: 3979.73, Cost: 3979.73, Comm 0.00

2006-11-06T23:59:59+00:00, BUY CREATE, exectype Stop, price 4085.67

2006-11-06T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-11-13T23:59:59+00:00, BUY EXECUTED, Price: 4085.67, Cost: 4085.67, Comm 0.00

2006-11-24T23:59:59+00:00, SELL CREATE, 4048.16

2006-11-24T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-11-27T23:59:59+00:00, SELL EXECUTED, Price: 4045.05, Cost: 4045.05, Comm 0.00

2006-12-11T23:59:59+00:00, BUY CREATE, exectype Stop, price 4093.42

2006-12-11T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-12-13T23:59:59+00:00, BUY EXECUTED, Price: 4093.42, Cost: 4093.42, Comm 0.00

执行类型:StopLimit

设定高于信号价 1%的止损价。但限价设定为高于信号(收盘)价 0.5%,这可以解释为:等待涨势出现,但不要买入峰值。等待下潜。

有效期上限为 20(日历)天

elif self.p.exectype == 'StopLimit':

price = self.data.close * (1.0 + self.p.perc1 / 100.0)

plimit = self.data.close * (1.0 + self.p.perc2 / 100.0)

self.buy(exectype=bt.Order.StopLimit, price=price, valid=valid,

plimit=plimit)

if self.p.valid:

txt = ('BUY CREATE, exectype StopLimit, price %.2f,'

' valid: %s, pricelimit: %.2f')

self.log(txt % (price, valid.strftime('%Y-%m-%d'), plimit))

else:

txt = ('BUY CREATE, exectype StopLimit, price %.2f,'

' pricelimit: %.2f')

self.log(txt % (price, plimit))

输出图表。

命令行和输出:

$ ./order-execution-samples.py --exectype StopLimit --perc1 1 --perc2 0.5 --valid 20

2006-01-26T23:59:59+00:00, BUY CREATE, exectype StopLimit, price 3677.83, valid: 2006-02-15, pricelimit: 3659.63

2006-01-26T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-02-03T23:59:59+00:00, BUY EXECUTED, Price: 3659.63, Cost: 3659.63, Comm 0.00

2006-03-02T23:59:59+00:00, SELL CREATE, 3763.73

2006-03-02T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-03-03T23:59:59+00:00, SELL EXECUTED, Price: 3763.95, Cost: 3763.95, Comm 0.00

2006-03-10T23:59:59+00:00, BUY CREATE, exectype StopLimit, price 3836.44, valid: 2006-03-30, pricelimit: 3817.45

2006-03-10T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-03-21T23:59:59+00:00, BUY EXECUTED, Price: 3817.45, Cost: 3817.45, Comm 0.00

2006-03-28T23:59:59+00:00, SELL CREATE, 3811.45

2006-03-28T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-03-29T23:59:59+00:00, SELL EXECUTED, Price: 3811.85, Cost: 3811.85, Comm 0.00

2006-03-30T23:59:59+00:00, BUY CREATE, exectype StopLimit, price 3913.36, valid: 2006-04-19, pricelimit: 3893.98

2006-03-30T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-04-19T23:59:59+00:00, BUY EXPIRED

...

...

2006-12-11T23:59:59+00:00, BUY CREATE, exectype StopLimit, price 4093.42, valid: 2006-12-31, pricelimit: 4073.15

2006-12-11T23:59:59+00:00, ORDER ACCEPTED/SUBMITTED

2006-12-22T23:59:59+00:00, BUY EXECUTED, Price: 4073.15, Cost: 4073.15, Comm 0.00

测试脚本执行

在命令行help中详细说明:

$ ./order-execution-samples.py --help

usage: order-execution-samples.py [-h] [--infile INFILE]

[--csvformat {bt,visualchart,sierrachart,yahoo,yahoo_unreversed}]

[--fromdate FROMDATE] [--todate TODATE]

[--plot] [--plotstyle {bar,line,candle}]

[--numfigs NUMFIGS] [--smaperiod SMAPERIOD]

[--exectype EXECTYPE] [--valid VALID]

[--perc1 PERC1] [--perc2 PERC2]

Showcase for Order Execution Types

optional arguments:

-h, --help show this help message and exit

--infile INFILE, -i INFILE

File to be read in

--csvformat {bt,visualchart,sierrachart,yahoo,yahoo_unreversed},

-c {bt,visualchart,sierrachart,yahoo,yahoo_unreversed}

CSV Format

--fromdate FROMDATE, -f FROMDATE

Starting date in YYYY-MM-DD format

--todate TODATE, -t TODATE

Ending date in YYYY-MM-DD format

--plot, -p Plot the read data

--plotstyle {bar,line,candle}, -ps {bar,line,candle}

Plot the read data

--numfigs NUMFIGS, -n NUMFIGS

Plot using n figures

--smaperiod SMAPERIOD, -s SMAPERIOD

Simple Moving Average Period

--exectype EXECTYPE, -e EXECTYPE

Execution Type: Market (default), Close, Limit,

Stop, StopLimit

--valid VALID, -v VALID

Validity for Limit sample: default 0 days

--perc1 PERC1, -p1 PERC1

% distance from close price at order creation time for

the limit/trigger price in Limit/Stop orders

--perc2 PERC2, -p2 PERC2

% distance from close price at order creation time for

the limit price in StopLimit orders

完整代码

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import argparse

import datetime

import os.path

import time

import sys

import backtrader as bt

import backtrader.feeds as btfeeds

import backtrader.indicators as btind

class OrderExecutionStrategy(bt.Strategy):

params = (

('smaperiod', 15),

('exectype', 'Market'),

('perc1', 3),

('perc2', 1),

('valid', 4),

)

def log(self, txt, dt=None):

''' Logging function fot this strategy'''

dt = dt or self.data.datetime[0]

if isinstance(dt, float):

dt = bt.num2date(dt)

print('%s, %s' % (dt.isoformat(), txt))

def notify_order(self, order):

if order.status in [order.Submitted, order.Accepted]:

# Buy/Sell order submitted/accepted to/by broker - Nothing to do

self.log('ORDER ACCEPTED/SUBMITTED', dt=order.created.dt)

self.order = order

return

if order.status in [order.Expired]:

self.log('BUY EXPIRED')

elif order.status in [order.Completed]:

if order.isbuy():

self.log(

'BUY EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

else: # Sell

self.log('SELL EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

# Sentinel to None: new orders allowed

self.order = None

def __init__(self):

# SimpleMovingAverage on main data

# Equivalent to -> sma = btind.SMA(self.data, period=self.p.smaperiod)

sma = btind.SMA(period=self.p.smaperiod)

# CrossOver (1: up, -1: down) close / sma

self.buysell = btind.CrossOver(self.data.close, sma, plot=True)

# Sentinel to None: new ordersa allowed

self.order = None

def next(self):

if self.order:

# An order is pending ... nothing can be done

return

# Check if we are in the market

if self.position:

# In the maerket - check if it's the time to sell

if self.buysell < 0:

self.log('SELL CREATE, %.2f' % self.data.close[0])

self.sell()

elif self.buysell > 0:

if self.p.valid:

valid = self.data.datetime.date(0) + \

datetime.timedelta(days=self.p.valid)

else:

valid = None

# Not in the market and signal to buy

if self.p.exectype == 'Market':

self.buy(exectype=bt.Order.Market) # default if not given

self.log('BUY CREATE, exectype Market, price %.2f' %

self.data.close[0])

elif self.p.exectype == 'Close':

self.buy(exectype=bt.Order.Close)

self.log('BUY CREATE, exectype Close, price %.2f' %

self.data.close[0])

elif self.p.exectype == 'Limit':

price = self.data.close * (1.0 - self.p.perc1 / 100.0)

self.buy(exectype=bt.Order.Limit, price=price, valid=valid)

if self.p.valid:

txt = 'BUY CREATE, exectype Limit, price %.2f, valid: %s'

self.log(txt % (price, valid.strftime('%Y-%m-%d')))

else:

txt = 'BUY CREATE, exectype Limit, price %.2f'

self.log(txt % price)

elif self.p.exectype == 'Stop':

price = self.data.close * (1.0 + self.p.perc1 / 100.0)

self.buy(exectype=bt.Order.Stop, price=price, valid=valid)

if self.p.valid:

txt = 'BUY CREATE, exectype Stop, price %.2f, valid: %s'

self.log(txt % (price, valid.strftime('%Y-%m-%d')))

else:

txt = 'BUY CREATE, exectype Stop, price %.2f'

self.log(txt % price)

elif self.p.exectype == 'StopLimit':

price = self.data.close * (1.0 + self.p.perc1 / 100.0)

plimit = self.data.close * (1.0 + self.p.perc2 / 100.0)

self.buy(exectype=bt.Order.StopLimit, price=price, valid=valid,

plimit=plimit)

if self.p.valid:

txt = ('BUY CREATE, exectype StopLimit, price %.2f,'

' valid: %s, pricelimit: %.2f')

self.log(txt % (price, valid.strftime('%Y-%m-%d'), plimit))

else:

txt = ('BUY CREATE, exectype StopLimit, price %.2f,'

' pricelimit: %.2f')

self.log(txt % (price, plimit))

def runstrat():

args = parse_args()

cerebro = bt.Cerebro()

data = getdata(args)

cerebro.adddata(data)

cerebro.addstrategy(

OrderExecutionStrategy,

exectype=args.exectype,

perc1=args.perc1,

perc2=args.perc2,

valid=args.valid,

smaperiod=args.smaperiod

)

cerebro.run()

if args.plot:

cerebro.plot(numfigs=args.numfigs, style=args.plotstyle)

def getdata(args):

dataformat = dict(

bt=btfeeds.BacktraderCSVData,

visualchart=btfeeds.VChartCSVData,

sierrachart=btfeeds.SierraChartCSVData,

yahoo=btfeeds.YahooFinanceCSVData,

yahoo_unreversed=btfeeds.YahooFinanceCSVData

)

dfkwargs = dict()

if args.csvformat == 'yahoo_unreversed':

dfkwargs['reverse'] = True

if args.fromdate:

fromdate = datetime.datetime.strptime(args.fromdate, '%Y-%m-%d')

dfkwargs['fromdate'] = fromdate

if args.todate:

fromdate = datetime.datetime.strptime(args.todate, '%Y-%m-%d')

dfkwargs['todate'] = todate

dfkwargs['dataname'] = args.infile

dfcls = dataformat[args.csvformat]

return dfcls(**dfkwargs)

def parse_args():

parser = argparse.ArgumentParser(

description='Showcase for Order Execution Types')

parser.add_argument('--infile', '-i', required=False,

default='../datas/2006-day-001.txt',

help='File to be read in')

parser.add_argument('--csvformat', '-c', required=False, default='bt',

choices=['bt', 'visualchart', 'sierrachart',

'yahoo', 'yahoo_unreversed'],

help='CSV Format')

parser.add_argument('--fromdate', '-f', required=False, default=None,

help='Starting date in YYYY-MM-DD format')

parser.add_argument('--todate', '-t', required=False, default=None,

help='Ending date in YYYY-MM-DD format')

parser.add_argument('--plot', '-p', action='store_false', required=False,

help='Plot the read data')

parser.add_argument('--plotstyle', '-ps', required=False, default='bar',

choices=['bar', 'line', 'candle'],

help='Plot the read data')

parser.add_argument('--numfigs', '-n', required=False, default=1,

help='Plot using n figures')

parser.add_argument('--smaperiod', '-s', required=False, default=15,

help='Simple Moving Average Period')

parser.add_argument('--exectype', '-e', required=False, default='Market',

help=('Execution Type: Market (default), Close, Limit,'

' Stop, StopLimit'))

parser.add_argument('--valid', '-v', required=False, default=0, type=int,

help='Validity for Limit sample: default 0 days')

parser.add_argument('--perc1', '-p1', required=False, default=0.0,

type=float,

help=('%% distance from close price at order creation'

' time for the limit/trigger price in Limit/Stop'

' orders'))

parser.add_argument('--perc2', '-p2', required=False, default=0.0,

type=float,

help=('%% distance from close price at order creation'

' time for the limit price in StopLimit orders'))

return parser.parse_args()

if __name__ == '__main__':

runstrat()